On Tuesday the FHFA Home Rate Index struck an all-time high. In this post I’ll discuss why this is occurring and why we still have a savagely unhealthy real estate market. The fast takeaway here is that overall active listings in the U.S. are still near lowest levels and the need has actually supported.

If house sales were crashing at the exact same speed they were in 2015, we would all be having a various conversation. This is why I have actually worried that Nov. 9, 2022, was an inflection point in real estate. It’s not due to the fact that need has actually rebounded in a huge method, it’s simply that house sales stopped collapsing as they performed in 2022.

Positive real estate information turned in November, so HousingWire produced the weekly Real Estate Market Tracker to supply real-time positive real estate information. I likewise just recently signed up with Mike Simonsen’s Leading of Mind podcast to speak about what’s taken place in real estate over the previous year. Positive real estate information may not be hot, however it works.

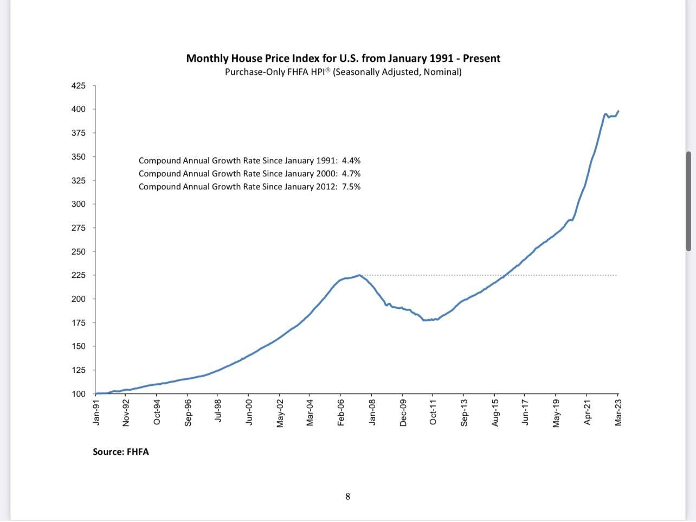

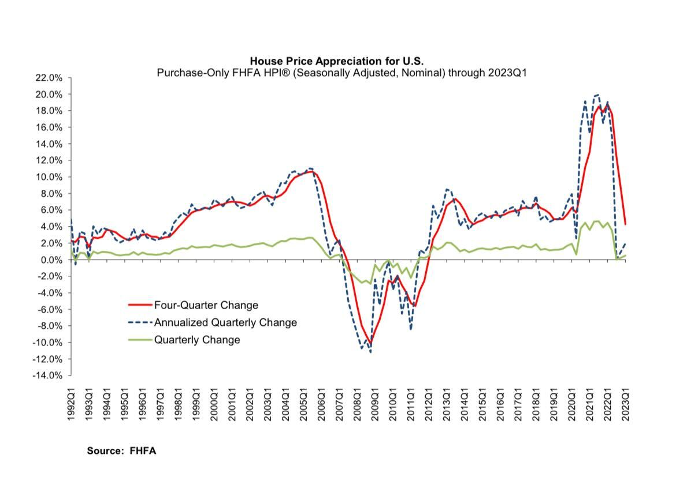

From FHFA: U.S. home rates increased 4.3 percent in between the very first quarters of 2022 and 2023, according to the Federal Real Estate Financing Company Home Rate Index (FHFA HPI). Home rates were up 0.5 percent compared to the 4th quarter of 2022. FHFA’s seasonally changed month-to-month index for March was up 0.6 percent from February.

How and why did the index reach this high, and what should we anticipate in the future?

Stock is still near record lows

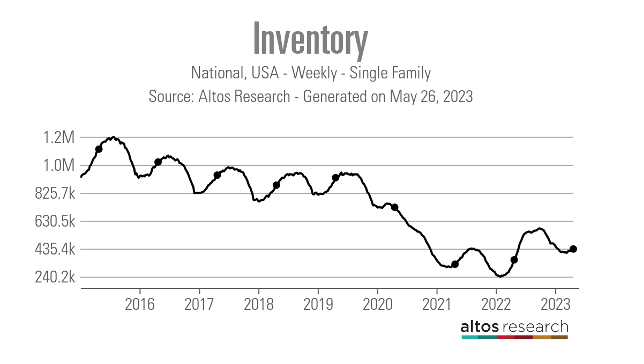

The simplest financial conversation today is the real estate stock story in the U.S. which it’s traditionally low. Nevertheless, it’s likewise the most-lied-about subject in current financial history. Individuals declare stock isn’t low due to the fact that “shadow stock” is on the brink of including countless houses into the market any 2nd now. Another misconception is that we’ll have a silver tsunami where every Infant Boomer notes their house in one month, flooding the market with stock.

