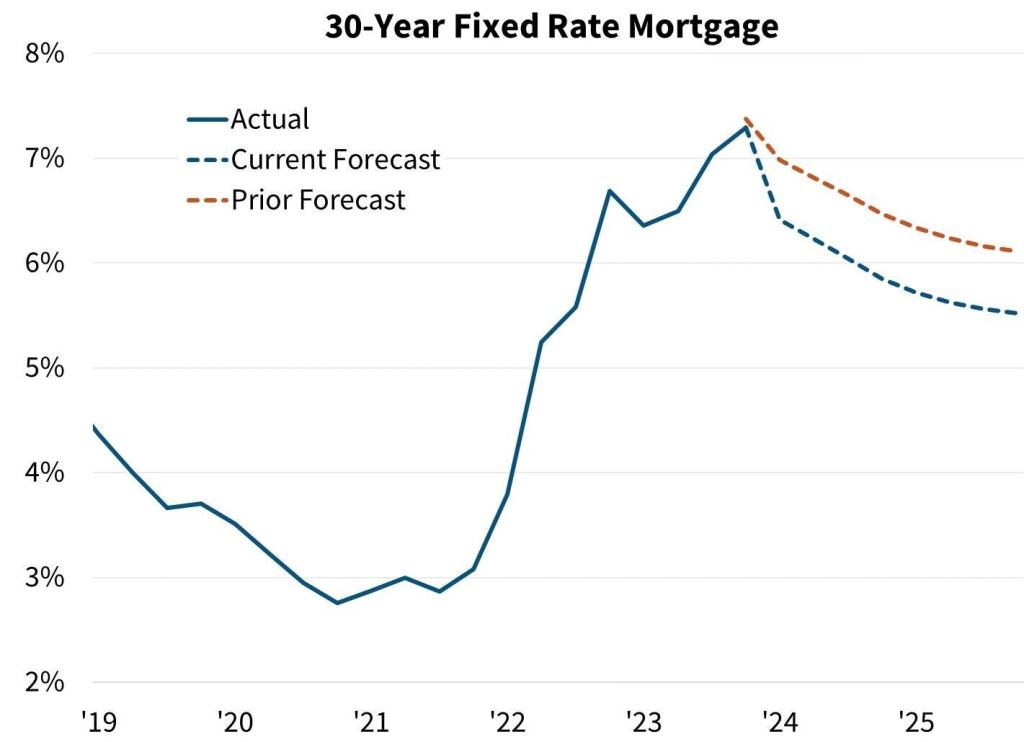

Fannie Mae has a rosy outlook for home mortgage rates. The federal government sponsored business is predicting that rates will drop listed below 6% by the end of 2024, which in turn will enhance refi volumes and assist thaw the existing home sales market.

Following years of volatility in home mortgage rates, the real estate market will start its progressive go back to a more regular balance in 2024.

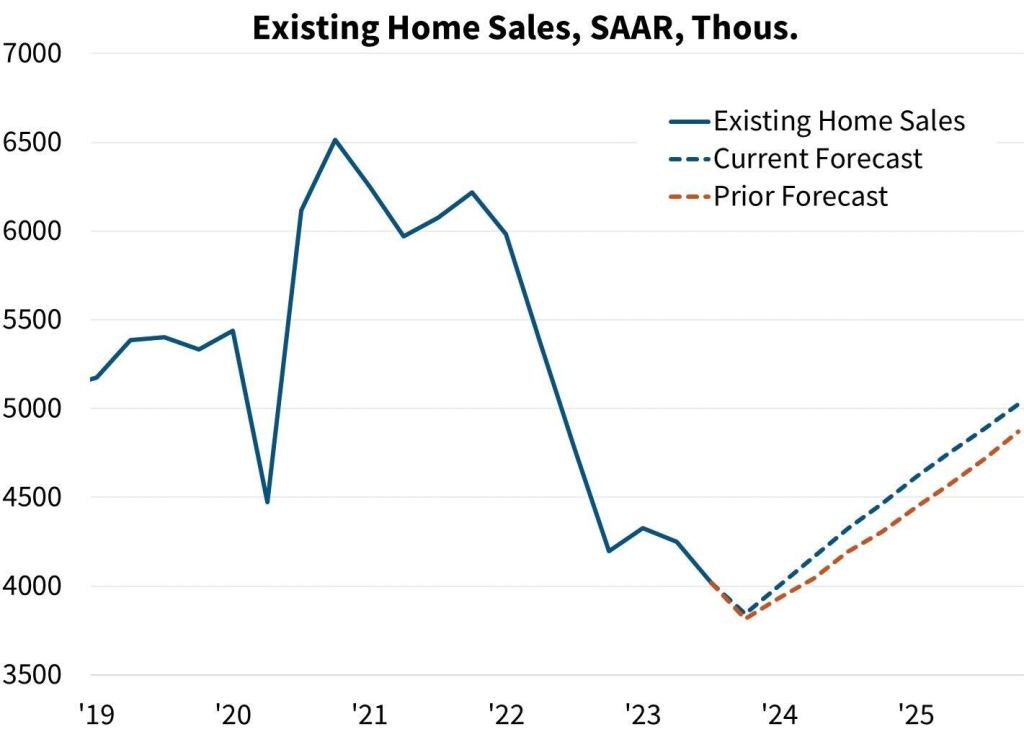

Fannie Mae’s financial and tactical research study (ESR) group anticipates home sales and home mortgage origination activity to start a progressive healing in the existence of a slow-growing economy.

