CNBC’s Jim Cramer informed financiers on Wednesday that the Federal Reserve requires to relax prior to it makes a rash choice about rate walkings that might make the marketplace even worse.

With 2 weeks to precede its next conference, Cramer worried the requirement for vigilance, not recklessness, in times of market confusion.

” There are a lot of Fed-heads who think they require to keep raising rate of interest, instead of take their time to evaluate the scenario,” Cramer stated. “They do not wish to wait, they merely wish to tip us into a conclusive economic downturn. I believe their view is careless merely since we remain in an exceptionally unusual scenario and we do not have all the realities. Possibly the Fed requires to tighten up more, however would it eliminate them to wait another month or more?”

Cramer kept in mind that from a surface-level view, the economy might appear fantastic: real estate rates are growing, there are more tasks than there are employees, and the travel and leisure sector is seeing a lot success that American Airlines raised its projection Wednesday early morning.

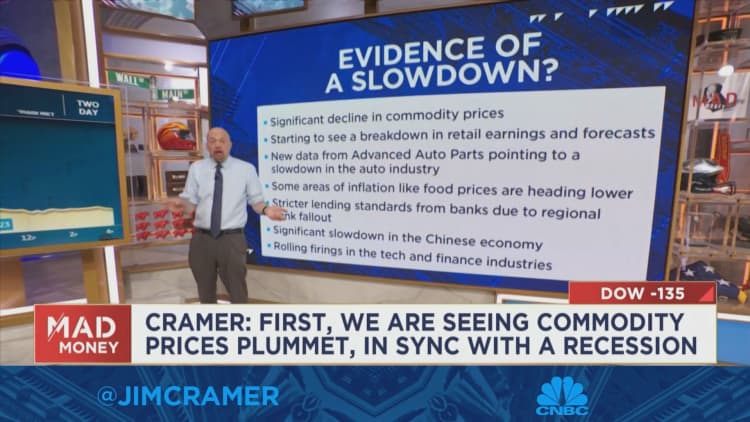

Nevertheless, these realities are deceptive, Cramer stated. With the exception of a couple of huge winners, many markets are suffering, he included.

” Whatever else has actually gotten soft– whatever– to the point where possibly the strength in real estate and earnings ought to be tempered by the information from whatever else,” Cramer stated. “I’m not stating the inflation hawks are incorrect, I simply hope they ‘d concur with Philly Fed President Patrick Harker today, who confessed that the economy’s durable, however possibly they ought to avoid in-meeting walkings, simply put, possibly refrain from doing the next walking in June, simply attempt to deal with the boom/bust paradox initially.”

Cramer worried that numerous market giants are sending indication that the Fed ought to not disregard, specifically brick-and-mortar merchants, who are seeing “disheartening revenues and practically consistently lukewarm projections.” CEO of grocery chain Costco— which Cramer called “the arbiter of 10s of countless Americans”– stated recently that food inflation is gradually beginning to ease off.

He likewise worried that the Fed’s rate walkings up until now have not even assisted bring home mortgages down, and rolling layoffs appear to be pestering most markets. Even tech and financing are seeing mass layoffs, consisting of ones not as extremely advertised as Meta, Cramer included.

” Is it actually worth it to raise rate of interest in order to cool off real estate, when current rate walkings have not done a thing to make home mortgages more costly? Does it actually make good sense for the Fed to stimulate on more layoffs when the layoff wave’s currently growing?” he asked. “We do not understand whether the Fed’s winning. So why not wait? Beats the heck out of me.”

Register now for the CNBC Investing Club to follow Jim Cramer’s every relocation in the marketplace.

Disclaimer The CNBC Investing Club Charitable Trust holds shares of Costco.

Concerns for Cramer?

Call Cramer: 1-800-743-CNBC

Wish to take a deep dive into Cramer’s world? Strike him up!

Mad Cash Twitter – Jim Cramer Twitter – Facebook – Instagram

Concerns, remarks, ideas for the “Mad Cash” site? [email protected]