DNY59

Co-authored by Treading Gently.

These words were penned by Henry Wadsworth Longfellow, from his poem entitled Rainy Day

The day is cold, and dark, and uninspiring; It rains, and the wind is never ever tired; The vine still holds on to the mouldering wall, However at every gust the dead leaves fall, And the day is dark and uninspiring.

My life is cold, and dark, and uninspiring; It rains, and the wind is never ever tired; My ideas still hold on to the mouldering Past, However the hopes of youth fall thick in the blast, And the days are dark and uninspiring.

Be still, unfortunate heart! and stop repining; Behind the clouds is the sun still shining; Thy fate is the typical fate of all, Into each life some rain need to fall, Some days need to be dark and uninspiring.

I was initially presented to this poem and its ideas when I was simply a freshman in college. It was a poem that I was appointed to recite in front of my whole Speech 101 class. The objective was to appropriately encapsulate the ideas and sensations behind the poem by very first absorbing it and comprehending it.

You likely have not lived long if you have actually never ever experienced a bad day. Nearly each people has had a day where we get up beginning the day going for it to be a terrific day and whatever appears to fail. It belongs to the universal human condition. A lot of us will take actions to attempt to prevent or neutralize it when we’re having a bad day, yet we can’t prevent them all.

When it concerns the marketplace, financiers are so crazy about attempting to prevent losses. By fearing the important things that they think will trigger them, like an economic downturn or a bearishness, they make absurd options in an effort to prevent them. Some financiers credit the concept of “offer in May and disappear.” They think that the summer season, which normally are marked by less volume and more volatility, must be prevented. They just offer out of their shares.

There’s a well-known stating by Peter Lynch that’s extremely relevant:

” Much more cash has actually been lost by financiers attempting to time corrections than in all corrections integrated.”

Regretfully, numerous think that they’re using a guideline that Warren Buffett has actually stated about never ever losing cash, and they offer pre-emptively in the name of capital conservation, just to actually be securing losses rather of permitting themselves to have success in the long run.

So today, I wish to talk about how economic crises and bearishness are advantageous to your portfolio and what my suggestion would remain in those times. It’s not a surprise that an economic downturn is coming. We have actually all been becoming aware of it for one to 2 years, and the Federal Reserve is attempting its hardest to make it as soft of an economic downturn as possible. Some authors, even on Looking for Alpha, are requiring a decades-long bearish market or anxiety, which is triggering worry amongst numerous readers.

So today, let’s take a look at the bear in the face and see how it can assist you.

They’re Both Essential and You’ll Experience Lots of

I believe the most significant error that newbie financiers make is the expectation that they will have the ability to appropriately and efficiently time any correction or bearish market. Anticipating the future, whether utilizing technical analysis, Fibonacci numbers, or any other ways, is haphazard at finest.

When I’m asked to supply an outlook for the total market, I attempt to supply a simple response as much as possible, while completely acknowledging that what I’m stating might be totally inaccurate. What I would rather like to concentrate on is what I would perform in each situation.

It’s an easy truth of the matter that due to the fact that of business cycle, there are going to be durations where there is a boom and a subsequent bust. An economic crisis is just a duration where most services in the whole nation are not expanding. It resembles when you require to clear out your fireplace. If you have a wood-burning fireplace in your house, you understand that ashes and soot will develop gradually, and this can trigger your fires to burn less effectively. Expect the whole nation and its company performance resembles a fire in your fireplace. Gradually, you’re going to have business that are not running effectively or that are basically zombie business that require to be cleared out and cleaned out so that the economy can burn brighter once again.

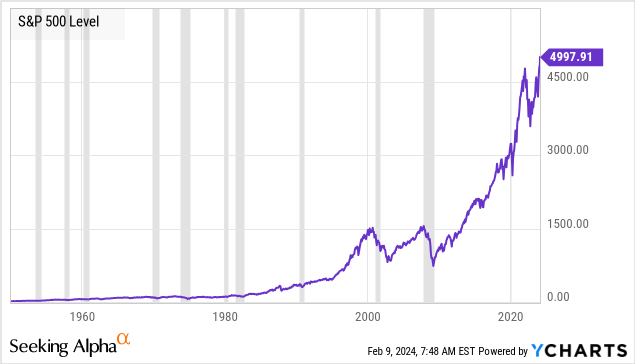

Bearish markets typically happen when there is an economic downturn or other sort of financial circumstance putting pressure on the total economy; for that reason, both are required to happen. This permits the marketplace to rebound and radiance even brighter than previously.

You must not be running in worry of them. You must be anticipating them and comprehending that they will enable the marketplace to reach greater highs in the future.

So What Should We Do?

Numerous financiers think that they require to prevent an economic downturn or a correction in the name of capital conservation. Numerous of those financiers are just triggering themselves to experience capital losses. What must you do?!

I have a stating that I frequently duplicate to brand-new members of my personal neighborhood when inquired about what we wish to do throughout an economic downturn or correction or bearish market. My response to them is, “Booming market make millionaires, however bearishness are where you identify who’s going to be those millionaires.”

When it concerns a bearishness, if you are purchased a portfolio that creates strong earnings, you can see money entering your account, and it is readily available to utilize to spend for your costs and/or to reinvest into more financial investments. The objective of an earnings portfolio is to create earnings no matter the financial circumstance. Your portfolio worth might drop and likely will drop in a correction or a bearishness, however that is not a capital loss unless you have actually offered. If you believe you’re maintaining capital by offering and locking on losses– you’re just damaging it. You’re in fact maintaining capital by hanging on to those financial investments even when they have actually dropped in worth and continuing to reinvest dividends to grow your portfolio’s earnings stream. When that portfolio which market rebound into the next booming market, you will see gains like you have actually never ever seen before.

I can take, for instance, when the marketplace had its COVID crash and dropped greatly in worth; some members of my personal neighborhood saw their portfolio worth drop upwards of 50%, yet the dividends that they got and the earnings that gathered dropped far less. How is that possible? Well, the dollar worth of your portfolio is just what somebody else will want to spend for it if you offer every share today. However that’s simply what they want to spend for it; that’s not the worth of what you own. Understanding what you own and owning things that are of high quality that continue to pay you strong earnings no matter what the marketplace is doing permits you to be a net-buyer of the marketplace.

The marketplace is crashing? Fantastic! Keep purchasing shares.

The marketplace is increasing? Fantastic! Keep purchasing shares.

When you’re preparing for earnings and your retirement, all your objectives must be concentrating on having a strong earnings stream that’s putting into your account. That’s the trademark of a real expert earnings financier’s portfolio.

I have a trick. I like bearishness. They enable me to see my reinvested dollars supply me with much more earnings than might be attained in a booming market where whatever is overpriced and costly. Your earnings will grow quicker in a bearishness, and the years following frequently see an above-average rate of dividend boosts.

When it concerns your retirement, if you depend on the worth of your shares constantly increasing to have the ability to manage your costs, then you are betting on a future that likely will not happen. There is this continuous force that is towering above you called the “series of return” threat– if you offer shares to delight in living your retirement when the marketplace remains in a bearishness, it’ll be even harder for your portfolio to attend to you in future years. It’s one reason that I have actually established a whole method that does not include offering your shares for your retirement. My distinct Earnings Technique is created and is utilized by thousands to be able to do precisely what we require for my retirement and yours– the marketplace pays our method. So, utilizing it permits you, as a retired person, to accept bearishness and economic crises rather of attempting to escape from them.

That’s the appeal of my Earnings Technique. That’s the appeal of earnings investing.