SBWorldphotography/iStock via Getty Images

Introduction

As I mentioned in my recent article about Amerigo Resources (OTCQX:ARREF) (ARG:CA), the largest position in my stock portfolio is French cabling specialist Nexans (OTCPK:NXPRF) (OTCPK:NEXNY). One major theme that Iâve seen time and time again while researching Nexans over the past several months has been a global shortage of power transformers which is unlikely to be resolved anytime soon. In light of this, Iâve been looking at ways to get some exposure to the power transformer manufacturing sector, but the issue is that the major players in the market are diversified groups such as Siemens (OTCPK:SIEGY), ABB (OTCPK:ABBNY), Schneider Electric (OTCPK:SBGSF), and Mitsubishi Electric Corporation (OTCPK:MIELY) (OTCPK:MIELF). Looking at microcaps, Espey Manufacturing & Electronics Corp (ESP) which I covered on SA in July 2023 produces transformers, but they seem to be a small part of the business. It seems the only pure play power transformer stock in North America is Canadaâs Hammond Power Solutions (HPS.A:CA) (OTCPK:HMDPF) whose market capitalization has increased by over 250% over the past year. In my view, the order backlog of the company looks strong and there could be more room for growth in the market valuation. My rating on the stock is a speculative buy and Iâve just opened a small long position. Letâs review.

Overview of the business and financials

Hammond Power Solutions was established in 1917 and is involved in the manufacturing of dry-type standard and custom electrical engineered magnetics, liquid filled, and cast resin transformers. The company has a network of 7 production facilities across Canada, the USA, Mexico, and India and 9 regional warehouses in Canada, and the USA. Itâs the largest dry-type transformer manufacturer in North America and its engineering database contains more than a million designs. The clients include companies in the oil and gas, mining, steel, construction, data centers, and wind power generation sectors among others. According to the corporate website of Hammond Power Solutions, its products are present on every continent in the world and have even orbited in space.

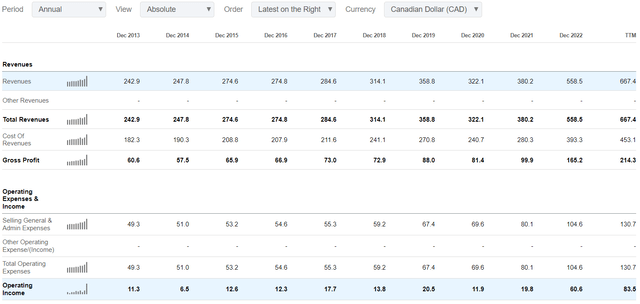

Turning our attention to the financial performance of the company over the past decade, we can see that revenues and operating income were growing at a steady but relatively low pace until 2021 when they started to soar. In 2022, Hammond Power Solutions implemented two price increases to offset rapidly increasing rapidly rising raw materials costs. With copper and aluminum prices retreating in the second part of 2022 and 2023, this has boosted operating margins. It’s worth noting that we are not comparing apples to apples as Hammond Power Solutions bought active harmonic filters, and induction heating products manufacturer Mesta Electronics in July 2021. The revenues of the latter came in at C$14.5 million ($10.8 million) in 2022 (see page 23 here).

Seeking Alpha

Yet, the major reason for the rapid increase in revenues and operating income is not product price increases or acquisitions – it’s tight global transformer demand. This can be traced to the global push for electrification as well as the rise of electric vehicle sales, renewable energy generation, electrical interconnector construction, and the buildup of data centers with the rapid growth of the artificial intelligence market. As PV Magazine reported in October 2023:

We have seen a significantly tight supply of transformers in the US and European markets. The prices of transformers used to trend with metal prices. Nowadays, the prices of transformers are more driven up by demand and the industry will have to pay whatever is needed

And it seems that the shortages are here to stay as the minimum lead times for transformers of all sizes were over a year.

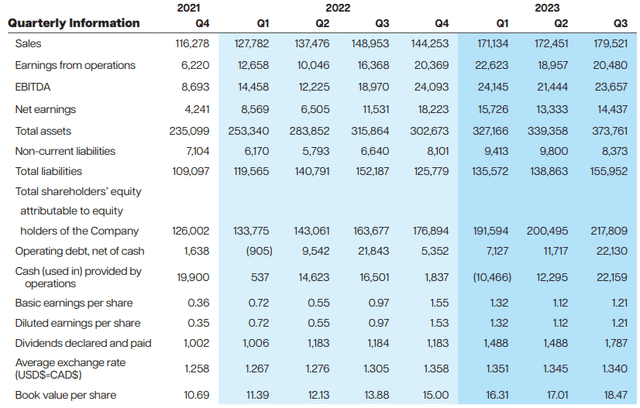

Looking at the latest available financial results of Hammond Power Solutions, we can see that sales rose by 20.5% year on year to C$179.5 million ($133.9 million) in Q3 2023. The EBITDA margin, in turn, grew to 13.8% from 12.7% a year earlier thanks to economies of scale. Hammond Power Solutions said that demand continued to be strong, especially in custom power units for renewable and data center applications (see page 3 here). As a result, the order backlog soared by 40.3% year on year and 11.3% quarter on quarter. Unfortunately, the financial reports of the company donât mention the value of the order backlog.

