blackCAT/E+ by means of Getty Images

” All advantages get here unto them that wait– and do not pass away in the meantime …” Mark Twain.

Because the preliminary explosive charge of sports wagering stocks after the U.S. Supreme Court judgment in 2018, the sector has actually gone through a foreseeable cycle: Phase one, skyrocketing, illogical ebullience that saw the normal trees-growing-to-the-skies deceptions. Especially sizzling were the shares of DraftKings Inc. ( DKNG), which ranged from its IPO level ~$ 20 in April of 2020 to an excessive high of $72 by March of 2021. The crucial chauffeur of the mad trading was the easy reality– absolutely easy to understand– that the only real pure play in the area was DKNG.

However there can be little doubt that delusions about where the market was headed were made it possible for by lots of experts. Some projection unreasonable forecasts of a company that would grow to $200b in yearly incomes based upon absolutely nothing however designs shaped out of algorithms that were borderline fake. However Mr. Market took the bait. And yes, there were certainly smart financiers who rode the rocket, rejected at near highs, and drifted down on golden parachutes into a sea of money. However for one of the most part, financiers who awaited too long took a bath.

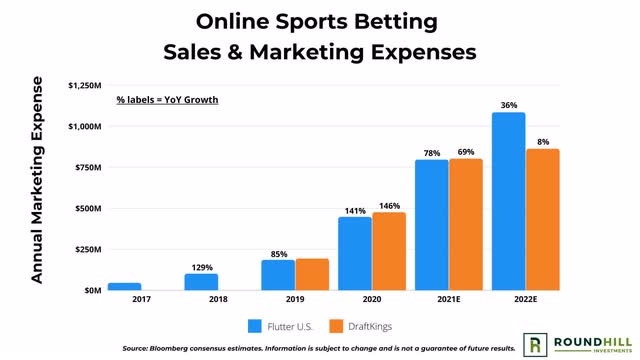

The calculus was based simply on a sales development driver, the underlying presumption being that DKNG’s management would discover a method to progressively minimize its extreme marketing cost as it continued to grow earnings. Market peers were all doing the very same thing weren’t they? Contribute to this the very first class task DKNG had actually done transforming their dream sports client base to genuine cash bettors and you had a bull circumstance.

The American Video Gaming Association (” AGA”) revealed the outcomes of its research study on the involvement rate for March Insanity. The outcome: 68m Americans prepared to wager $15.5 b either online, at a live sports book or taking part in bracket contests for enjoyable. Of this overall, the research study tasks that 31m will access legal online websites, 21.5 m will wager good friend to good friend, and 56.3 m will soak themselves in bracketology. At this writing, 33 states plus Washington, D.C., have legal live sports wagering. 3 more markets are waiting for launch at some point this year. Over 146m American grownups (57%) reside in a legal sports wagering market. So, the sales development component in valuing sector stocks stays strong, though financiers stay careful of when these platforms will turn lucrative.

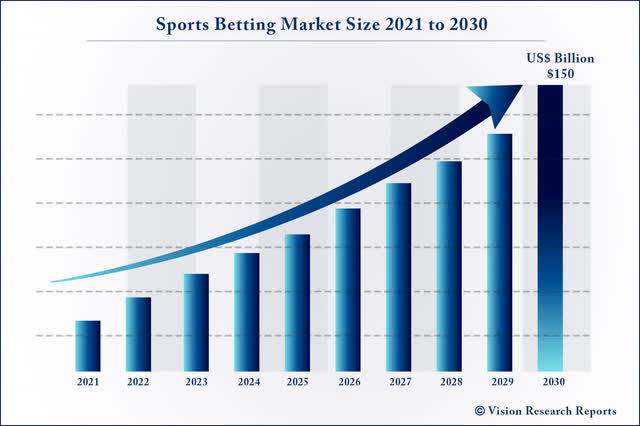

Above: Among the research study reports throughout the early craze that suggests what had actually driven the wild runup of DKNG and other sports wagering stocks. A more reasonable projection is ~$ 40b by 2027-30.

Once truth started to embed in, it took the stock down as low as $10., The running for the exits eased off and ever since, DKNG has actually settled into a trading variety that is even more reasonable. At composing, $17.22 appears about right– however success still avoids them.

However the one viewpoint that continues to keep in our view is the pure play style in DKNG. When you take a look at the remainder of the sector, you see either internationally based online wagering operators with recognized companies in the UK, EU, and other areas plus the U.S. Moreover, there are the U.S. gambling establishment sports books whose trading varieties consist of some assessment to their online systems however, by and big, still increase or fall on the post-covid efficiency of their physical gambling establishments.

