Deagreez/iStock by means of Getty Images

Financial Investment Thesis

Snap Inc. ( NYSE: BREEZE) put out assistance with its Q1 2023 revenues that took financiers by surprise. Not just is the leading line relocating the incorrect instructions, however its underlying success even more substances matters.

Despite the fact that Snap opens its investor letter with a perfunctory allusion to its AI potential customers, financiers quickly looked beyond this.

To be clear, Snap has 3 concerns to repair:

- There are personal privacy modifications by Apple Inc. ( AAPL), that make it harder for marketers to target specific users with advertisements that affect Snap’s direct-response (DR) service.

- There’s competitors from its larger peers, and the majority of them have significantly more resources than Snap.

- And there’s the weak advertisement market, which does not seem slowing down.

With numerous various issues dealing with the stock, I stay bearish on this name.

Fast Wrap-up

As we headed into the revenues call, 4 days ago I composed a bearish short article that talked about the following:

My assertions showed precise. Moreover, I wish to be in advance and sincere with you. That I’m prejudiced on this stock given that I have actually been bearish on Snap Inc. for so long. So keep that in mind, as we push ahead.

So, what really occurred to Snap?

Snap is Losing Market Share. Duration

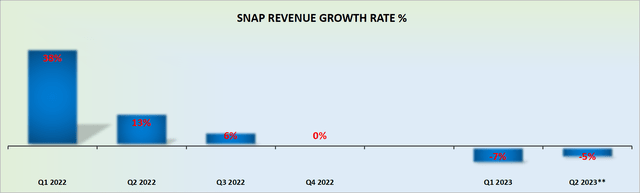

breeze income development rates

Snap is under pressure from all sides. The economy is weak, so marketing is weak. Then, TikTok of ByteDance ( BDNCE) pressures on one side and Meta Platforms, Inc.’s ( META) Reels on the other, eventually leaving Snap without any capability to grow in the middle.

Furthermore, the assistance for Q2 indicate about 5% unfavorable y/y development rates. What’s more, remember that long gone are the days when Snap was lowballing profits to permit a simple beat in the future.

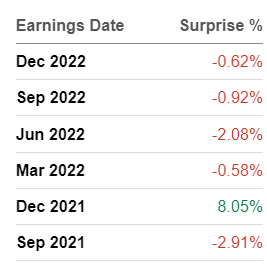

SA premium

If we consist of Snap’s Q1 2023 income miss out on, it’s been more than a year given that Snap favorably beat agreement profits.

Snap’s Near-Term Potential customer

Snap’s assistance for Q2 indicate its Daily Active Users (” DAUs”) reaching roughly 395 million, which is a 19% y/y boost anticipated.

Nevertheless, most of Snap’s quickly growing user base now originates from beyond the U.S. and Europe.

Appropriately, considered that Snap’s Remainder of the World users deserve about 15% of its North American users, that indicates its DAUs need to grow 6 times faster to make up for the uninspired development in The United States and Canada, in the coming couple of quarters.

No Longer a Development Business, What Should Financiers Consider?

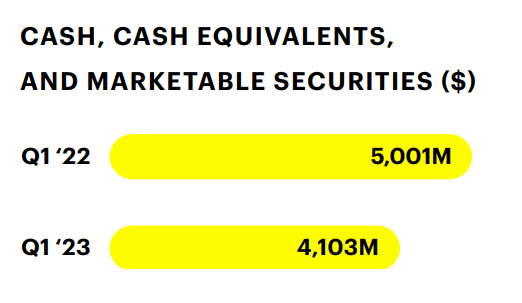

Financiers have actually long made the claim that Snap held a significant quantity of money on its balance sheet, and this supported its assessment. In the previous twelve months, money and equivalents are down $900 million.

BREEZE Q1 2023

So where did the bulk of this money go?

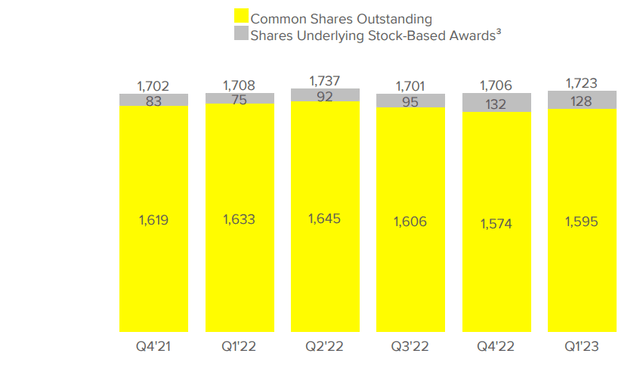

Snap acquired $1 billion worth of shares at roughly $9.50. For this reason, this requires the concern, just how much did this lower Snap’s overall share count in the previous year?

The share count is basically flat. In any case, as Snap goes to excellent lengths to validate in its investor letter, financiers should not be too concerned, as a percentage of management’s stock-based payment share count runs out the cash.

The Bottom Line

In the meantime, Snap Inc.’s hyper-growth days remain in the rearview mirror. Most importantly financiers need to concern terms with its unimpressive development rate expectations and a service that is meaningfully GAAP unprofitable.

Put another method, will brand-new financiers taking a look at Snap Inc. stock be attracted to pay more than around 30x forward non-GAAP EPS for this service?

Maybe, I should reverse the concern, exist other organizations that are valued at 30x non-GAAP revenues that I would choose to own in the marketing sector to Snap Inc.? I believe there are numerous.