Hammond Power Solutions

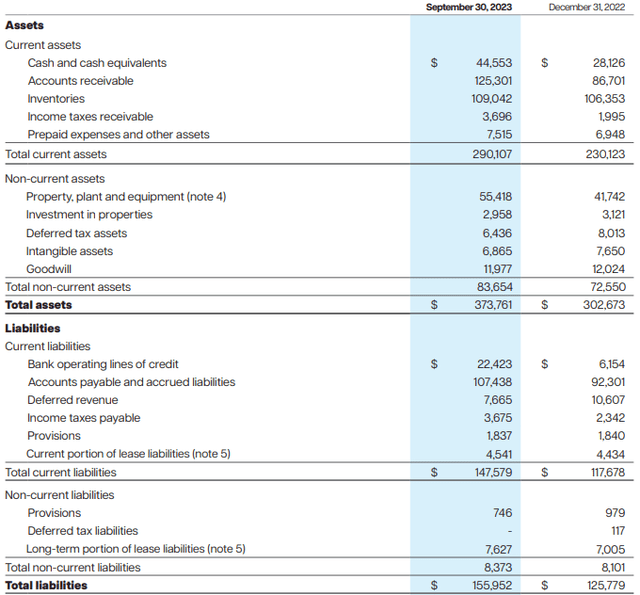

Turning our attention to the balance sheet, we can see that the book value for property, plant, and equipment increased significantly during the first nine months of 2023 as Hammond Power Solutions invested in expanding its production capacity. The acquisitions of property, plant, and equipment owned soared by 158.9% year on year to C$15.6 million ($11.6 million) in the first nine months of 2023. Receivables and accounts payable also rose due to the increase in revenues. The net cash position, in turn, improved slightly to C$22.1 million ($16.5 million) from C$22 million ($16.4 million) as Hammond Power Solutions decided in September to increase its quarterly dividend to C$0.15 ($0.11) per share.

Hammond Power Solutions

Overall, this was a strong quarter for the company and the TTM EBITDA stands at C$82.4 million ($61.5 million). With the order backlog continuing to grow, I expect Q4 2023 sales and EBITDA to stand at around C$185 million ($138 million) and C$25 million ($18.6 million), respectively. Hammond Power Solutions should release its results for the quarter in early March.

Turning our attention to the valuation, the company is trading at an EV/EBITDA ratio of 11.9x on a TTM basis. While this figure seems high, I expect it to improve in the next few quarters as the order backlog is still growing at double-digit percentage points quarter on quarter. Hammond Power Solutions is experiencing a boom thanks to the high global demand for power transformers, and I doubt that supply will catch up to demand in the next 12 months. However, this makes it hard to come up with a price target and I think that for retail investors the exit point should depend on their risk tolerance and investment strategy. I plan to close half of my position at around C$110 ($82.03) per share and exit completely at about C$140 ($104.41) per share. These price levels are at 15.6x and 20x EV/EBITDA and reflect my personal risk tolerance level, which makes them somewhat arbitrary. And if the financials start to deteriorate, or the order backlog starts shrinking, I’m likely to exit at a lower price.

Looking at the downside risks, I think the major one is that power transformer prices should come down significantly at some point in the future as supply catches up to demand. Itâs a classic boom and bust cycle and itâs difficult to estimate when this will happen. I may be underestimating how soon the supply shortage will end. I plan to follow the matter closely through specialized online sources such as Transformers Magazine, PV Magazine, and Engineering News-Record. If the order backlog of Hammond Power Solutions stops growing or the number of articles about the shortage declines significantly, I would start considering closing my position. Overall, I rate this stock as a speculative buy and itâs unlikely that Iâll still be a shareholder here in 2025.

Investor takeaway

The financial results of Hammond Power Solutions are benefiting from a global shortage of power transformers and Iâm optimistic that this will last for a few more quarters as the order backlog is growing fast. I expect Q4 2023 sales and EBITDA to be about C$185 million ($138 million) and C$25 million ($18.6 million), respectively. My investment strategy revolves around a highly concentrated portfolio of stocks and Hammond Power Solutions is currently my fifth largest position. It accounts for 7.4% of the value of my portfolio as of the time of writing. I rate Hammond Power Solutions as a speculative buy, and I think it could be best for risk-averse investors to avoid this stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.