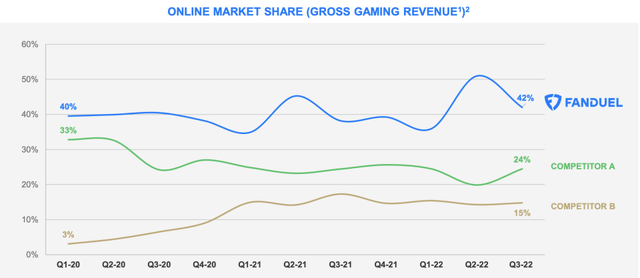

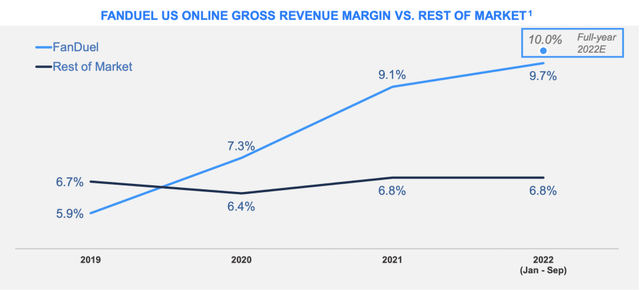

Amongst the worldwide operators sits the greatest of all, Flutter Home entertainment plc ( OTCPK: PDYPF) ( OTCPK: PDYPY), the Ireland-based world leader in online gaming. It owns U.S. market leader FanDuel Group, which at this writing, is the # 1 earnings generator in the U.S., leading in 15 of 18 markets. FanDuel is thought to presently hold in between 42% and 50% of the overall U.S. sports wagering market, forecasting it will obtain well over $3b in 2023 earnings. Its margin at 7.7% sits a bit above the long-lasting mathematically shown standard hold for sports wagering at 7%.

Our present agreement price quote of the U.S. sports wagering market is that it will reach ~$ 40b in overall earnings by 2018. Needs to FanDuel hold share up until then while having actually tamped method down on marketing invest, you would be reasonably taking a look at an income base at ~$ 18b to $20b every year, which would have long paid. Which is what forms the basis for a long-awaited relocation by its moms and dad to spin off its FanDuel system as a different, U.S.-traded sports wagering business. When that takes place, it would offer financiers who think the pure play style makes good sense an option. One need not own both. DKNG will do great, however FanDuel is a far much better bet.

Flutter holders study: 75% authorize of FanDuel spinoff

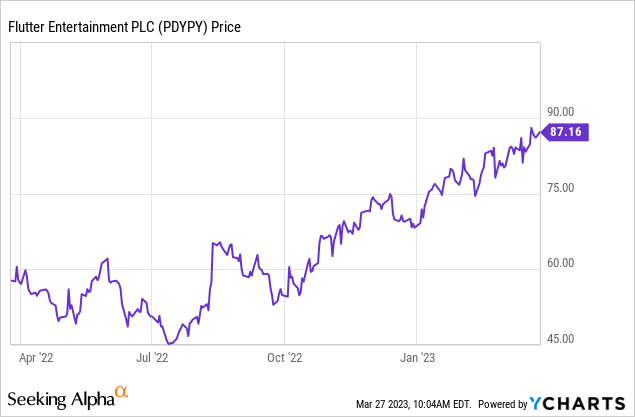

Presently, U.S. financiers who see fantastic returns driven by amazing Q on Q sales development reported by lots of platforms in the sector hold its NASDAQ-traded Flutter Home entertainment shares under the PDYPY ticker. At composing the stock is trading at $86 versus a 52 week variety of $43.71–$ 88.12. The 1 year agreement target is $96, which bakes in y/y FD quarterly sales development, decreasing marketing expenses approaching success prior to completion of 1Q24.

Given That 2021, FLTR management has actually set an objective to bring FanDuel public as a different U.S. entity. However a series of barriers, primarily macro plus legal actions to rise, has actually postponed them. Now the business has actually buckled down and put in location a series of actions that it thinks might produce a FanDuel U.S.-traded IPO prior to completion of this year. If effective, it would make the stock not just a pure play like DKNG, however an instant market leader poised to sustain that management in the years ahead.

Next action: Next month, FLTR investors will be asked to verify their approval of the FanDuel IPO through a proxy vote at the yearly conference. Market sources we have actually talked to all concur that FLTR holders will offer an agreement approval of 75% and activate the legal actions that will lead to the long-awaited public concern in the U.S.

