Established in 2014, Bloom Financing was very first planned for Muslim business owners in the United States. The microfinancing platform links financiers with small companies utilizing mudarabah, a shariah-compliant profit-sharing arrangement. However creator Matthew Joseph Martin quickly recognized that the start-up, backed by financiers like Increase VC and Tim Draper, was serving a reasonably specific niche market in the States. So he began investigating markets with big populations of Muslim individuals. Indonesia became the very best option.

Southeast Asia is currently house to a flourishing fintech scene, where Grab, GoTo and Sea have actually developed extremely apps that incorporate monetary services, and start-ups like Xendit, Akulaku and Dana (among others) have actually raised numerous countless dollars for payments, banking services and other monetary tools. Indonesia and Malaysia, in the heart of Southeast Asia, are amongst the nations with the biggest Muslim populations on the planet.

These aspects are showing fertile ground for developing and growing fintechs that focus solely on Islamic financing, offering services and products that follow shariah law. To name a few things, this prohibits accumulating interest, speculation and funding non-halal items like pork, tobacco and alcohol.

According to the World Bank, Indonesia has the most Islamic fintech business on the planet– maybe fitting, given that it’s likewise the most populated Muslim-majority nation on the planet with about 231 million Muslims.

Some significant Islamic fintech business consist of peer-to-peer financing platform and digital bank Hijra (previously called Alami), online bank Bank Aladin, LinkAja, which is backed by Telkomsel and Bank Mandri, the biggest bank in Indonesia in regards to property loans and deposits.

Gojek’s GoPay is likewise partnered with the Indonesia mosque council to permit users to make zakat, or required alms providing, online.

On The Other Hand in Malaysia, where 61.3% out of its 33.6 million residents practice Islam, fintech business that concentrate on Islamic financing consist of crowdfunding platform Ethis Ventures and financial investment platform Wahed, which is the only shariah-compliant robo-advisory platform in the nation. Financing Societies, the SoftBank Vision Fund II-backed SME digital financing platform, just recently introduced a shariah-compliant funding item there, and now uses it as the default item to all its Malaysian consumers.

Shariah law requires a various method to monetary services, and standard banks are likewise releasing items for Muslim consumers. Together with the growing variety of Islamic fintech start-ups digitizing the procedure, Islamic-compliant services are ending up being available to more individuals.

Revenue sharing rather of financial obligation

The seed of Bloom Financing was planted when Martin was running a task in the U.S. making it possible for individuals to purchase Bitcoin. He faced a receivables issue, and the normal method to fund money receivables is to get credit line or receivables funding from a bank. As a practicing Muslim, nevertheless, Martin could not utilize standard loans. However he likewise could not discover any other choices in the U.S.

” Quite naively, I believed there are a lot of Muslims who own companies, certainly they deal with the exact same issue,” he stated. “They should have an option. So what is the service?”

After finding out more about the concepts of Islamic financing, Martin introduced Bloom Financing, a platform that links financiers with microbanks, which in turn pay out shariah-compliant funding to microbusinesses. Headquartered in Delaware, Bloom Financing hosts financiers from mainly the United States and Europe, however all of the microbusinesses it serves remain in Indonesia.

After at first soft-launching in the U.S., the Bloom Financing group recognized that the marketplace there for Islamic financing was extremely little, stated Martin. They began trying to find a larger market, and arrived on Indonesia due to the fact that of the monetary addition obstacles dealing with micro and small companies.

Other factors Bloom Financing selected Indonesia over other nations with big Muslim populations included its relative political stability, Martin stated. It likewise has a strong standard facilities for running companies with mainly foreign capital.

” There’s currently been over the previous 20 years previous to us showing up lots of remarkable work,” Martin stated. “A great deal of the foundation was currently there and we had the ability to be available in and run as an adapter where there are inadequacies, and an absence of capital. We had the ability to bridge that absence of capital utilizing an innovation service. All that underlying facilities for the last mile of serving the microbusinesses was currently there and we had the ability to take advantage of it.”

Financiers on Bloom Financing’s platform swimming pool their cash into funds, or cooperatives, which are then handled by microbanks. The microbanks pay out the funding to microbusinesses to buy stock and other things they require. All losses and revenues are shared professional rata, Martin discussed. If a financier’s capital is 1% of a fund, they can anticipate to get 1% of its revenues, or take in losses at the exact same rate.

