Leas have not changed much over the previous year, increasing 1% in January– a far cry from double-digit development throughout the pandemic. Landlords do not have much space to improve rates as they come to grips with increasing jobs and the pandemic real estate craze moves even more into the rearview mirror.

The mean U.S. asking lease increased 1.1% year over year to $1,964 in January, the biggest yearly boost because March 2023, and was the same from a month previously. While leas ticked up from a year previously, the larger image is that lease development is leveling off after rising throughout the pandemic and after that quickly slowing from mid-2022 to mid-2023.

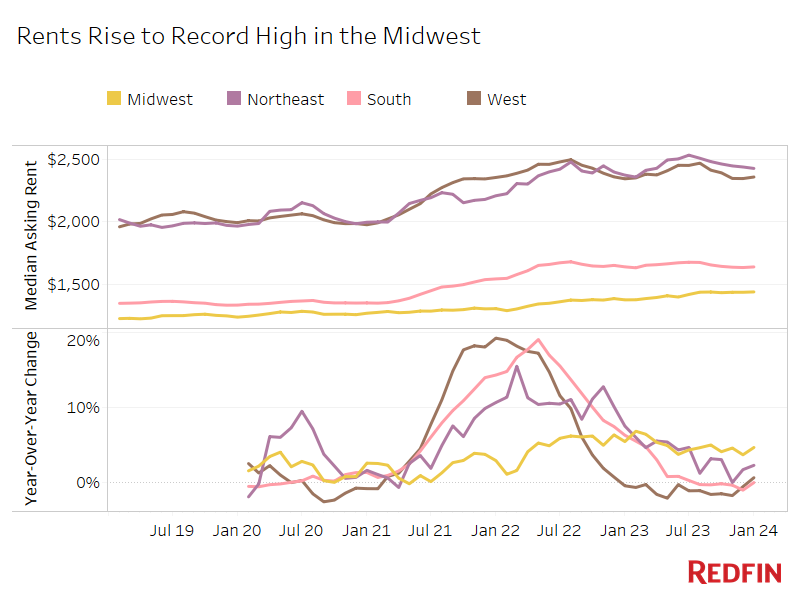

Year-over-year lease development has actually hovered in between -2.1% and +2.4% for the previous year, a much narrower variety than the previous year, when lease development was as low as 4.8% and as high as 17.7%.

Asking leas have actually flattened since the pandemic moving craze is over and proprietors are coming to grips with jobs due to a dive in home supply. The rental job rate was 6.6% in the 4th quarter, connected with the previous quarter for the greatest level because early 2021. Jobs have actually climbed up due to a structure boom recently. The number of just recently finished houses is near its greatest level in more than thirty years, and the number under building is simply shy of its record high. Redfin Chief Economic Expert Daryl Fairweather anticipates home conclusions to peak in 2024.

While leas have actually cooled, they have not yet published substantial decreases. That’s most likely since high home loan rates continue to sustain rental need, and since some proprietors are using one-time concessions like a totally free month’s lease or lowered parking expenses to draw in occupants without needing to lower asking leas on paper.

Home rates are increasing much much faster than leas, which is likewise sustaining rental need and inspiring occupants to sit tight rather of getting in the real estate market.

” There’s not a substantial reward for occupants to purchase today. Asking leas are steady, and while home loan rates have actually dipped in current months, they have not fallen enough to make the monetary formula of homebuying practical for lots of people,” Fairweather stated. “If you’re a tenant who has an interest in purchasing however isn’t in a rush, there’s very little disadvantage to awaiting home loan rates to fall and your cost savings to grow.”

Purchasing might make good sense for individuals who can manage a big deposit and strategy to sit tight for a minimum of 5 years, Fairweather stated. Putting 20% down assists balance out the expense of raised home loan rates and eliminates the expense of personal home loan insurance coverage, and some might choose to purchase now before competitors undoubtedly warms up when home loan rates fall even more. Obviously, lots of Americans can’t manage a 20% deposit, though some do get approved for deposit help.

Leas Climb Up Fastest in the Midwest and Northeast

The mean asking lease in the Midwest increased 4.6% year over year to a record $1,437 in January. Leas likewise increased in the Northeast (2.3% to $2,427) and the West (0.6% to $2,358). In the South, leas were the same at $1,637. The Midwest was the only area where leas strike a record high.

” Lease rates in Chicago are still out of control,” stated regional Redfin Premier property representative Dan Close “A great deal of the purchasers I’m dealing with are individuals who have been pressed out of leasing– if you’re paying an arm and a leg for lease, why not shop and construct some equity? We’ll likely see this pattern heighten in the spring and summer season, when the large bulk of leases end.”

Leas are most likely holding up best in the Midwest and Northeast since those areas have not been structure as much as the South and West, implying proprietors aren’t under as much pressure to fill openings.

Approach

Asking rate information consists of single-family homes, multi-family systems, condos/co-ops and townhouses from Rent.com and Redfin.com

Redfin has actually gotten rid of metro-level information from month-to-month rental reports for the time being as it works to broaden its rental analysis.

Costs show the existing expenses of brand-new leases throughout each period. To put it simply, the quantity revealed as the mean lease is not the mean of what all occupants are paying, however the mean asking rate of houses that were readily available for brand-new occupants throughout the report month.