There are great factors for the favorable belief both by management along with for financiers. The stock plainly would raise presence for Flutter Home entertainment’s U.S. profile. It would offer the business instant access to U.S. capital markets. This might suggest a substantial shot that a U.S. FanDuel can get 2nd and 3rd tier websites with a mix of money and stock that would not materially water down holders. Combination in the area is not an IF any longer. It’s just a WHEN.

Trading volume: At the minute, PDYPY’s typical day-to-day trading volume is ~ 630,000 (London moms and dad shares) shares vs. DKNG at 12.5 m (NASDAQ). Our conversations with lenders and traders in the rate inform us that a FanDuel stock would quickly jump to a comparable, if even bigger, day-to-day volume than DKNG.

Stated one lender,

” Look you would have a market leader, not formerly readily available as a pure play per se. If these men are right– and the numbers are pointing that method– that they will turn lucrative by the end of this year– you have the makings for significant institutional buy in integrated with the retail attraction presently taken pleasure in by DKNG.”

PDYPY’s present ratio of 0.87 vs. DKNG’s at 1.57 is an unfavorable since as an avatar of the world’s greatest operator, it brings a lot more financial obligation, $6b. However DKNG’s present ratio is a much healthier 1.67, with money at $1.3 b, winnowing below $2.6 b in 2021– actually half of its money burned through ever since. PDYPY has $2.4 b in money. PDYPY’s money stood at $2.35 b in 2021, so plainly its capital structure because location informs much about how its service utilizes money for marketing to name a few things.

An IPO will demand management resolving the financial obligation concern in filing. So on balance, it is relatively particular than a FanDuel IPO would get a strong reception from Mr. Market whenever it debuts. However it would be misinforming to recommend that a rousing welcome to a FanDuel IPO would activate a bearish outlook for DKNG. One can imagine a section of Mr. Market liking the long-lasting bull case for FanDuel above that of DKNG and moving cash from one to the other.

At the very same time, it would likewise appear than a quick run up on FanDuel shares might bring its trading variety method above DKNG and for that reason present another circumstance to financiers: DKNG is getting its act together on marketing invest. Its Q-on-Q sales development stays strong. It is an extremely close # 2 to FanDuel in overall incomes. So, they will hold their real followers also.

The takeaway

There is an in-depth analysis of the actions Flutter Home entertainment plc holders have ahead to reach approval under both present London and Dublin exchanges and securities laws. Its available on the FLTR financier relations website now.

What is unidentified at this phase naturally is how the lenders will price the concern. There are many concerns at this time in regards to the basic tone of the marketplace, year-to-date earnings overalls of sports wagering prior to the NFL season, brand-new states ready to go live (or not), and so on. To that include the normal metrics discovered in providing files that plan the existing service, discuss its prospective and reasoning for the prices. One standard we can utilize is the assessment placed on the U.S. FanDuel service at $22b by the New york city courts.

That was the quantity got to by the arbitration panel who supervise the conflict in between FLTR and Fox ( FOXA). Fox got a choice to purchase 18.6% of FanDuel in 2020 for $2.1 b and firmly insisted that is what it would pay to work out that right in 2022/23. A New york city court ruled its alternative was supported however not its assessment. Based upon subsequent efficiencies considering that the offer was struck, the court held that Fox needs to pay $3.7 b for its 18.6% of FanDuel.

Utilizing the court’s evaluation of $22b is reasonable. However we do not understand what the float would be, and how the presumed worth of $22b will either remain where it is or increase once again provided a robust year ahead. So, it is simple guesswork at this moment to think where the shares will debut.

What we do feel extremely bullish about is this: If the lenders do not get genuine greedy, as they often do, and drift the shares at a rate with a well-reasoned compensation to DKNG’s trade at the time, the FanDuel shares striking the marketplace will run.

As excessive about the prospective along with the ills of the sports wagering area is now understood, we do not see a rocket trip of the kind DKNG experienced. Yet it is clear that a smartly priced IPO will run, providing financiers with what our company believe will be the single finest contended returns in the area considering that the 2018 SCOTUS choice. With the clearness that pure play stocks present in growing customer markets, it will stay a far simpler call to produce experts than was the DKNG launching.

Financiers are directed to remain tuned on this. Next news needs to break on April 28 th when word that Flutter holders have actually validated approval of a FanDuel IPO. After that, occasions need to move as management declarations show: By 3Q/4Q 23.

Without understanding opening costs, size of float, portion of equity provided, management structure, we put this one ahead of itself: it’s a strong conviction stock that will shriek purchase.

Editor’s Note: This short article goes over several securities that do not trade on a significant U.S. exchange. Please know the threats connected with these stocks.