What makes Bloom Financing’s microfinance platform shariah-compliant is its usage of murabaha agreements rather of conventional interest-charging loans. For instance, when a microbusiness, like a corner shop, requires to purchase stock like drinks or treats, they go to among the cooperatives for funding. Martin describes that the basis of the funding is not the capital, however the product that requires to be acquired. The cooperative purchases it at wholesale costs and supplies it to business at a markup rather of charging interest. They then share the earnings with financiers. Martin stated cooperatives can frequently link microbusinesses with wholesalers that they didn’t formerly understand, and likewise gain from economies of scale, which likewise assists microbusinesses.

An Indonesian warung, or little shop selling treats, beverages and everyday usage products (Gratsias Adhi Hermawan/Getty)

Cooperatives do not set costs, and rather mudarabah arrangements are based upon present market value, which microbusinesses consent to. To make certain microbusinesses get reasonable arrangements from microbanks, expense of financing for microbusinesses is among the important things Bloom Financing thinks about when choosing whether to deal with a cooperative/microbank.

” Let’s state you’re the bank and I wish to purchase chickens. You consent to purchase me 100 chickens. Let’s state it costs $1,000. We will concur that your earnings will be 20%, so I need to pay you $1,200 throughout, state, 12 months. So you as the investor have that 20% earnings,” Martin stated.

The benefit of dealing with cooperatives rather of industrial banks is that they supply more versatile payment terms and funding period, which is valuable if a service faces monetary problem, Martin included.

Martin stated there is conversation amongst Islamic scholars about whether profit-sharing is naturally much better than financial obligation. However, he asks, “if equity and financial obligation are equivalent, why is it that the Prophet Muhammed wished security from financial obligation? I believe all of us naturally understand the response to that concern, due to the fact that financial obligation can trap the bad in a cycle of hardship that they can not get away. Equity, on the other hand, includes the principle of threat involvement. Financiers ideally have a much better benefit, and the factor they get that much better benefit is due to the fact that they’re taking part similarly with the business owner in regards to threat.”

Cultivating monetary addition

A 2022 report by research study company DinarStandard and fintech Ellipses approximates that the marketplace size of Islamic fintech in the Organisation of Islamic Coorporation (OIC) nations was $79 billion in 2021, comprising 0.83% of international fintech deal volume. While Islamic fintech’s market size is still little, it is anticipated to reach $179 billion at a 17.9% CAGR by 2026, outmatching conventional fintech’s 13.5% CAGR development over the exact same duration.

DinarStandard and Ellipses likewise discovered that there are 375 Islamic fintech business worldwide. Many remain in the P2P funding area, and Indonesia is among the leading markets in deal volume.

Islamic fintech start-ups in Malaysia and Indonesia have the assistance of federal government policies. For instance, Indonesia’s National Islamic Financing Committee is concentrated on establishing Islamic financing and the nation’s Islamic economy.

And in Malaysia, Bank Negara’s Investments Accounts Platform is the very first Islamic P2P effort developed by a reserve bank, while the government-owned Malaysia Digital Economy Corporation links financiers with halal entrepreneur. In 2019, the Malaysian federal government likewise provided its Shared Success Vision 2030, a 10-year structure for reorganizing its economy that consists of constructing an Islamic fintech center as an essential part of its technique.

The World Bank has stated that the development of Islamic fintech can cultivate monetary addition by providing unbanked individuals access to monetary services.

For instance, one group of individuals it can reach are those who prevent checking account due to the fact that their terms are not shariah-compliant, and desire usury-free monetary deals based upon risk-sharing. Islamic fintech can likewise assist deal with concerns that unbanked individuals face, like absence of cash, absence of correct documents and liing far from standard Islamic banks.

Golden Gate Ventures partner Justin Hall, a financier in Hijra and Financing Societies, thinks that Islamic fintech makes Islamic monetary services available to more individuals.

” Islamic banks are extremely conservative, not just with how they run, however the expense of funding, who they can provide to, and so on,” he stated. “Having business that separate from that and supply a good customer experience on the digital banking side, however within the structure of an Islamic bank, there’s a chance there.”

The World Bank likewise states the Islamic microfinancing, or short-term funding with regards to less than 12 months, can play an essential function in reducing hardship in OIC nations given that they deal with consumers who are frequently underserved by conventional banks.

One example of a fintech business developing shariah-compliant items for underserved consumers is Financing Societies, which is headquartered in Singapore with operations in Indonesia, Malaysia and Thailand.

Kien Poon Chai, the nation supervisor of Financing Societies Malaysia, stated its shariah-compliant funding item was introduced in 2022 to serve reasonably brand-new micro- and small companies, which are typically neglected by banks when looking for working capital.

Chai stated the incentive for releasing shariah-compliant funding items was due to the fact that Malaysia has a big Muslim population and the business was seeing need from lending institutions and SMEs trying to find funding items in line with their faith.

