jetcityimage

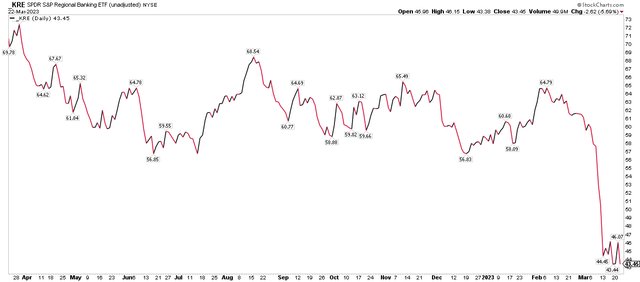

Regional banks have got smoked this month. By way of now, everyone seems to be conscious, however following Powellâs charge hike on Wednesday and Treasury Secretary Yellenâs name for no build up within the FDIC insurance coverage restrict, the SPDR S&P Regional Banking ETF (KRE) settled only a penny off its 52-week low.

I see price in Areas Monetary (NYSE:RF), a long way got rid of from Silicon Valley troubles. In spite of upper investment prices and tighter lending requirements, a single-digit P/E and top yield are too robust to forget about.

KRE: Close to Contemporary Lows Following the March Price Hike, No FDIC Insurance coverage Build up

In keeping with Financial institution of The us World Analysis, Areas is a large-cap regional financial institution founded within the Southeast with greater than $160 billion in belongings. Headquartered in Birmingham Alabama, the corporate has over 1,800 branches and a number one marketplace proportion in Alabama, Tennessee, and Mississippi. The corporate’s lending portfolio focuses totally on C&I, residential mortgages, house fairness, and business loan.

The Alabama-based $17.8 billion marketplace cap banks business corporate throughout the Financials sector trades at a low 7.8 trailing 12-month GAAP price-to-earnings ratio and will pay a top 4.5% dividend yield, in line with The Wall Boulevard Magazine.

Again in January, Areas reported a GAAP income beat. $0.70 of per-share earnings crowned analystsâ estimates of $0.66 whilst revenues have been $2 billion, a $50 million beat. Stocks rose within the days following the discharge, however turmoil within the regional banking area of interest hit the inventory arduous in March. Internet charge-offs fell 17bps Q/Q to 29bps, however that was once above steering of simply 20bps.

The control workforce reiterated its function to handle its CET1 ratio on the higher finish of the 9.25% to 9.75% vary in comparison to 9.6% at year-end 2022. It’ll be key to observe updates to those figures all over Areasâ Q1 file subsequent month.

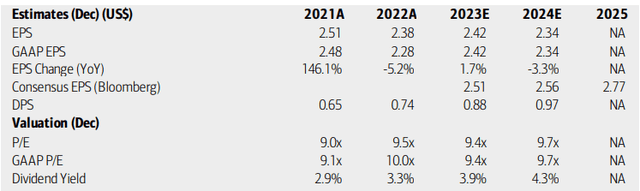

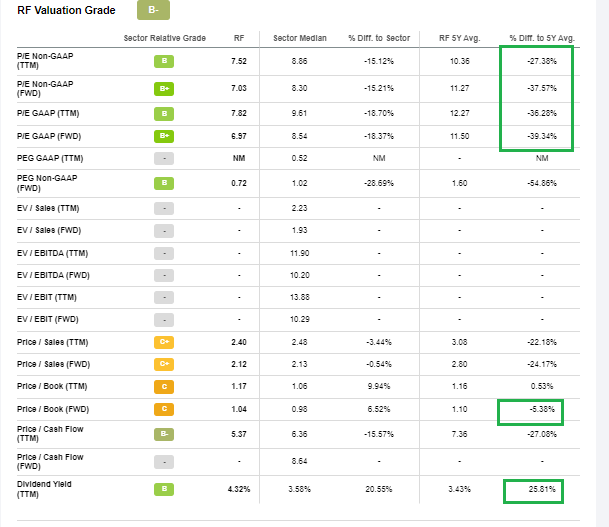

On valuation, analysts at BofA see income maintaining stable within the low to mid-$2s via subsequent 12 months whilst the Bloomberg consensus forecast is extra sanguine at the regional financial institutionâs benefit possible. Dividends, in the meantime, are observed as emerging often over the approaching quarters. With each its working and GAAP P/Es now underneath 10, the inventory seems as a robust price. Whatâs extra, the present yield above 4% is greater than 25% upper than its 5-year reasonable.

