Apple Card Cost Savings Account, a brand-new combination for the Wallet app initially revealed back in October, is now readily available with a remarkable 4.15% interest rate. Head listed below for all the information you require to understand.

In a news release on Monday, Apple revealed that Apple Card Cost savings Account is now readily available by means of the Wallet app. It uses a high-yield APY of 4.15%, which is “more than 10 times the nationwide average. There are no costs, no minimum deposits, and no minimum balance requirements.

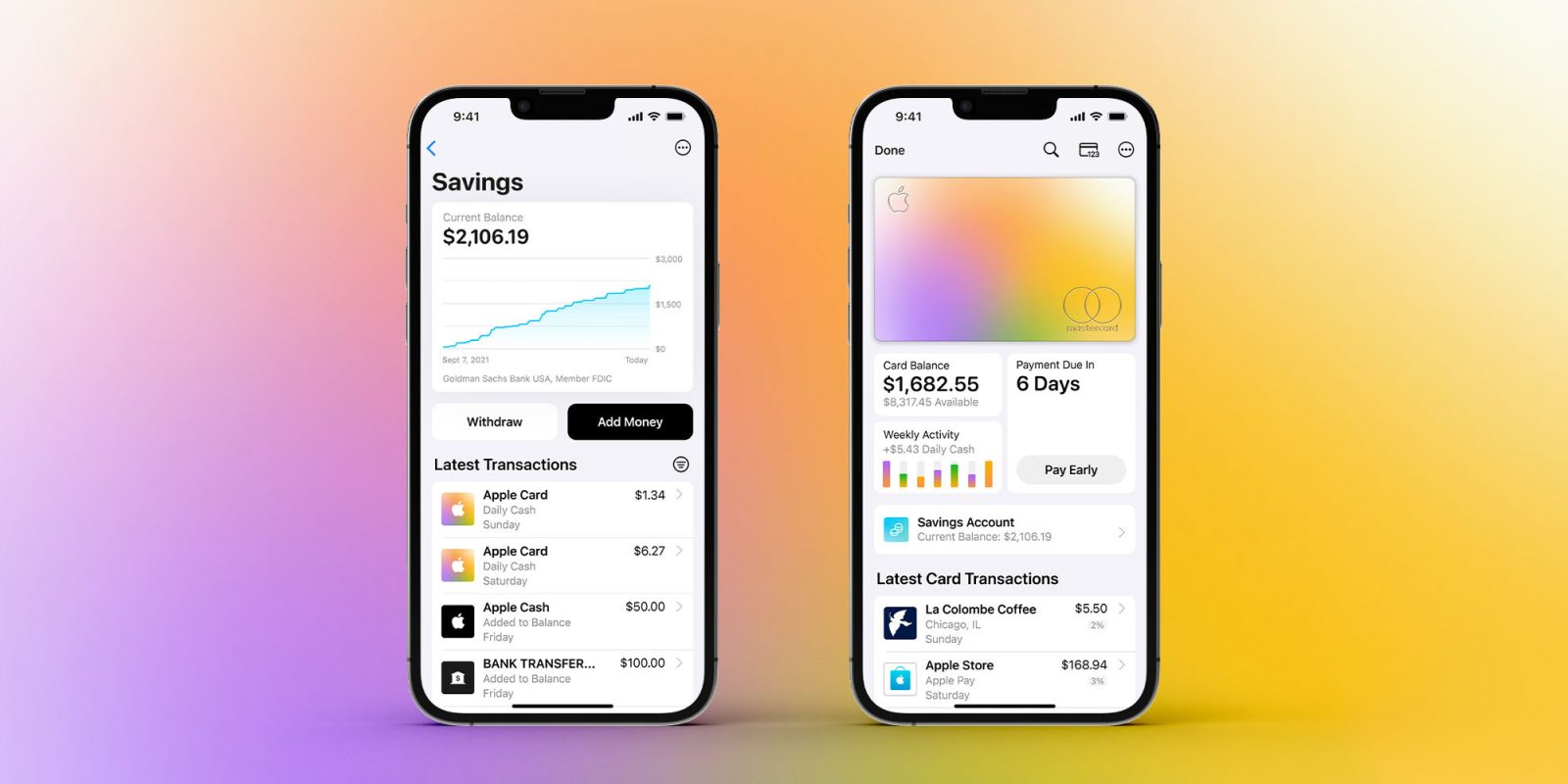

Apple Card Cost savings Account permits you to immediately transfer your Daily Money rewards into the account. This suggests that as you make Everyday Money with your Apple Card, that cash can be immediately transferred into the high-yield cost savings account in the Wallet app.

As a refresher, Apple Card uses Daily Money rewards at 3% for all buy from Apple, 2% on all purchases utilizing Apple Pay, and 1% on all other purchases. You can likewise get 3% Daily Money back when you purchase with Apple Pay at a choice of particular shops and merchants:

- Ace Hardware

- Exxon

- Nike

- T-Mobile

- Uber Consumes

- Duane Reade

- Mobil

- Panera Bread

- Uber

- Walgreens

You can find out more about how these benefits compares to other charge card on the marketplace with an app like CardPointers

More on Apple Card Cost Savings Account

In addition to transferring Daily Money straight into the cost savings account, Apple Card users can likewise transfer extra cash utilizing a connected checking account or their Apple Money balance.

” Cost savings assists our users get back at more worth out of their preferred Apple Card advantage– Daily Money– while offering them with a simple method to conserve cash every day,” stated Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet. “Our objective is to develop tools that assist users lead much healthier monetary lives, and structure Cost savings into Apple Card in Wallet allows them to invest, send out, and conserve Daily Money straight and perfectly– all from one location.”

Users can to track the balance of this high-yield cost savings account straight in the Wallet app. There will be a brand-new “Cost savings Account” button in the Apple Card user interface. Tapping on it will reveal a list of deals and a chart revealing the account’s development. You’ll likewise have the ability to withdraw it to your bank quickly.

Apple Card Cost savings Account is run in collaboration with Goldman Sachs, which is likewise Apple’s partner for the Apple Card itself.

The 4.15% APY being provided by Apple bests lots of other high-yield cost savings accounts on the marketplace, consisting of the Marcus cost savings account provided by Goldman Sachs straight. A few of the choices that surpass Apple Card Cost savings Account (and do not need minimum deposits) consist of People Bank, Synchrony, Wealthfront, LendingClub, and some cooperative credit union.

You can register for Apple Card Cost savings account beginning later on today in the Wallet app on your iPhone. You can discover the choice when taking a look at your Apple Card and tapping the 3 dots in the upper-right corner, then tapping on “Daily Money.” It’s anticipated to totally present around 1 p.m. EDT/10 a.m. PDT.

Follow Possibility: Twitter, Instagram, and Mastodon

FTC: We utilize earnings making vehicle affiliate links. More.