Brand-new listings are down more than 20% from a year ago as house owners hang onto low home loan rates. That’s triggering purchasers to grab houses rapidly and keeping rates from falling even more; rates are down by approximately 3% each year, comparable to the decreases we have actually seen over the last month.

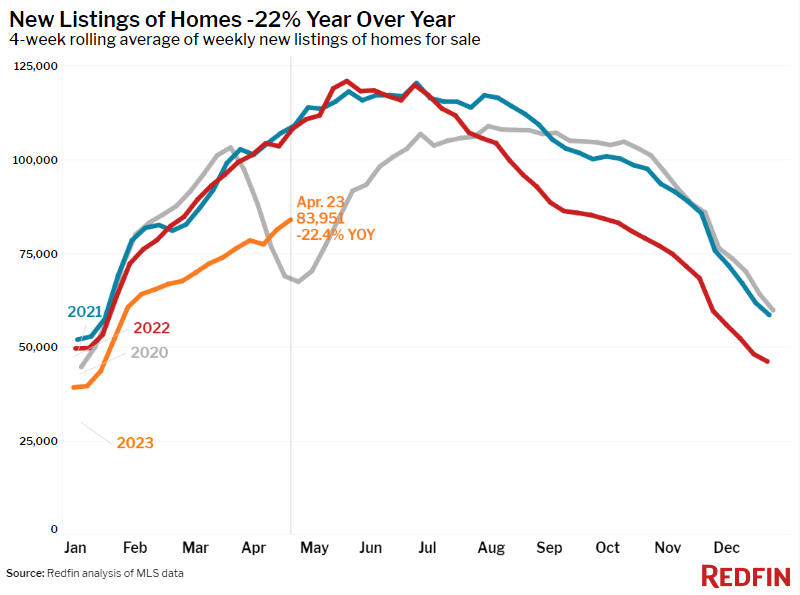

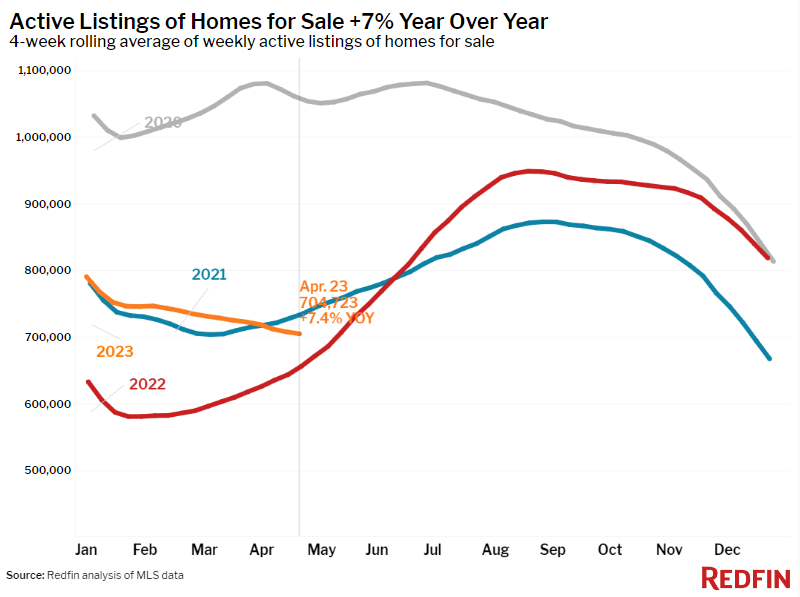

New listings of houses for sale fell 22.4% across the country from a year previously throughout the 4 weeks ending April 23, among the greatest decreases considering that the start of the pandemic. Property owners are sitting tight due to the fact that they wish to hang onto their low home loan rates– today’s typical 30-year home loan rate increased for the 2nd week in a row– and due to the fact that it’s difficult for them to discover another house to purchase. The absence of brand-new listings is driving an unseasonal decrease in the overall variety of houses for sale.