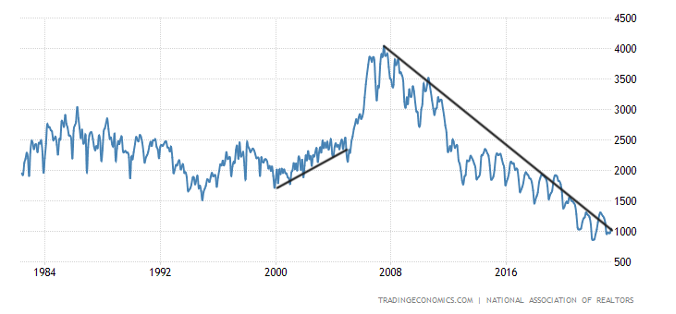

The NAR overall active listings information is in between 2 million and 2.5 million in a regular market in between 1982-2023. Post COVID-19, we broke to lowest levels and it’s tough to get it back to those levels: we’re presently at 1,040,000 active listings. This is a truth that some individuals have a difficult time thinking due to the fact that they think the shadow stock or uninhabited house thesis.

These are frequently middle-age male stock traders or anybody from the anti-central bank motion who has actually become part of a borderline insane bearish American financial crash team that just can be matched by the Russian giant motion spreading out disinformation about the state of the U.S. economy. Economic cycles reoccur, however the 24/7 doom pornography individuals are a one-trick pony that will fall under the tomb with all American bears who have actually stopped working given that 1790.

NAR overall stock given that 1982:

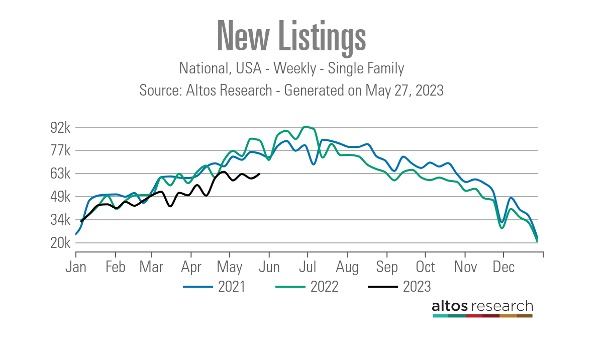

I choose the Altos Research Study weekly single-family information to the NAR information due to the fact that it offers us a fresh appearance at not just active listing information however brand-new listing information. In this manner, no one can be shocked when old stagnant information concerns the market. This is likewise why we produced the weekly Real estate Market Tracker post. We wish to link the dots with supply and need.

The Altos Research study brand-new listing information is vital in tracking the supply element of real estate, which is why I include it as part of the Tracker. Even in 2022, when we had the most considerable house sales collapse ever tape-recorded, the brand-new listing information never ever blew up greater; in reality, it was trending at lowest levels in 2021 and 2022, and now is at a brand-new all-time low in 2023.

The information in the charts above ought to clean up any shadow stock and uninhabited house rubbish we have actually heard for over 11 years. Let’s speak about the 2nd considerable element: need!

In 2015 was a whirlwind for real estate economics. The very first 3 months of 2022 were so bad that I considered it the unhealthiest real estate market post-2010. I created the term savagely unhealthy due to the fact that we had a lot of individuals going after too couple of houses. More than 70% of the market saw several quotes on residential or commercial properties.

In February of 2021, I spoke about how we required greater rates to cool off the real estate market due to the fact that this wasn’t the real estate bubble of 2005. Nevertheless, by February 2022, it was far too late; a lot home-price development in such a brief time suggested that need would collapse when home loan rates did increase.