Financing Societies finances its shariah-compliant funding item in the exact same method as its standard funding equivalents, however there are a number of subtleties it needs to pay attention to. For instance, funding can not be utilized for non-halal companies, consisting of ones that offer alcohol, pork, tobacco or massage homes.

Monetary deals likewise need to be backed by underlying properties, so for each dispensation Financing Societies makes through its shariah-compliant item, it needs to buy underlying products through exchanges.

Cost disclosures and charges likewise need to be shariah-compliant. There can not be unpredictability in funding items, so all charges and charges should be plainly specified and laid out. For instance, punishing individuals for early payment with prepayment charges is prohibited.

Peer-to-peer financing without interest

Another Islamic start-up concentrated on monetary addition is P2P financing platform and neobank Hijra. Established in 2018, Hijra has actually raised $30 million in equity from financiers like Quona Capital, Golden Gate Ventures and EV Development. It initially began as an aggregator of conventional Islamic banks serving SMEs, however co-founder and CEO Dima Djani informed TechCrunch that after about 9 months, the group recognized that the Islamic banking market in Indonesia could not stay up to date with the development of fintech.

As an outcome, Hijra got certified by Indonesia’s Financial Providers Authority (OJK) in 2019 to run as a digital financing platform. Then retail lending institutions started requesting more extensive monetary services, so Hijra, then called Alami (which is still the name of its P2P financing platform) obtained a little Islamic bank in 2015 and introduced a brand-new digital bank with cost savings accounts and cash transfers.

The primary factor Djani wished to release an Islamic financing platform is due to the fact that Indonesia has among the biggest Muslim populations on the planet, however the penetration of Islamic financing was still extremely low, at about 6% to 7% of overall banking properties, compared to about 30% penetration in Malaysia. Djani associates this to low customer awareness of Islamic financing, however states a new age of spiritual instructors, who get fans on social networks, has actually triggered a strong halal economy over the last ten years and likewise stimulated interest amongst millennial and Gen Z Muslims in embracing services that are customized to their faith.

In Indonesia, the standards for Islamic financing are figured out by 3 authorities, stated scientist Fahmi Ali Hadaefi. These are the Financial Provider Authority (OJK), which manages and monitors the monetary services sector, Bank Indonesia, which manages banks, and the Majelis Ulama Indonesia (National Sharia Board-MUI), or the nation’s leading Islamic scholars body.

The MUI has actually released a minimum of 2 fatwas on fintech. The very first, provided in 2017, has to do with Islamic point of views on practices connected to e-money. The 2nd one, provided a year later on with the Financial Provider Authority, covers Islamic principles for P2P financing.

Considering that Muslims are restricted from interest-bearing deals, Hijra’s group wished to supply an option for users in requirement of working capital funding. Like Bloom Financing, it utilizes a profit-sharing design to prevent interest.

The method it manages P2P loans in between lending institutions and farmers is one example. When a fish farmer requires to purchase feed, they do not secure a loan with interest from a lending institution. Rather, their loan provider purchases fish feed and offers it at an earnings to the farmer, with markups based upon present market rates. Rather of spending for the feed right away, farmers pay it off after gathering fish in about 3 to 4 months.

Islamic financing is suggested to produce a transparent and reasonable monetary service for everybody,” stated Djani. “For instance, we see interest or usury as an unjust instrument on its mechanics. In addition, we likewise see that speculation and gaming as unjust, as they do not commensurate the effort and return equally.”

Collecting fish on Ganga Island, North Sulawesi, Indonesia (Giordano Cipriani/Getty)

Hijra’s digital banking app, which it had the ability to release after getting the little Islamic bank in Jakarta, does not provide any yield to depositors at the minute, however it likewise does not charge them any charges. In the future, Hijra is preparing to release more sharia-compliant monetary services, like rent-to-own, payments and community-driven cost savings for groups of individuals who have a typical objective, like conserving cash for a journey to Capital.

Structure a halal payment entrance

Another example of a business established to get more Muslims taking part in digital monetary services is PayHalal, which was developed to supply a shariah-compliant online payment entrance.

Co-founder Pat Salam Thevarajah informed TechCrunch that he and fellow PayHalal co-founders recognized in 2016 that if they wished to get more individuals in the Muslim neighborhood to embrace online payments, they would need to construct their whole tech stack from the ground up, rather of going to a white-label service provider like Ayden. Thevarajah stated that 55% of the Malaysian population is unbanked mainly due to the fact that they fear riba, or interest.