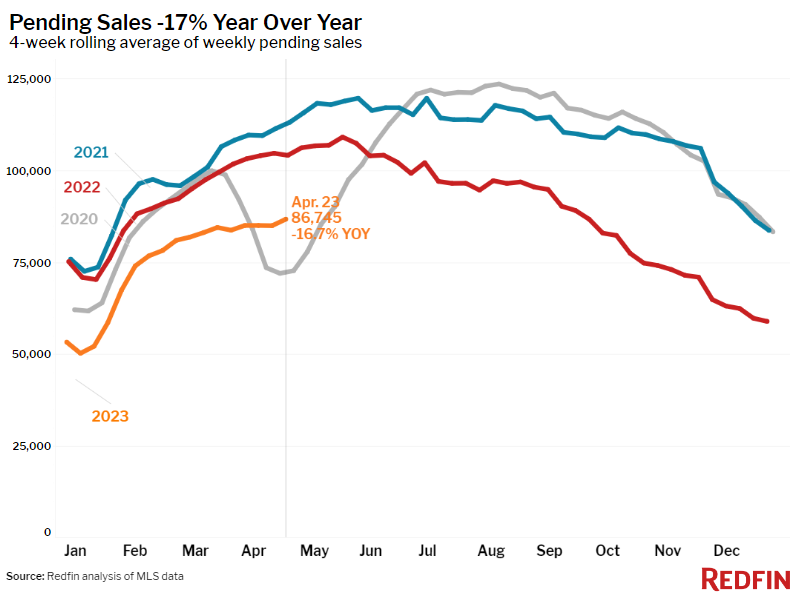

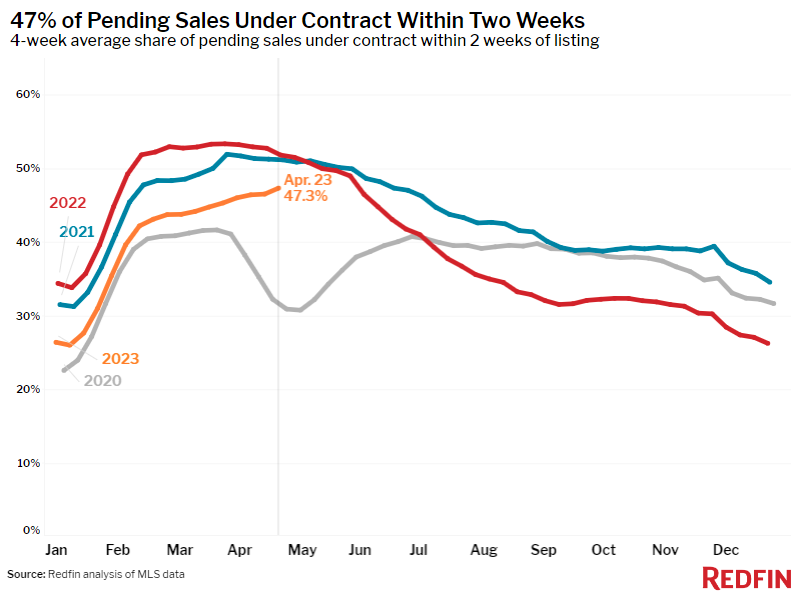

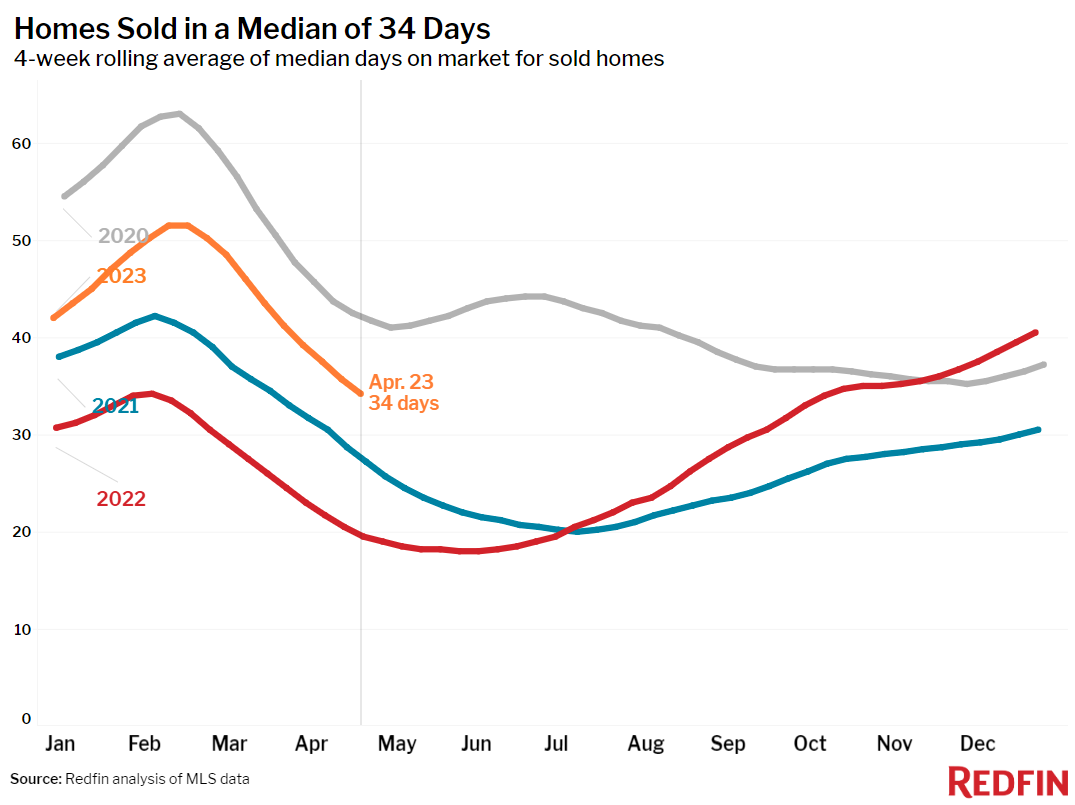

The lack of stock is likewise making some houses offer rapidly. Almost half of houses on the marketplace are offering within 2 weeks, the greatest part in almost a year. The share has actually increased throughout April, irregular for this part of the year. That remains in spite of raised home loan rates keeping some purchasers on the sidelines, with pending house sales down 17% year over year.

