bymuratdeniz/iStock by means of Getty Images

TG Therapies ( NASDAQ: TGTX) CEO Mike Weiss made an excellent impression at the J.P. Morgan Health Care Conference today. The business began the discussion day with an at first badly gotten in-licensing statement of an allogeneic VEHICLE T cell treatment from Accuracy BioSciences ( DTIL). This was not the upgrade financiers and traders were awaiting, nevertheless. Weiss made us await the real discussion, where he shared Briumvi’s net sales for the 4th quarter and earnings assistance for 2024 that was a little ahead of the Street agreement at the mid-point.

Notably, Weiss exposed prepare for the start of human trials for the subcutaneous variation of Briumvi, which is the crucial next action to enhance the item’s benefit and competitive profile versus Ocrevus and Kesimpta.

Azer-cel handle Accuracy BioSciences

VEHICLE T cell treatment is ending up being progressively crucial in oncology, however it just recently began discovering its method to autoimmune signs with some business rotating from oncology to immunology. The theory is that automobile T cell therapy treatment might reset the body immune system and substantially enhance the lives of clients experiencing particular autoimmune illness. There are early, however appealing, results with this technique.

Treatment with anti-CD19 autologous automobile T cells led to remission of all 5 systemic lupus erythematosus (” SLE”) clients, as reported in Nature in November 2022.

Last month at ASH, extra information existed with 12 SLE clients getting CD19/BCMA CAR-T cells with the SLEDAI-2K rating reducing in all clients, from a mean of 18.3 to 1.5, and all clients fulfilled the LLDAS requirements and had the ability to stop SLE-related medications, consisting of glucocorticoids.

TG in-licensed azer-cel from Accuracy BioSciences for the treatment of autoimmune illness and signs beyond cancer. The in advance payment is $7.5 million, including money and 2.9 million shares of Accuracy typical stock at $0.77 per share, and Accuracy will get $2.5 million within 12 months as an equity financial investment and another $7.5 million in money and typical stock upon the accomplishment of particular turning points. Accuracy is qualified to get approximately $288 million in extra turning point payments and high-single-digit to low-double-digit royalties on net sales.

This is an extremely low monetary threat and high benefit in-licensing for TG. The scientific threat is extremely high as there is extremely little information on automobile T cells in autoimmune illness and no information on azer-cel. The field is getting progressively crowded with lots of business changing their programs from oncology to autoimmune illness, and it likewise stays to be seen whether an allogeneic (off-the-shelf) technique TG has actually in-licensed can be equivalent to or much better than the autologous technique where cells are drawn from a client, processed beyond the body, and reestablished.

Briumvi went beyond expectations in Q4 with some stock advantage, 2024 earnings assistance is a little much better than agreement at the mid-point

TG anticipates to report $40 million in Briumvi net sales for the 4th quarter. This was much better than the $33-37 million assistance variety, the $38.6 million agreement, and my $37-39 million variety. I kept in mind in the incomes sneak peek post to our Investing Group customers that it is possible we see some stock advantage in the quarter, which did occur– CEO Weiss stated there was a stock advantage of a couple of million as wholesalers increased days on hand at the end of December. This recommends real need was around the high-end of the business’s assistance variety or a little above it, which is still a respectable outcome after $25.1 million in the previous quarter.

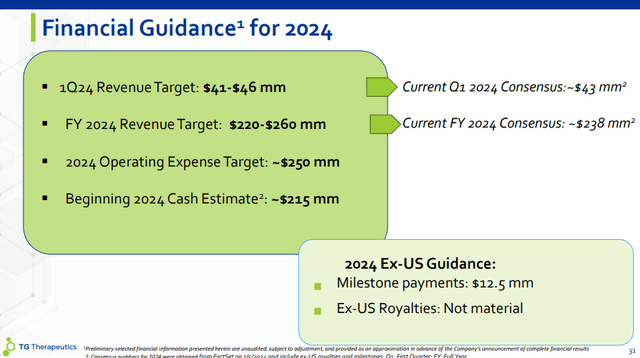

For the very first quarter, the assistance variety is $41-46 million and is mainly in line with the Street agreement of $43.4 million. Q1 is the seasonally weakest quarter of the year for many pharmaceutical items, and Briumvi is no exception– insurance coverage resets at the start of the year, anticipated greater co-pay help causing greater discount rates and lower net cost, and the stock take advantage of Q4 develops into a headwind of a couple of million as wholesalers are most likely to lower days on hand.

All this recommends underlying development needs to be great which Briumvi will create much more powerful consecutive development in the 2nd quarter.