” We developed it due to the fact that of the pure requirement to produce end-to-end compliance into the deal. That’s how PayHalal happened. The main goal is to keep payment devoid of riba and gharar, or speculation, so that Muslims have the ability to carry out electronic payments face to face or e-commerce with no type of non-compliance.”

Among PayHalal’s objectives is to produce a network like Visa or Mastercard that remains real to Islamic financing concepts. One secret distinction is the absence of interest.

Standard payment entrances deal with cash as a product, which indicates it can be cost a rate greater than stated value or provided out with interest. PayHalal does not deal with cash as a product, rather just utilizing it to buy items and services, and makes earnings on the trading of items or services. PayHalal ensures its services are shariah-compliant with the aid of 2 staff member, scholar Dr. Daud Bakar and co-founder Indrawathi Selvarajah, who was a business attorney prior to she ended up being a shariah fintech expert.

Today, when an instrument originates from a standard banks, PayHalal feeds it into its AI-based non-shariah compliance screening tool. The tool then recommends treatment based upon the quantity of non-compliance element, and PayHalal states that it takes the charge it makes on the deal, composes it off and contributes it to social work, like feeding bad individuals or constructing mosques, as part of a procedure called filtration.

Thevarajah stated the procedure is auditable due to the fact that Islamic banks have internal shariah compliance departments, which in turn go through routine audits by external shariah supervisory boards. The procedure of determining non-compliant deals, crossing out revenues and contributing charges is recorded and examined by internal and external auditors for precision.

Some examples of shariah non-compliant deals consist of ones that include the sale of prohibited products like alcohol, tobacco and pork. Deals that include riba or gharar are likewise thought about non-compliant, and these can consist of interest charged on late payments or unsure terms utilized in sales agreements.

” There is no assurance that we can keep riba away, unless it’s a closed-loop Islamic deal,” stated Thevarajah. “If it ends up being an open-loop deal, we are then needed to do filtration.”

Cases of non-compliant deals it attempts to prevent consist of the exchange of items for intake that aren’t made with halal components. Another remains in cases of salaam agreements, where a purchaser pays right away for something that will be provided at a later date. When that type of deal is managed by PayHalal, it reduces chargebacks by ensuring consumers get their items at the concurred upon time.

” Openness is essential with Islamic deals,” Thevarajah stated.

Among PayHalal’s objectives is to construct a very app with various shariah-compliant monetary services, like insurance coverage items and conserving represent trips to Capital. It just recently took an action towards broadening its item portfolio by releasing a shariah-compliant buy now, pay later on service with Atome. The BNPL program is interest-free and has no yearly and maintenance charges. It is presently onboarding merchants who provide halal and shariah-compliant product and services.

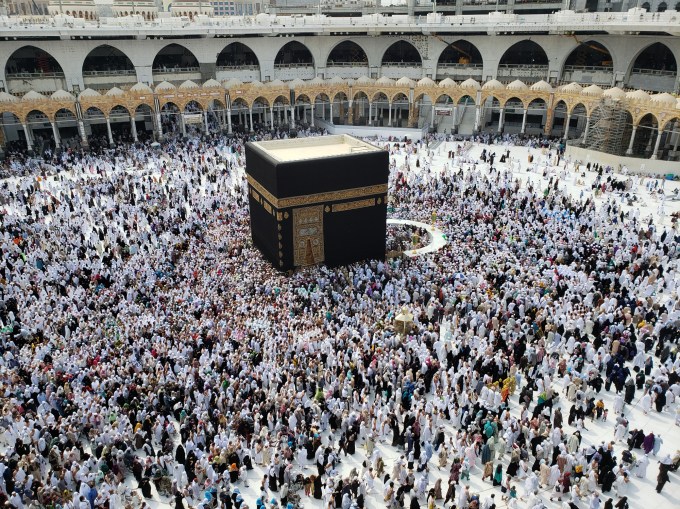

Capital throughout the Hajj trip (Reptile8488/Getty)

Thevarajah describes that if a client defaults beyond the three-month regard to the loan, PayHalal can’t charge interest. Rather, it needs to finance the whole deal. “Our agreement with the merchant would be active involvement where we purchase the item and we resell it to the customer for the factor to consider of a charge,” he stated, including “The agreement alters the whole structure of how an Islamic buy now, pay later on runs.”

Thevarajah included that deals are structured as credit sales, which indicates PayHalal, serving as the seller, purchases the item for a provider and after that offers it to a client at an earnings margin. The client than settles the overall rate of the item in installations over a fixed amount of time. The deal is asset-based, which indicates that it is protected versus the item being offered, not the purchaser’s credit reliability.