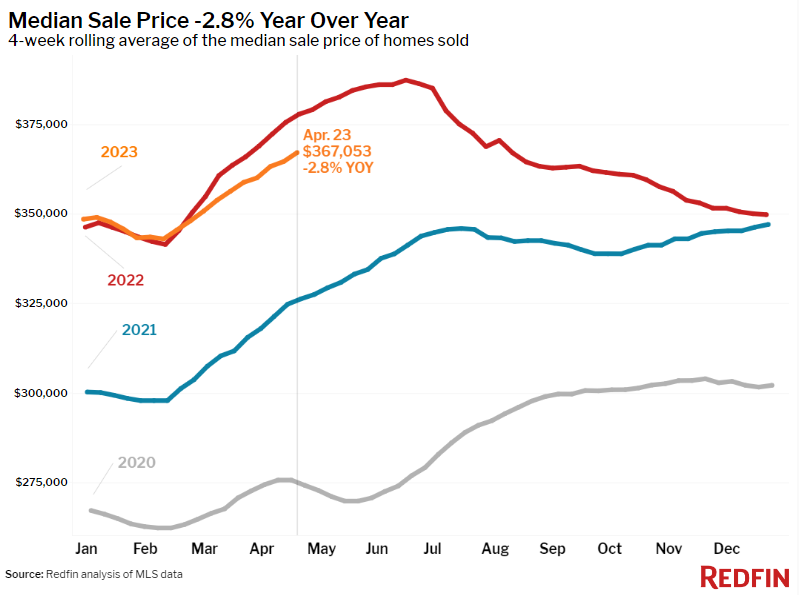

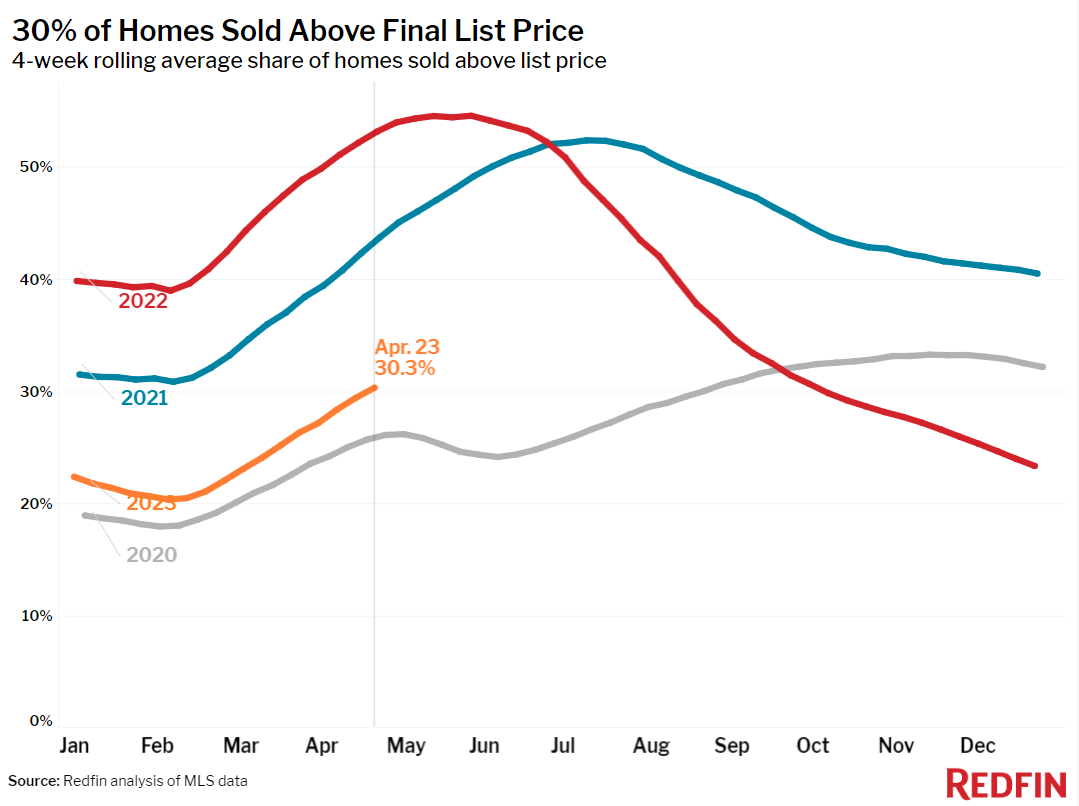

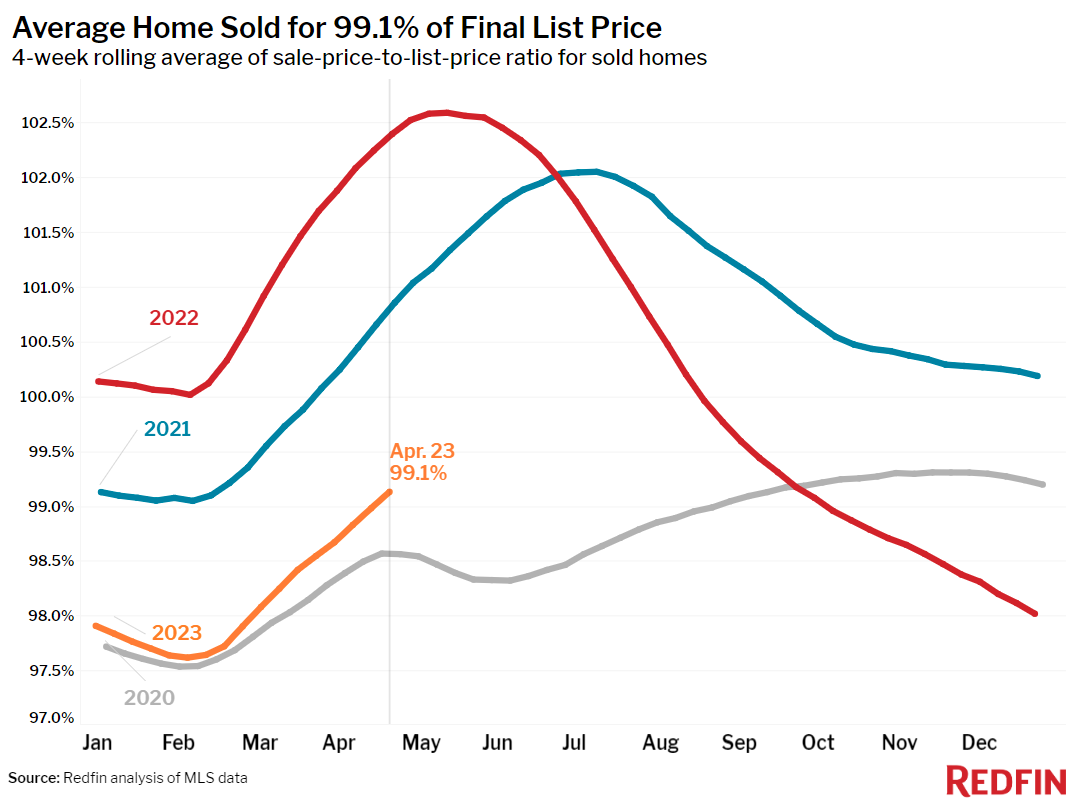

Purchasers are fighting for the couple of houses on the marketplace, keeping house rates from falling more. The U.S. typical list price is down 2.8% year over year, comparable to the cost decreases we have actually seen over the last month. Costs are falling more in some parts of the nation and increasing in others; they’re down many in Austin, TX (-13.7% YoY), Oakland, CA (-13.5%) and San Francisco (-12.3%).

” High home loan rates have actually triggered some property buyers to bail out of the marketplace. However there are still more individuals searching for a house than there are houses for sale,” stated Redfin Deputy Chief Economic Expert Taylor Marr “That’s excellent news for the house owners who desire or require to offer their house now. In specific parts of the nation where brand-new listings are particularly uncommon, sellers who price their houses in line with the marketplace are bring in numerous deals. Propped-up house rates and worths likewise bode well for the future of the real estate market due to the fact that they might ultimately entice more potential sellers off the sidelines.”

Phoenix Redfin representative Heather Mahmood-Corley stated need is outmatching supply. “New listings have actually slowed over the last couple of weeks and purchasers are demanding the houses that do begin the marketplace,” she stated. “Great, well-priced houses are getting numerous deals. I revealed a house to a purchaser last weekend and we needed to wait in line due to the fact that there were many potential purchasers there. It was the very first time in a year I have actually needed to wait in line to see a home.”

In Seattle, rates and pending sales have both decreased more than the nationwide average. However regional Redfin representative Shoshana Godwin stated she’s seeing an uptick in need this month. “Some purchasers are wishing to get an offer due to the fact that home loan rates are high, however rates for preferable houses are in fact increasing due to the fact that there’s such restricted stock,” Godwin stated. “I’m informing purchasers that rates might increase from here due to the fact that stock will stay tight as long as rate of interest are high. Those who can manage to must think about purchasing now if they’re fortunate sufficient to discover a house they desire.”

Leading signs of homebuying activity:

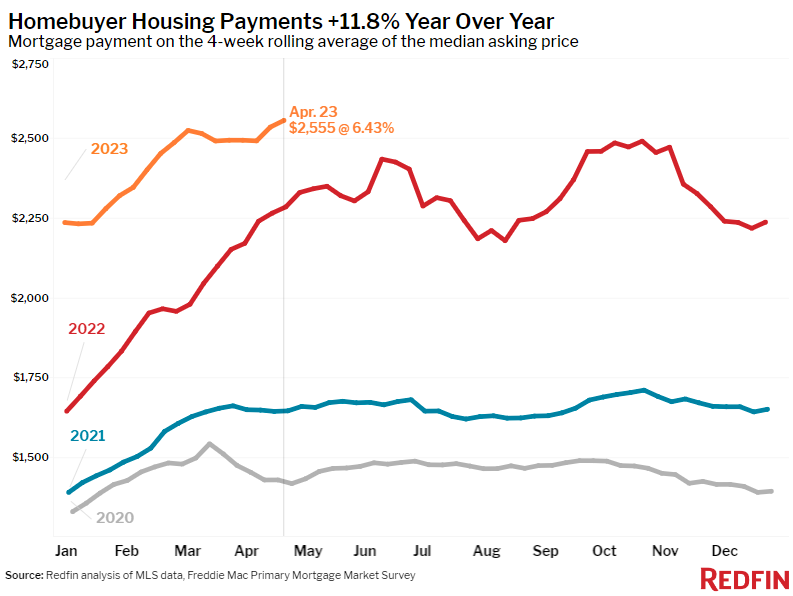

- For the week ending April 27, typical 30-year set home loan rates inched as much as 6.43%, the second-straight little boost after 5 straight weeks of decreases. The everyday average was 6.67% on April 27.

- Mortgage-purchase applications throughout the week ending April 21 increased 5% from a week previously, seasonally changed. Purchase applications were down 28% from a year previously.

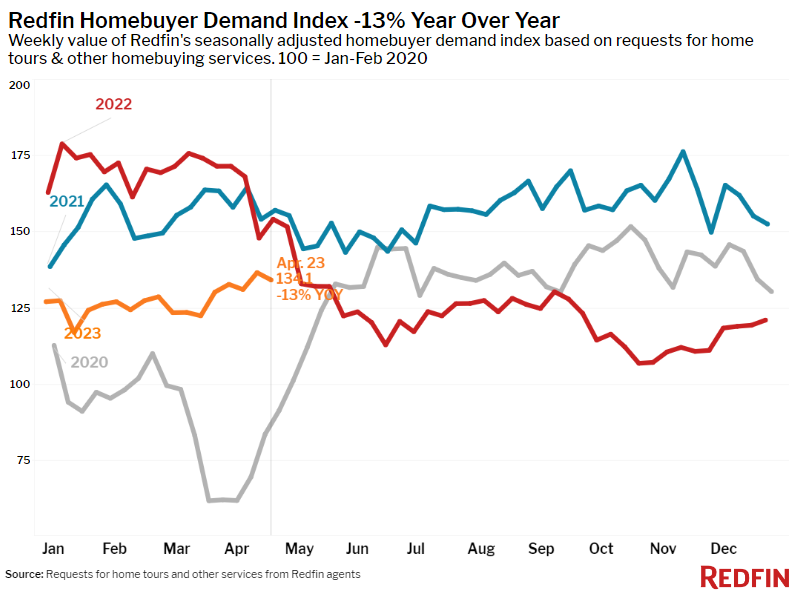

- The seasonally changed Redfin Property buyer Need Index– a step of ask for house trips and other homebuying services from Redfin representatives– was down a little from a week previously throughout the week ending April 23, however up 3% from a month previously. It was down 13% from a year previously.

- Google look for “ houses for sale” were down about 8% from a month previously throughout the week ending April 22, and down about 20% from a year previously.

- Exploring activity since April 22 was up about 28% from the start of the year, compared to a 17% boost at the very same time in 2015, according to house trip innovation business ShowingTime

Secret real estate market takeaways for 400+ U.S. city locations:

Unless otherwise kept in mind, the information in this report covers the four-week duration ending April 23 Redfin’s weekly real estate market information returns through 2015.

Information based upon houses noted and/or offered throughout the duration:

- The typical house list price was $367,053, down 2.8% from a year previously. That’s the ninth-straight four-week duration of decreasing list price.

- Home-sale rates decreased in 29 of the 50 most populated U.S. cities, with the greatest drop in Austin, TX (-13.7% YoY). It’s followed by Oakland, CA (-13.5%), San Francisco (-12.3%), Anaheim, CA (-10%) and Sacramento, CA (-9.4%).

- List price increased most in Fort Lauderdale, FL, where they increased 10% year over year. Next come Miami (8.7%), Cleveland (7.9%), Cincinnati (7.5%) and Columbus, OH (7%).

