The media as soon as once more presumes that The usâs monetary negligence will lead to a brand new international reserve foreign money. As we wrote in The Greenbacks Dying, No longer So Speedy Section I, âDonât dangle your breath. Headlines forecasting the greenbackâs demise as the arenaâs reserve foreign money had been round for a very long time.â Whilst the case for a brand new international reserve foreign money is robust, the alternative choices faded when compared. There are 4 necessary the explanation why discovering a alternative will end up tough.

The 4 causes, the rule of thumb of regulation, liquid monetary markets, and financial and army may, all however ensure the demise of the greenback is not going to happen anytime quickly.Â

The Greenbacks Dying, No longer So Speedy Section I supplies background for the greenbackâs position as the worldwide reserve foreign money and the inherent flaws in serving that position. The assemble of the greenback and the explanations for its beginning as the arenaâs foreign money is an very important basis for working out its present place.

Key Takeaways

- The greenback will likely be extraordinarily onerous to interchange for 4 causes: The rule of thumb of regulation, liquid monetary markets, and financial and army may.

- 60% of worldwide foreign money reserves are in greenbacks, and about 90% of industry happens in greenbacks.

- No different foreign money or block of countryâs currencies, gold-backed foreign money, or bitcoin is these days a viable candidate to interchange the greenback as the worldwide reserve foreign money.

The Rule of Legislation

The rule of thumb of regulation is helping be sure that U.S. electorate and establishments are equipped human rights, assets, contracts, and procedural rights. Whilst many different countries might declare to have identical criminal processes, few are living as much as U.S. requirements. The criminal gadget similarly protects foreigners with greenback and different monetary and criminal pursuits within the U.S.

From a foreign money viewpoint, the court docket gadget, no longer a central authority decree, guidelines on monetary disputes. It’s for sure improper and biased. As Russia, Iran, and different international locations have discovered, the U.S. executive will grasp their greenbacks in the event that they deem it in its very best hobby. Whilst such acts bend the worth of the rule of thumb of regulation, nearly all international countries are assured that the U.S. gadget of regulation and governance guarantees their skill to carry and transact in U.S. greenbacks. Additional, rules and rules supply self belief in the right kind functioning of U.S. markets they depend closely on to satisfy their borrowing and funding wishes.Â

Hedge fund tycoon Mark Mobius is finding why making an investment in international locations much less considered than the U.S. can also be unhealthy. Consistent with CNN:

âI’ve an account with HSBC in Shanghai. I willât take my cash out. The federal government is proscribing the drift of cash in a foreign country,â Mobius, founding father of Mobius Capital Companions, instructed FOX Industry on March 2, 2023.

For the ones pondering that China, Russia, and Saudi Arabia can cobble in combination a reserve foreign money, ask your self a query. For those who had been the chief of a country, would you allow finances of their banking gadget or believe their executive with mentioned finances? Extra importantly, do you even suppose the ones international locations believe every different?

Liquid Markets

From an operational viewpoint, the scale and liquidity of U.S. monetary markets and the convenience with which foreigners can borrow and make investments U.S. greenbacks are of maximum significance.

Foreigners enacting international industry want greenbacks to facilitate trade. Due to this fact, they dangle greenbacks and care for the power to borrow greenbacks. Global industry calls for a monetary gadget with immense liquidity. Additional, the extra liquid a marketplace, the decrease the borrowing, making an investment, and hedging prices.

On this admire, the U.S. is 2nd to none. The U.S. bond markets are regarded as the arenaâs private and maximum liquid markets. As we quote beneath, the U.S. bond marketplace accounts for just about 40% of all bonds remarkable globally.

Consistent with the Securities Trade and Monetary Markets Affiliation (SIFMA): âAs of 2021, the scale of the bond marketplace (general debt remarkable) is estimated to be at $119 trillion international and $46 trillion for the U.S. marketplace.â