With a ahead price-to-book ratio of one.04, a 5% cut price to its long-term imply, I see stocks as a worth right here. If we observe a P/E close to 10, nonetheless underneath the 5-year norm, then the inventory must be within the low $20s.

Areas: Income, Valuation, Dividend Yield Forecasts

RF: Sexy Valuation Metrics, Prime Yield

BofA World Analysis

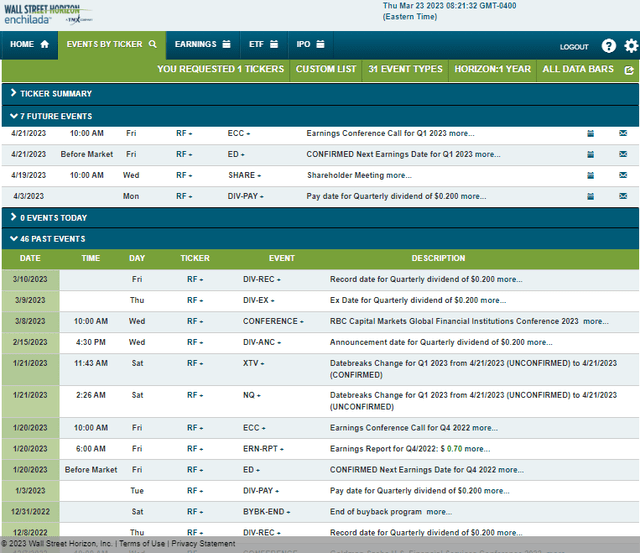

Taking a look forward, company match knowledge equipped through Wall Boulevard Horizon display a showed Q1 2023 income date of Friday, April 21, BMO with a convention name later that morning. You’ll be able to pay attention reside right here. Prior to that, a shareholder assembly takes position on April 19 which might result in some volatility, too.

Company Tournament Chance Calendar

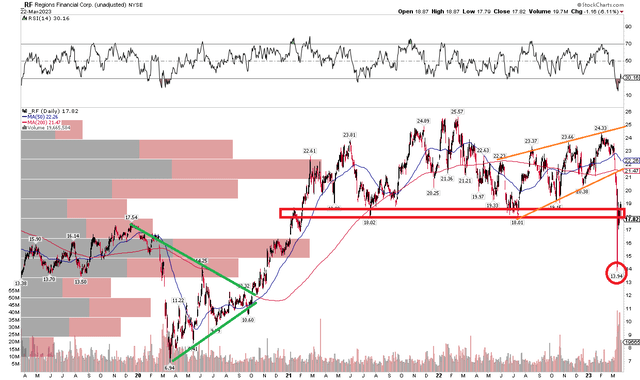

The Technical Take

Whilst the valuation of RF is compelling, the technical image seems stricken. Realize within the chart underneath that the stocks fell underneath key toughen I described again in January. The $17.50 to $19 zone is a key spot for RF, and till it climbs again above it, thereâs technical chance. Even with a transfer via that outdated toughen, now resistance, thereâs top quantity through payment as indicated at the left facet of the graph.

A chart development emerged after my earlier article â a bearish ascending triangle (indicated through the orange traces). Stocks broke down via an uptrend toughen line on their manner right down to underneath $14 â toughen from the apex of a consolidation development in 2020.

However the place can we pass from right here? I might get lengthy above $20, or you’ll bet through buying the inventory nearer to the March low of $13.94, then having a forestall underneath $13. Nonetheless, Regional options relative energy in opposition to the KRE because the inventory is definitely off its low from remaining week whilst business ETF is revisiting its nadir.

RF: Stocks Rebound to Key Resistance, Be expecting A Pause In The Rally

The Backside Line

I proceed to love RF on valuation, however the technicals recommend warning. General, I can stay my purchase ranking according to the long-term valuation thesis, whilst acknowledging the technical dangers.