cemagraphics

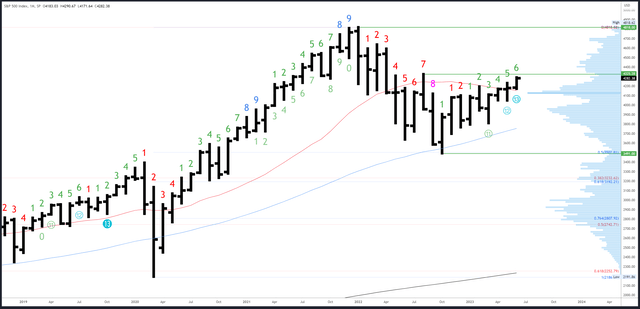

A dip early in the week provided bulls the possibility to get wish for the breakout. As recently’s short article concluded, “… prepared with a predisposition, targets and crucial levels, the marketplace must provide chances.” My tweet on Wednesday ideally assisted as it mentioned a prospective bottom at 4163 (the bottom came 10 minutes later on at 4166).

Next week will provide more chances and it’s once again time to prepare. A range of technical analysis strategies will be utilized to take a look at likely relocations for the S&P 500 ( SPY) in several timeframes. I will then utilize the proof phone for the week ahead.

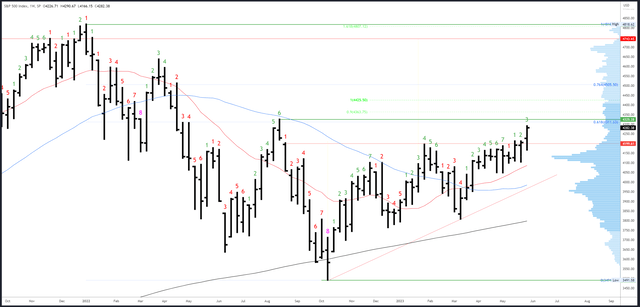

S&P 500 Month-to-month

The May candle light closed at 4179, which was close adequate to the 4166 available to be thought about a ‘doji’. June’s greater high has actually currently negated its bearish capacity and any turnaround pattern will require to time to establish. At this early point, this merely imply remaining above the 4183 June open.

SPX Month-to-month (Tradingview)

Resistance is at 4325 and the high of August, then the 4500 location.

It’s taken a long period of time to break 4195-200 and it preferably now acts a flooring. The VPOC at 4130 is the next assistance listed below.

An upside Demark fatigue count is on bar 6 (of 9).

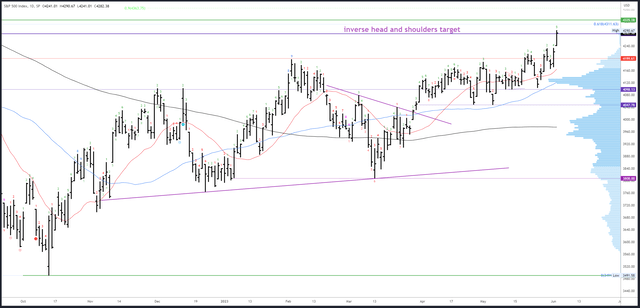

S&P 500 Weekly

Todays bar is not to be second-guessed and appears like a real break-out/range growth after prolonged coiling and debt consolidation.

The close at 4282 was near adequate to the 4290 weekly high to anticipate instant follow above 4290 early next week.

The next significant targets are the 61% Fib retrace of the 2022 bearishness at 4311, with the August high of 4325 simply above. There’s not excessive resistance above that up until 4500, however I have my eye on 4363 due to the determined relocation there.

4195-200 is the very first assistance, then 4166 and 4098.

The advantage (Demark) fatigue count will be on bar 4 (of 9) next week.

S&P 500 Daily

The inverted head and shoulders pattern has actually now played out to its target of 4280. We can now concentrate on the greater timeframe targets in play.

Friday’s strong close ought to result in a minimum of a brand-new high over 4290 prior to any turnaround pattern can form. As pointed out previously, 4311-25 is the very first location of interest and cost would then require to break back through 4231-41 to signify weak point.

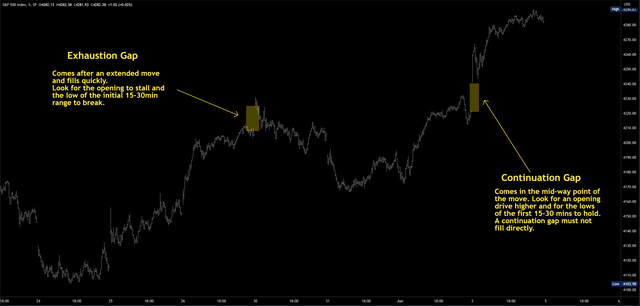

4231-41 is assistance developed by Friday’s extension space and it deserves reviewing the 2 various spaces developed today as I discussed the topic in my last short article.

An upside Demark fatigue count will be on bar 6 (of 9) on Monday. A response is anticipated on bar 8 or 9 so keep an eye out for a time out/ dip from Wednesday onwards.

Occasions Next Week

Markets are now dealing with the presumption the Fed will stop briefly in June which now has around a 75% likelihood according to the CME Fedwatch tool. No arranged occasions or information next week are most likely to alter this circumstance and the Fed has actually simply begun its blackout duration. CPI is the next ‘huge’ release on the 14th June, the day prior to the FOMC conference.

The resolution of the financial obligation ceiling crisis suggests the Treasury General Account can be increased with brand-new financial obligation, possibly triggering a drain on liquidity. To be truthful, I do not understand the effect or timeframe for this motorist, and I question lots of do, a minimum of in the context of near-term cost action. I for that reason go back to what I understand, and the Demark fatigue signal might have a comparable impact i.e. a liquidity

Probable Relocations Next Week

A greater high above today’s 4290 high is most likely however ought to fade once again. Markets have actually just recently followed a pattern of reversing lower on Mondays, dipping into a mid-week bottom and after that rallying into a strong weekly close. I will for that reason search for another fatigue space on Monday comparable to the one explained above. 4311-25 stays the perfect target, and even when/if this is evaluated, the upper assistance location of 4267-71 might hold for debt consolidation and more highs to 4363.

Just a break of 4231 would damage the bullish momentum. If this occurs straight (i.e. without a transfer to 4363 very first), I would not think about the leading to be in, however I would require to re-evaluate prior to attempting to get long once again. This might be late next week so it’s tough to predict how things will line up when I’m composing this on a Saturday afternoon. 4195-200 is the very first good assistance on the greater timeframes.