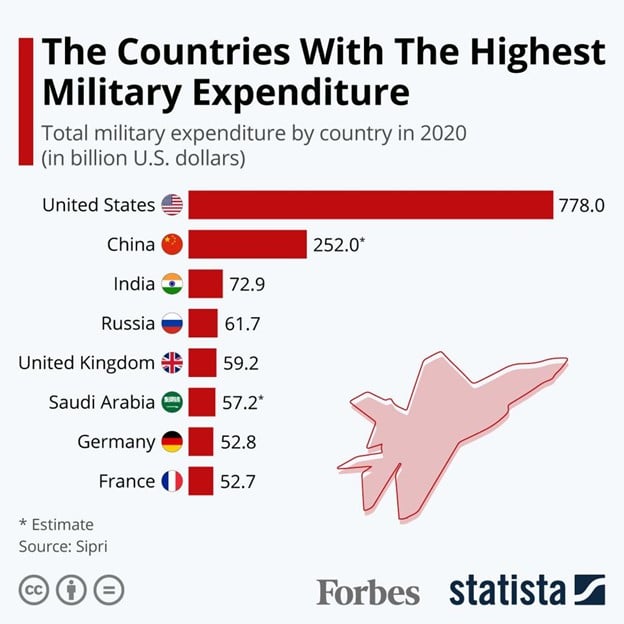

Army May

A key issue permitting Europe and Japan to get better briefly from Global Battle II was once the power to borrow U.S. greenbacks and use the cash to concentrate on rebuilding. Similarly necessary, they didn’t need to refortify their army for every other warfare. The us had its again if every other nation had been to invade. In consequence, over 750 US army bases these days exist in additional than 80 international locations.

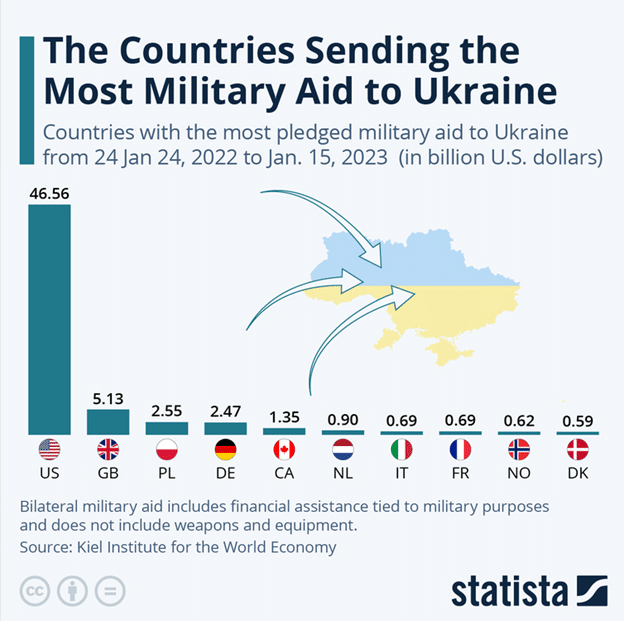

Letâs believe Ukraineâs scenario. Its protection in opposition to Russia is being closely funded and supported via the U.S. What may occur if Ukraine begins buying and selling with Chinese language Yuan or Euros? Do you suppose The us would nonetheless give them the strengthen they desperately want? Does Ukraine be capable to forgo the usage of the greenback in industry? The solution to each questions is a definitive no.

The graph beneath presentations the U.S. Accounts for roughly 80% of army assist to Ukraine.

With China and Russia flexing their army muscular tissues, different international locations are observing the location and spotting that the greenback and The usâs army are a bundle deal.

Given The usâs superpower standing, for every other foreign money to turn out to be the worldwide reserve foreign money, authorized via an overwhelmingly massive proportion of nations, that alternative executive must defeat the U.S.

Financial Energy

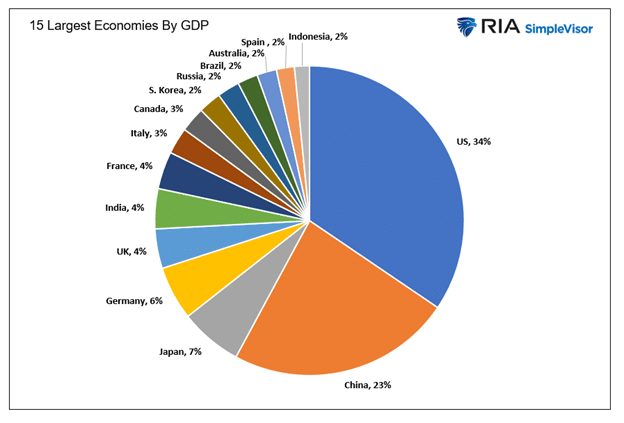

As proven beneath, america financial system is kind of the similar measurement as the following 3 greatest economies blended. Given U.S. financial task dwarfs each country however China, a big proportion of worldwide industry comes to U.S.-based patrons and dealers. The greenback is the most well liked foreign money to facilitate trade with those entities.

Present Buck Standing

In keeping with the IMF, the greenback makes up nearly 60% of worldwide foreign currency echange reserves. Whilst the share has declined via about 10% during the last decade, it’s nonetheless 3 times the following main reserve, the Euro, which accounts for roughly 20% of worldwide reserves. For the ones keen on China, their foreign money, the renminbi (yuan), accounts for two.5% of all reserves. This is explanation why sufficient to depend China out.