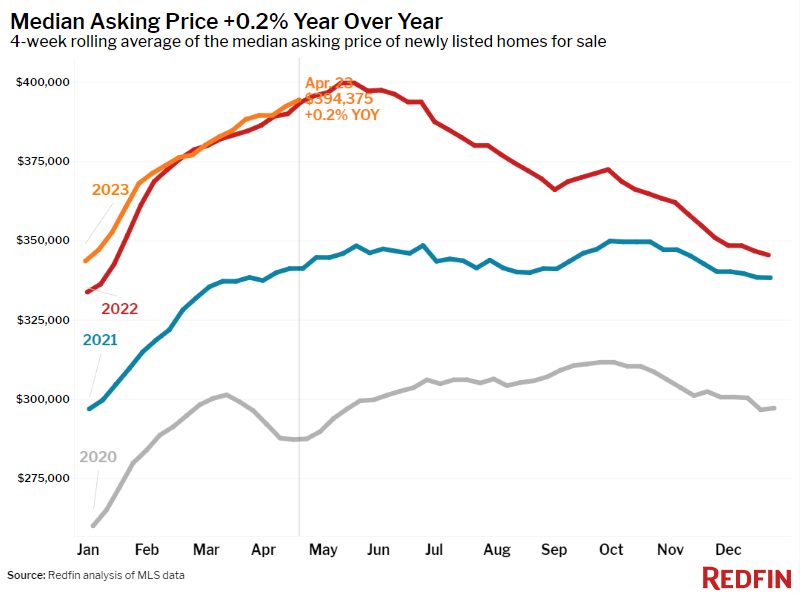

- The typical asking cost of freshly noted houses was $394,375, up 0.2% year over year.

- The month-to-month home loan payment on the median-asking-price house was $2,555 at a 6.43% home loan rate, the existing weekly average. That’s an all-time high and up 12% ($ 271) from a year back.

- Pending house sales were down 16.7% year over year.

- Pending house sales fell in all 50 of the most populated U.S. cities. They decreased most in Las Vegas (-39%), Seattle (-38.9%), Portland, OR (-38.7%), Chicago (-36.9%) and Oakland, CA (-36.2%).

- New listings of houses for sale fell 22.4% year over year.

- New listings decreased in all 50 of the most populated U.S. cities. They dropped most in Oakland (-43.3% YoY), San Diego (-39.8%), Seattle (-39.6%), Sacramento (-39.2%) and Riverside, CA (-38.2%).

- Active listings (the variety of houses noted for sale at any point throughout the duration) were up 7.4% from a year previously, the tiniest boost in 9 months. This metric published an unseasonal decrease.

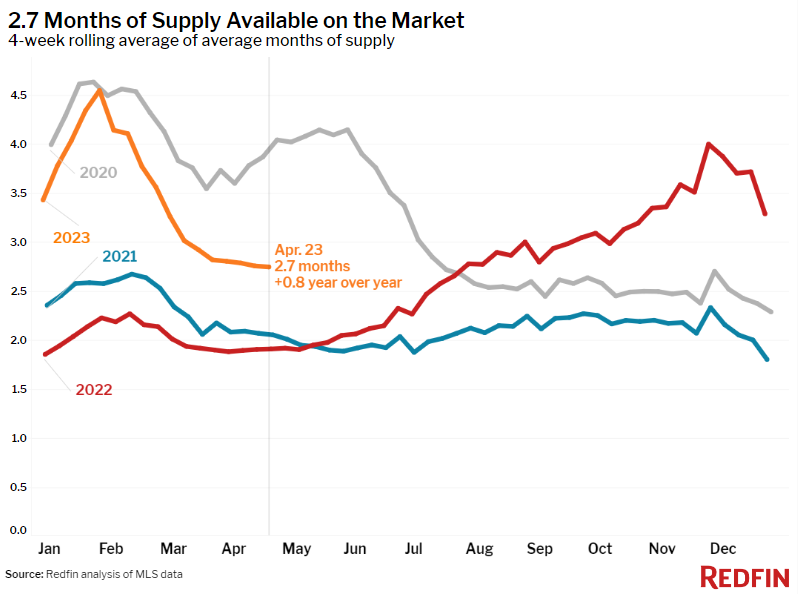

- Months of supply– a step of the balance in between supply and need, computed by the variety of months it would consider the existing stock to cost the existing sales rate– was 2.7 months, up from 1.9 months a year previously. 4 to 5 months of supply is thought about well balanced, with a lower number showing seller’s market conditions.

