guvendemir/iStock Unreleased through Getty Images

Financial investment thesis

Kraft Heinz ( NASDAQ: KHC) has actually been having a hard time to enhance its monetary efficiency for several years. Offered the stagnating profits together with diminishing success metrics, there is not a surprise that the stock has actually been underperforming over numerous years.

However, I see extremely favorable patterns in the business’s monetary efficiency over a couple of current quarters, which was thanks to the management’s tactical efforts. The management is concentrated on enhancing success, though the business presently browses a difficult macro environment where it is hard to manage expenses. Both near and long-lasting outlooks are favorable, with stable topline development together with EPS growth. The stock provides an appealing dividend yield together with significant upside capacity. Thinking about all these beneficial aspects, I think the prospective advantages surpass the threats, and the stock is a buy.

Business info

Kraft Heinz is among the world’s biggest food and drink business, with numerous popular brand names in its portfolio. The business was formed by combining Kraft Foods and H.J. Heinz in 2015.

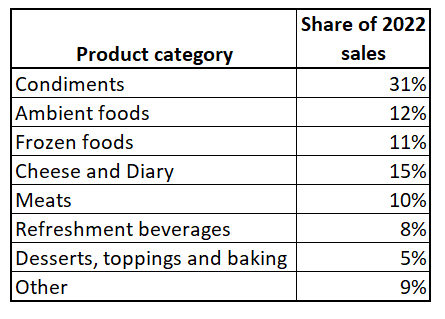

The business disaggregates its incomes by geographical locations, where The United States and Canada represented about 77% in FY 2022. Sales by item classification exist in the listed below table.

Assembled by the author based upon the business’s most current 10-K report

Financials

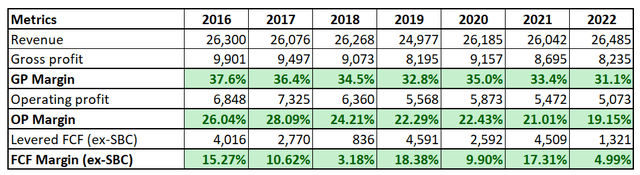

I evaluated the business’s monetary efficiency over the last 7 years in between FY 2016 and 2022 given that the merger took place in 2015, and the years prior to the mix would not be representative.

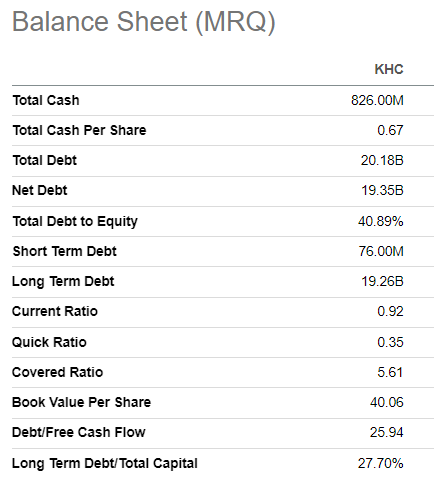

KHC’s profits stagnated over the previous 7 years, with margins degrading substantially. The business’s enormous complimentary capital [FCF] margin avoided a remarkable 15% to a simple 5%. The business has a considerable quantity of financial obligation on its balance sheet, though the interest protection ratio looks resistant.

Looking For Alpha

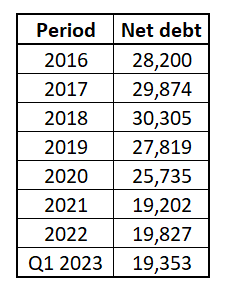

I likewise wish to highlight that the management has actually succeeded in reducing take advantage of over the previous 2 years, with net financial obligation moving from $28 billion in 2016 to a little listed below $20 billion in 2022. According to the most current quarterly financials, the net financial obligation position continued to show enhancement, which is a great indication for prospective financiers.

Assembled by the author

In February 2023, the management described its “Improvement Momentum” where long-lasting monetary objectives were shared. Apart from expectations of natural net sales to intensify at about 3% every year, crucial success metrics are anticipated to show sustainable development within the 4-8% variety and complimentary capital conversion to 100%. The business has an enthusiastic objective to reach a gross performance target of $2.5 billion.

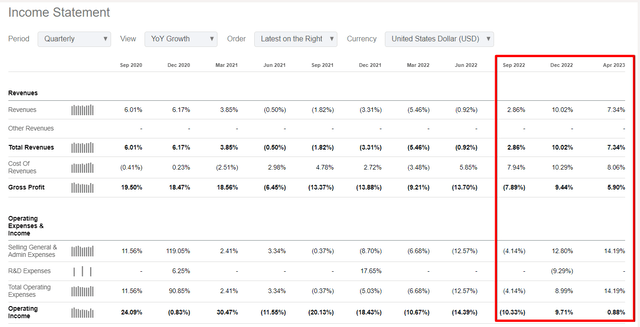

If we take a look at the last couple of quarters we can see that the business showed YoY development in 3 successive quarters which is a great indication, particularly in the existing difficult environment. Though, the expense of incomes together with business expenses grew much faster than the topline, indicating diminishing success metrics. For that reason, there is still a lot of space for management to enhance success.