Consistent with the BIS, international dollar-denominated debt totals roughly $16 trillion. This is up from $10 trillion in 2008. Subsequent in line is international Euro-denominated debt at kind of $4 trillion. That quantity has no longer modified since 2008.Â

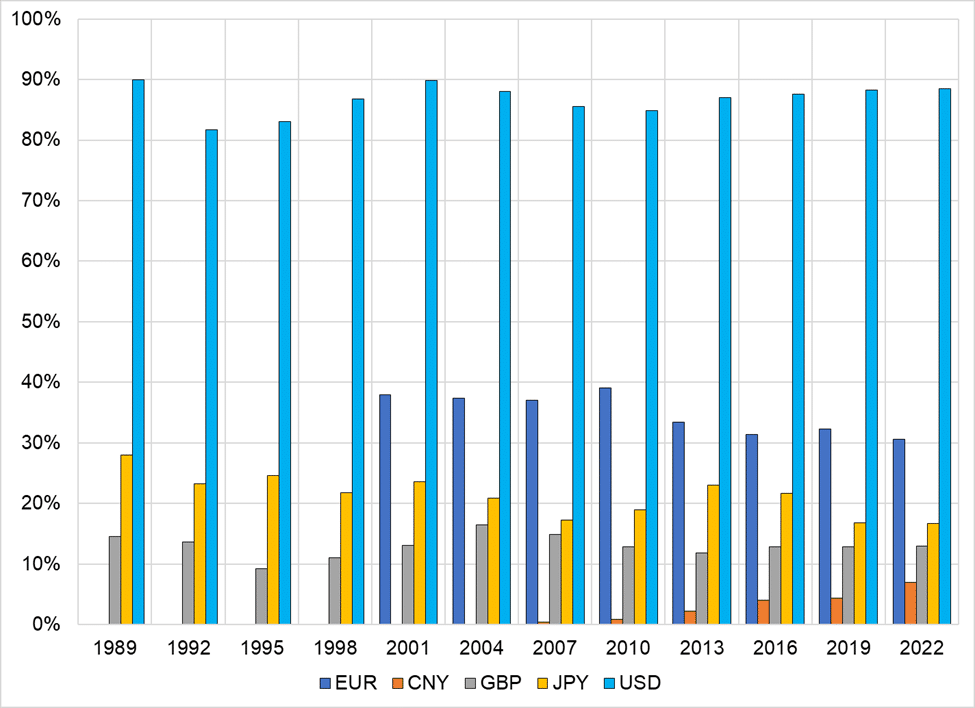

Knowledge from the BIS and the graph beneath from @donnelly_brent display the greenback accounts for just about 90% of worldwide transactions. That proportion has been secure during the last thirty years.

Abstract

The pundits will likely be proper at some point. The greenbackâs demise because the reserve foreign money will come, and a few different countryâs foreign money, cryptocurrency, gold, shells, or one thing else will take its position. Then again, that day isn’t coming anytime quickly. The 4 causes we describe within the article depart the arena and not using a selection.

Whilst China is unexpectedly rising its financial system and international industry footprint, it lacks the rule of thumb of regulation and liquid capital markets to maintain an international foreign money. Itâs tough to peer how a communist nation can conquer the ones demanding situations.

The Euro is probably the most viable competitor. They’ve the rule of thumb of regulation, however their capital markets aren’t just about liquid sufficient to facilitate international industry. In addition they lack the army may to pressure using the Euro. Allow us to additionally take into accout its price range are in similarly dangerous and even worse form than the U.S. There is not any explanation why to suspect the euro may just overtake the greenback.

Bitcoin? Put out of your mind about it! The federal government won’t ever relinquish its regulate over the foreign money as a result of, with that, they lose regulate of the country.

Gold-backed greenbacks had been a mainstay till 1971. Then again, as we now have discovered for the remaining fifty years, gold restricts the power of the central financial institution to run financial coverage as they see have compatibility. A rules-based gadget, like gold-backed greenbacks, may benefit the financial system. Then again, without reference to your ideas, the Fed and executive aren’t ones to surrender energy.

![]()

Michael Lebowitz, CFA is an Funding Analyst and Portfolio Supervisor for RIA Advisors. focusing on macroeconomic analysis, valuations, asset allocation, and possibility control. RIA Contributing Editor and Analysis Director. CFA is an Funding Analyst and Portfolio Supervisor; Co-founder of 720 World Analysis.Â

Apply Michael on Twitter or cross to 720global.com for extra analysis and research.

Buyer Courting Abstract (Shape CRS)

Put up Perspectives: 323

2023/04/19