- 47% of houses that went under agreement had actually an accepted deal within the very first 2 weeks on the marketplace, the greatest level in almost a year.

- Residences that offered were on the marketplace for a typical of 34 days, the quickest period considering that October. That’s up from 20 days a year previously and the record low of 18 days set last Might.

- 30% of houses offered above their last market price, the greatest share in 6 months however below 53% a year previously.

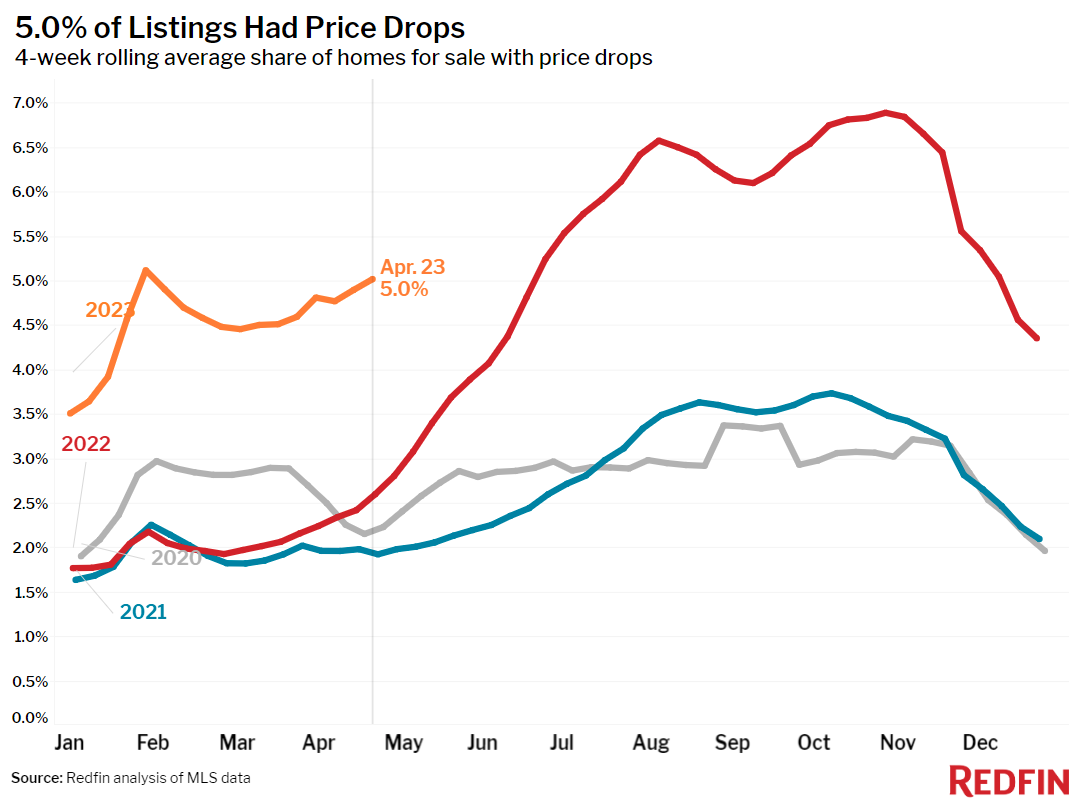

- Usually, 5% of houses for sale every week had a cost drop, up from 2.6% a year previously.

- The typical sale-to-list cost ratio, which determines how close houses are offering to their last asking rates, was 99.1%, the greatest level in 6 months however below 102.4% a year previously.

Describe our metrics meaning page for descriptions of all the metrics utilized in this report.