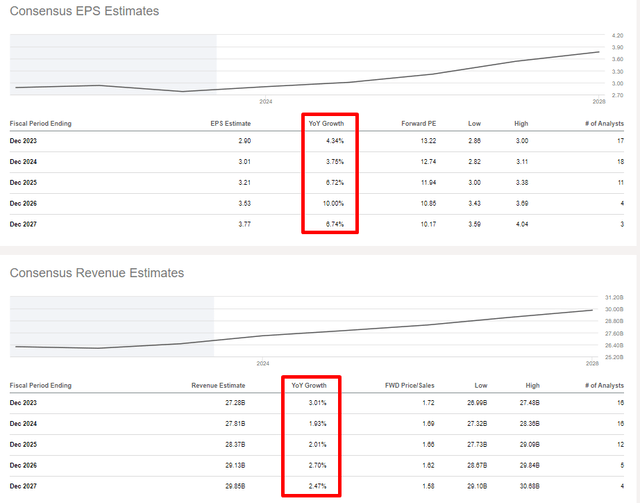

The approaching quarter’s topline is likewise anticipated to broaden on a YoY basis by about 5%, and EPS to broaden 5 cents per share. I believe that it is a favorable indication, and the management is most likely to be successful in its improvement. Long-lasting agreement quotes are likewise positive about the business’s future, with profits intensifying at about 2-3% variety and EPS broadening each year.

General, I think that Kraft Heinz experienced tough times over numerous years, however I see that we are at a turn-around point where current quarters’ monetary efficiency shows indications that management’s efforts are most likely to have a favorable effect.

Appraisal

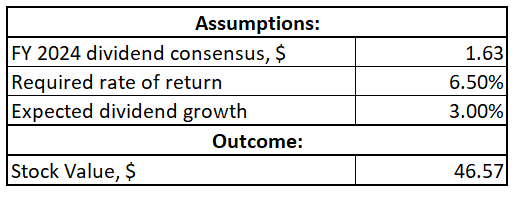

KHC pays dividends to investors, so the dividend discount rate design [DDM] assessment technique appropriates. I choose to be conservative when I pick underlying presumptions. For that reason, I assemble to 6.5% WACC offered by valueinvesting.io. I have agreement quotes for the existing dividend, agreement quotes forecasting $1.63 per share in FY 2024. The business has actually had a hard time to increase dividends over the previous years, however as we have actually seen in the “Financials” area, management is dealing with enhancing success. So, I utilize an extremely modest 3% dividend development presumption for my assessment analysis.

Author’s estimations

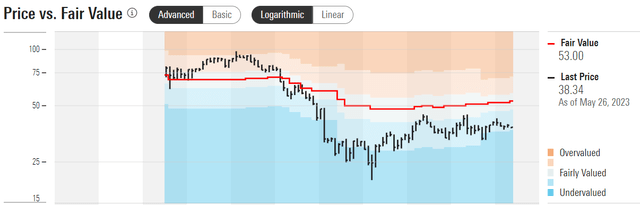

The DDM returns me a reasonable stock worth of about $47, or 21% greater than the existing stock cost levels. The upside prospective appearances appealing, particularly offered the 4.2% forward dividend yield.

To get more conviction, let me likewise describe Morningstar Premium, approximating the stock’s reasonable worth at $53 with a medium level of unpredictability. The chart listed below programs that the stock cost has actually traditionally traded with a considerable discount rate to Morningstar’s reasonable worth estimate.

Threats to think about

Buying Kraft Heinz stock brings threats, generally due to altering customer choices. While Kraft Heinz owns popular and popular brand names worldwide, the issue depends on altering customer tastes. There is a nonreligious shift where customers are moving from packaged foods and progressively choose natural and natural meals and dressings. For that reason, I think about significance threat to be high for KHC.

Another significant threat is the concentration threat. KHC deals with a high concentration of sales to its biggest clients, with Walmart alone representing 21% of overall sales in 2022. In addition, the truth that the leading 5 clients in the U.S. represent almost half of U.S. sales and the leading 5 clients in Canada represent 76% of Canadian sales suggests a substantial company concentration. Such a high level of sales concentration increases the business’s reliance on its significant clients’ monetary stability and tactical choices.

Lastly, the business is susceptible to the volatility of input expenses, particularly associated to products like farming items and energy. KHC has practically no power to manage products costs, so undesirable motions in basic materials costs can negatively impact the business’s success. Management needs to be proactive in hedging threats connected to basic materials volatility.

Bottom line

General, I think that the upside capacity and an appealing forward dividend yield surpass the threats. I like the characteristics of the last 3 quarters, which suggest a favorable pattern offered the management’s tactical efforts. The stock is a buy for financiers who look for a trustworthy dividend business to contribute to their portfolios.