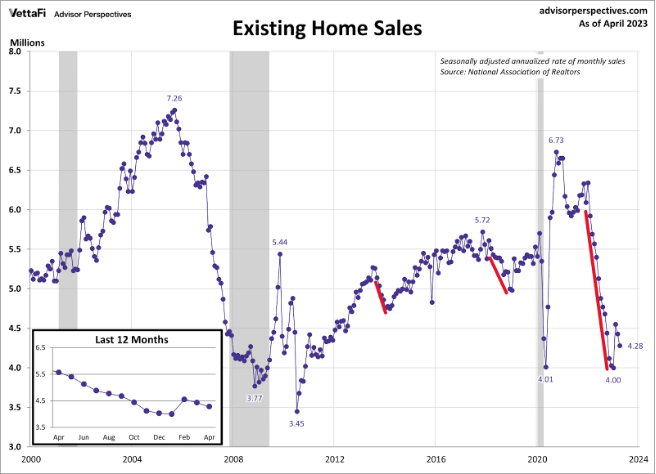

Home loan rates going from 3% to 5% had actually been the standard for the marketplaces; home loan rates going from 3% to 7.37% was another story completely. As an outcome, house sales collapsed in 2022 in the most popular style ever tape-recorded in U.S. history.

So what has altered? Well, beginning Nov. 9, 2022, home loan rates fell and home loan need improved. We didn’t see a healing in need, it simply supported.

Given That Nov. 9, purchase application information has actually had 17 favorable prints versus 9 unfavorable prints after making some vacation changes. Year to date, we have actually had 10 favorable prints and 9 negatives, and tomorrow purchase applications ought to be unfavorable, which reveals the stabilization in need up until now in 2023.

It is easy supply and need economics. In 2015, house sales crashed due to the fact that home loan rates blew up greater after the most considerable short-term home-price gains ever in history. Nevertheless, after Nov. 9, that truth altered from crashing house sales to supporting.

So the ethical of the story is that the marketplace characteristics were extremely historic in 2015; active stock and month-to-month supply were low, however house sales were crashing, and the stock that was on the marketplace, particularly in the seconnd half of 2022, needed rate cuts to offer.

In my 2023 projection for rates, I mentioned that home loan rates required to remain greater, above 5.875%, for rates to have a moderate decrease, in contrast to the enormous rate gains we have actually seen in 2020 through 2022. I selected 5.875% due to the fact that my cost index design was shot, however I likewise saw that the real estate market altered when rates moved from 7.37% to 5.99%.

Picture what the real estate information would appear like if rates remained in the low 5% for 2023. This is why tracking weekly real estate information is important. We do not have a real estate need healing as we saw with the COVID-19 healing, we simply have a stabilization in need, and overall active listings are still near lowest levels.

As you can see in the FHFA house rate index listed below, the development rate of rates cooled off a lot with greater home loan rates, however those didn’t crash rates like in 2007 and 2008, a duration in time with much greater active supply.

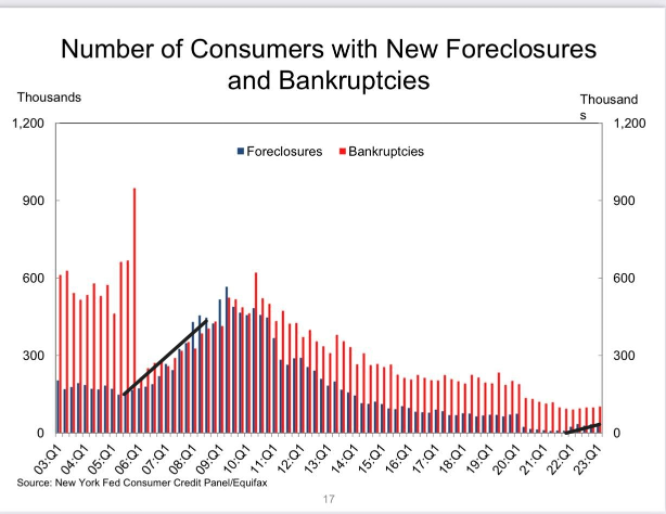

Likewise, to accompany the FHFA house rate index, not just was real estate stock over 4 million in the NAR information in 2007, however we likewise had enormous development in forced sellers. As we can see in the chart below, we had enormous credit tension in the system.

So, as we prepare for the 2nd half of 2023, we will track the weekly real estate information. We will concentrate on the real information that matter, favorable or unfavorable. The most considerable modification this year is that house sales are not collapsing in the exact same style they were in 2015.

.