For the complete year, TG supplied a fairly broad earnings assistance variety of $220-260 million, the mid-point being a little ahead of the $238 million agreement. This was not unforeseen, and I believed the business would not substantially differ the agreement and management most likely left some space for outperformance.

TG Therapies financier discussion

Client start types enhanced sequentially, from 900 in Q3 to 1,000 in Q4. As a suggestion, this number just consists of clients going through TG’s center and there are in between 10% and 20% of extra clients being recommended Briumvi beyond the center.

There are numerous tailwinds for Briumvi in 2024:

- More clients returning for the 3rd infusion. The six-month window in between the 2nd and 3rd infusion suggested we just saw clients beginning to return for the 3rd infusion in higher numbers in the 4th quarter.

- Physicians ending up being more knowledgeable with Briumvi and its effectiveness and security profile. Numerous sluggish adopters recommend Briumvi to one or a couple of clients to see how they are doing before broadening their usage. And provided the six-month window in between infusions, this takes more time than for regularly administered drugs.

- Better protection, the long-term J-code, and the increasing variety of organizations putting Briumvi on their formularies.

- The business anticipates to focus more on client awareness with direct-to-consumer marketing. This ought to cause more clients concerning doctors’ workplaces to request for Briumvi.

I anticipate 2024 to be a strong year for Briumvi, with net sales coming at the high-end of the business’s $220-260 million assistance variety and potentially above it, and the business leaving the year with an annualized net sales run rate of more than $350 million and possibly near to $400 million.

With an anticipated cost base of around $250 million in 2024, this recommends considerable operating utilize with the business reaching favorable capital and ending up being rewarding before completion of the year.

Partner Neuraxpharm will quickly release Briumvi in Europe, which will activate a $12.5 million turning point payment. Nevertheless, Weiss stated royalties this year will not be product, as it will require time for Neuraxpharm to protect gain access to and repayment on a country-by-country basis.

TG is actively dealing with enhanced benefit of Briumvi, checking out sign growth

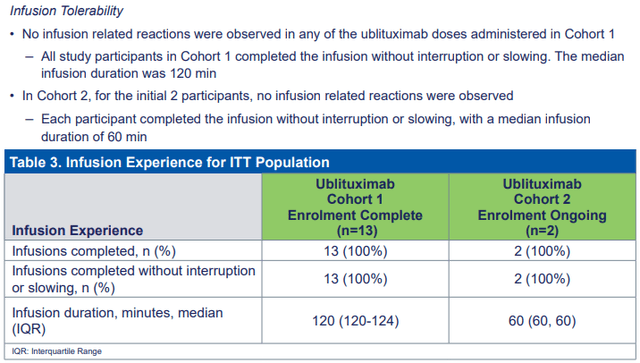

TG is carrying out a trial to reveal the expediency of clients changing from Ocrevus and taking a 1 year infusion rather of the preliminary four-hour one. The initial information were reported just recently and reveal great tolerability without any problems. This bodes well for need that will originate from clients that wish to change from Ocrevus and Kesimpta.

TG Therapies ECTRIMS discussion, November 2023

The more vital part is the advancement of the subcutaneous variation of Briumvi. The business now anticipates to begin a human bioequivalence scientific trial in mid-2024. Having a subcutaneous variation needs to assist TG take on Ocrevus, as it will quickly have a subcutaneous variation on the marketplace and versus Kesimpta which is just utilized as a subcutaneous injection. It might likewise attend to the bear thesis of Briumvi being the only CD20 item that does not have a subcutaneous variation.

Last, however not least, the business is preparing sign growth for Briumvi into other autoimmune illness, although I am unsure where TG wishes to take Briumvi, as neither Roche ( OTCQX: RHHBY) nor Novartis ( NVS) are actively establishing Ocrevus and Kesimpta beyond numerous sclerosis.

Conclusion

TG Therapies reported strong Q4 net sales of Briumvi and supplied Q1 2024 and full-year 2024 earnings assistance that did not dissatisfy. This puts the business in a strong position to increase investor worth and end up being capital favorable and rewarding before completion of the year, and substantially rewarding in 2025 and beyond. The active deal with enhanced benefit of Briumvi might likewise contribute to the long-lasting benefit, as might azer-cel in other autoimmune illness, although azer-cel has much to show. Luckily, the monetary dedications are modest, and while the scientific threat is high, the monetary threat is low and with high prospective benefit if this prospect produces favorable scientific information.

Editor’s Note: This post covers several microcap stocks. Please know the dangers connected with these stocks.