” Inflation’s decrease and the resultant Fed pivot to indicating future rate cuts rates lead us to think that home sales and home mortgage originations most likely bottomed out in the 2nd half of 2023 which a progressive enhancement is now underway. We anticipate home mortgage rates to dip listed below 6% by year-end 2024 and for homebuilders to continue to include brand-new supply, both of which ought to help cost,” stated Doug Duncan, Fannie Mae’s senior vice president and primary economic expert.

The ESR group anticipates the annualized rate of existing home sales to go up to 4.5 million systems by the 4th quarter of 2024, up from 3.8 million in Q4 2023.

In General, Fannie Mae anticipates that the gradually stabilizing existing homes market, along with extra real estate supply from the building and construction of brand-new homes, will assist keep additional home rate development in check in 2024.

Home costs are now anticipated to increase 3.2% for many years, compared to 7.1% in 2023.

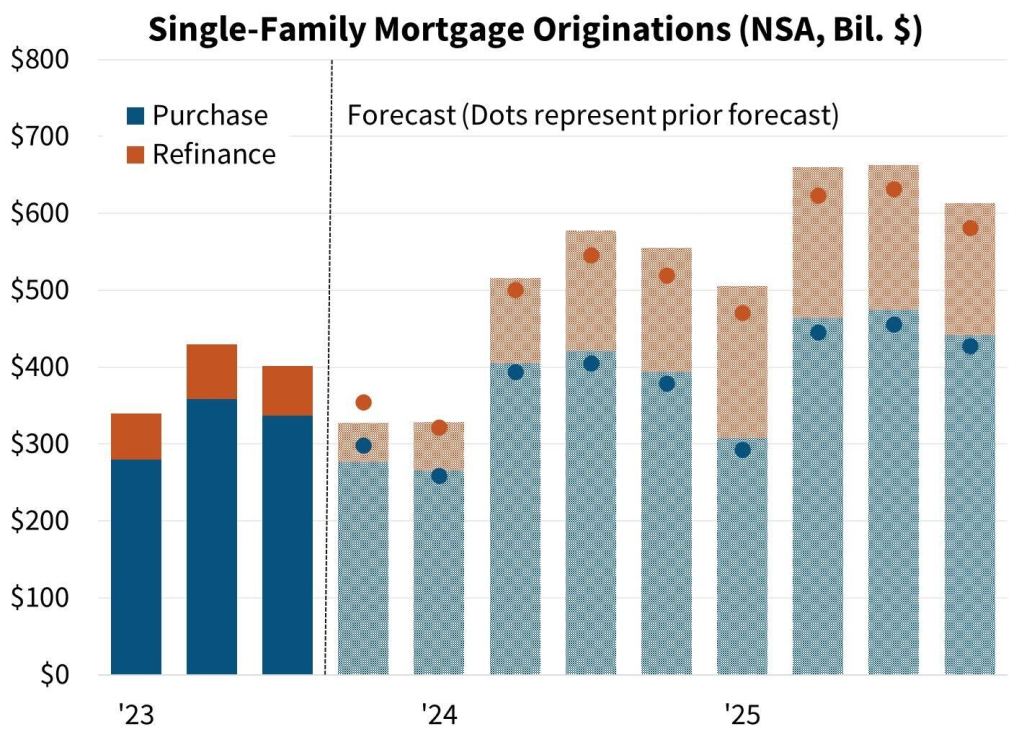

Origination volume projection for 2024

Fannie Mae anticipates the overall single-family home mortgage originations volume to be $1.98 trillion in 2024 and $2.44 trillion in 2025, up from $1.50 trillion in 2023.

Of the overall $1.98 trillion origination volume in 2024, $1.5 trillion is forecasted to come from purchase origination volume, a 19% boost from $1.3 trillion in 2023.

Re-finance home mortgage origination volume will stay suppressed as about 90% of impressive Fannie Mae single-family traditional 30-year set rate mortgage presently have a note rate listed below 6%.

” So, while lots of current debtors from 2023 will start to deal with significant advantages by refinancing, a strong re-finance wave driven by rate-term debtors is not anticipated in 2024. Even as rates moderate, we anticipate ongoing interest in cash-out refinancing relative to previous durations, particularly offered increased levels of aggregate house owner equity readily available following the home rate gains of the last couple of years,” the ESR group stated.

Financial background looks more favorable

Another great news is that Fannie Mae eliminated its specific require an economic downturn in 2024 and changed it with an expectation of “below-trend development.”

While Fannie Mae had actually anticipated a modest decline in 2024 up till in 2015, the ESR Group kept in mind the fast current relieving in monetary conditions following the Federal Reserve’s December conference and the strong, upward pattern in genuine individual earnings development in October and November as favorable impulses for development over the coming quarters.

As an outcome, Fannie Mae updated its 2024 financial outlook to a modest growth of 1.1% from a 0.3% Q4/Q4 contraction of genuine gdp (GDP).

Still, the ESR group thinks the economy stays at a higher-than-normal danger for an economic downturn in 2024.

Blended labor market signals, current increase in shipping rates due to attacks on container vessels in the Red Sea and relieving of financial policy opening doors for inflation to perhaps reanimate are amongst the aspects that Fannie Mae noted as dangers for an economic downturn.

” Our standard projection continues to reveal inflation trending towards the Fed’s 2% target throughout the year, however dangers to the outlook stay,” stated the ESR group.