Still early days

The increase of Islamic fintech in markets like Indonesia and Malaysia is connected to the development of Islamic financing in Southeast Asia. According to a S&P report released in 2015, Southeast Asia’s $290 billion Islamic banking market is anticipated to continue growing at a CAGR of about 8%. In Malaysia, Islamic banks will comprise 45% of the general industrial banking loan book by the end of 2025, and in Indonesia, Islamic financing’s market share is anticipated to grow to 10% by the end of 2026, at a much faster rate than standard banks.

However Islamic fintech still comprises a really little portion of the overall market. As specified previously, DinarStandard and Ellipses approximate that the marketplace size of Islamic fintech in was OIC nations was $79 billion in 2021, or simply 0.83% of international fintech deal volume. However that’s not stopping Hijra from making global growth strategies– the group currently has an eye on Malaysia, Turkey and Saudi Arabia.

Golden Gate’s Justin Hall, likewise a financier in Hijra and Financing Societies, thinks Indonesia is distinctively placed to be a beginning ground for Islamic banks to broaden to other markets worldwide.

” Indonesia is the only nation today that has a confluence of operators that comprehend Islamic banking, along with serial business owners, institutional LPs that want to capitalize business that are doing that, and a really, huge domestic market. It’s extremely uncommon to discover a design special to Southeast Asia that can go international and I really do not understand of any however Islamic fintech.”

As Muslim fintechs produce a more inclusive market landscape for Muslim users, they are likewise dealing with their own inclusivity concerns, such as getting more females into the field of monetary innovation companies.

Djani stated the rate of females operating in Muslim fintech is still relatively low, though some have actually promoted females to management functions, consisting of Hijra’s primary monetary officer Febriny Rimenta.

Among the co-founders of PayHalal, Selvarajah, is a female and Thevarajah stated Muslim fintech start-ups can take a number of actions to get more females into the area, consisting of constructing a gender-inclusive office based upon Islamic worths, supplying versatile working plans, mentorship and promoting openness to construct trust with females staff members.

He included that Muslim fintech start-ups can create items, consisting of cost savings and financial investment platforms, to increase females’s monetary empowerment.

Martin stated the cooperatives Bloom Financing deals with normally have a high representation of females, with one that is staffed entirely by females.

Barriers exist in other elements of the area, too. On the fundraising front, Martin stated among the primary barriers he dealt with in the U.S. was informing financiers.

” First you need to discuss what does Islam state and why is this even an issue, and after that you discuss your circumstance. So that was an obstacle. Nevertheless, I would state for VCs who had the ability to link the dots and comprehend it was a real issue– there were some that did state, ok, possibly this is too specific niche and they passed– however for those who had the ability to put in the time to comprehend the issue, we didn’t deal with any barriers.

Possibly remarkably, the most pushback he got was from other Muslims.

” Where we did face barriers was within Muslims living as a minority in America. They pressed back versus: ‘why are you calling this Muslim? Why are you concentrated on Islam?'” he stated. “Extremely surprisingly, the equity capital financiers [who did back us] resembled, this makes good sense. This is an essential specific niche. I believe that returns to being a minority and post-9/ 11, and being protective. There is that resistance versus going to a Muslim-majority [market], where it resembles “well obviously you’re doing Muslim financing, why would not you?”

For Islamic fintechs, discovering financiers can likewise imply doing their own due diligence.

PayHalal, which has actually gotten $4.5 million in seed financing from Asad Capital, Q Cap, Effective Shields and Crescent Capital, is now in the procedure of raising a $5 million Series A round at an appraisal of $33.5 million. Thevarajah stated part of fundraising ways examining possible financiers to guarantee both they and their fund management is performed in positioning with shariah concepts.

” Financier interest in the Islamic fintech sector for PayHalal was extremely high due to its capacity in a fast-growing Muslim population worldwide,” Thevarajah stated. “While some financiers saw it as a captive market due to the faiths of the Muslim neighborhood concerning halal food and deals, we still needed to guarantee that possible financiers fell within the fit and correct classification for Islamic monetary services.”

Creators in nations with big Muslim populations state they likewise needed to inform financiers, however that is altering. The $30 million Hijra has actually raised in equity up until now is practically all from non-Muslim nations. Djani stated numerous of its financiers currently had a strong interest in Islamic monetary services due to the fact that it is a growing specific niche that has the ability to supply distinction for fintech gamers.

” We will require to do education on what we are using, however significantly less so over the previous couple of years as Islamic financing has actually ended up being more traditional and commonly accepted in Muslim-majority nations, like Indonesia,” he stated.