Title: The Retirement Tsunami Has Begun

Description: There are 76.4 million infant boomers in the United States. 10,000 of them turn 65 daily and a lot of are fiscally unprepared for retirement in what is call a “Space Trap”. The majority of will depend on pensions, individual retirement account’s, 401K’s (and other personal strategies), social security and Medicare. What is the real condition of those retirement plans? How is that most likely to affect me?

ITM Trading’s Chief Market Expert Lynette Zang Discussing Expert Trading The Fiduciary Guideline And Retirement Plans.

Lynette Zang is the primary market expert at ITM Trading. For a long time now Lynette has actually been utilizing social networks to get in touch with her customers and fans. Following is a quick summary of a Facebook Live post in which we discover Lynette Zang speaking about expert trading, fiduciary duty, and issues in the retirement fund sector. Lynette made this discussion on April 11, 2017.

Lynette Zang Discussing: Expert Trading.

First Off, what is expert trading? Wikipedia specifies expert trading as the trading of public business stock or other securities (such as bonds or stock choices) by people with access to nonpublic details about the business. Trading by particular experts, such as staff members, is typically allowed as long as it does not count on product details, not in the general public domain. Lots of jurisdictions need that such trading be reported so that the deals can be kept track of in the United States and numerous other jurisdictions trading performed by business officers, crucial staff members, directors, or substantial investors need to be reported to the regulator or openly revealed, typically within a couple of service days of the trade. In these cases, experts in the United States are needed to submit a Type 4 with the United States Securities and Exchange Commission (SEC) while purchasing or offering shares of their own business.

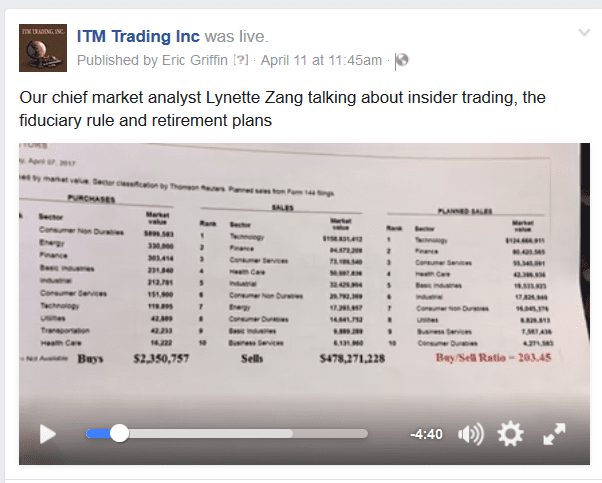

Now that we understand what expert trading is, what does Lynette need to state about it? She begins by specifying that experts are certainly offering and they are not purchasing. Due to the fact that particular crucial officers need to report their trades, as we discovered above, Lynette can track them. The very first graphic Lynette deals is an essential figure. If you take a broad summary take a look at what experts are doing you will discover that they are offering 203 shares in their business for every single one share that they acquire. The experts understand something, and they are certainly offering. They are not purchasing.

Lynette Zang Discussing Expert Trading.

Expert Trading At Amazon.

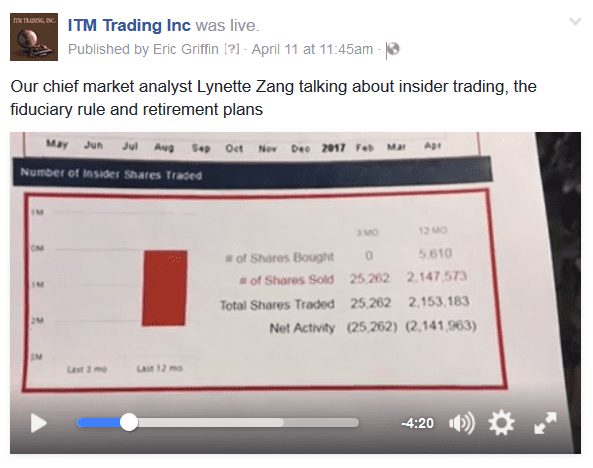

As a case in point Lynette provides some Amazon information. The experts at Amazon are certainly offering. Experts at Amazon are not purchasing. In reality, over a three-month duration, no experts bought Amazon stock. 25,000 shares, nevertheless, were liquidated by individuals who were needed to submit when they offered their stock.

Lynette Zang Discussing Expert Selling.

Over a 12 month duration, just 5610 shares of Amazon stock was bought by individuals needed to submit. However, over 2.1 million shares of Amazon stock were offered by individuals needed to submit. What is going on at Amazon? What do the experts understand that we do not understand? The stock cost has actually certainly been increasing, as Lynette explains. She provides that these are the kinds of things that you require to understand prior to you can make informed options about investing.

Lynette Zang Discussing Expert Trading At Amazon.

Lynette Zang Discussing: The Fiduciary Guideline.

What is fiduciary responsibility? If we speak with Wikipedia once again we discover that a fiduciary responsibility is the greatest requirement of care at either equity or law. A fiduciary is anticipated to be incredibly devoted to the individual to whom he owes the responsibility (the “primary”): such that there need to be no dispute of responsibility in between fiduciary and concept, and the fiduciary need to not make money from his position as a fiduciary (unless the primary authorizations).

What this eventually implies is that individuals you invest your cash with are expected to have your benefits in mind. Your revenues must be more crucial than their charges and charges. There were modifications set up to the fiduciary laws in the United States, however they have actually been pressed back till June. Obviously, industry is battling versus any modifications that would benefit the financier. On the other hand, they are revealing modifications that are self-benefiting.

Modifications Coming.

Lynette explains that FINRA, which is the self-regulatory body that supervises stocks and bond purchases and so on, has some originalities. Amongst these concepts, which will most likely end up being truth, are some offer breakers in Lynette’s viewpoint. For example, brokerage homes and other banks desire the right to keep dispensations and so on if they feel that the monetary deal you are making is not in your benefit.

In addition, organizations are likewise feeling the requirement to have somebody besides you to call about making modifications to your account. What they basically desire is the name of another celebration that can make choices in your place. Does this appear sensible to you? Do you require someone else, or another monetary entity making your choices for you?

Lynette Zang Discussing Increasing Financial Solutions Charges And Charges.

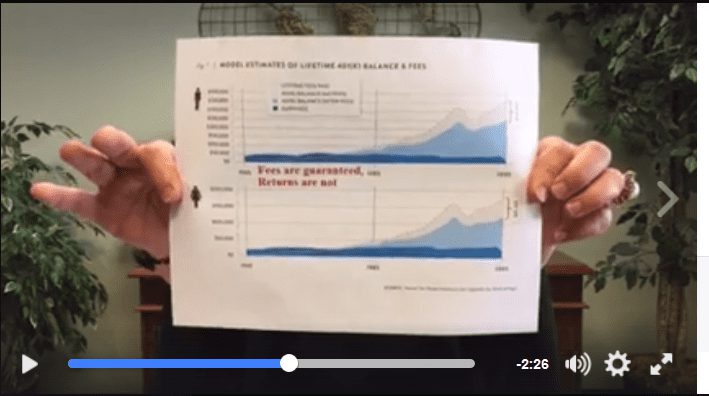

With what Lynette has actually provided, one need to question if there is still a fiduciary responsibility in location. We understand that there are still charges and expenses in location for investing. In her discussion, Lynette reveals a chart and it is apparent that the monetary sector is well-paid. In reality, one location of the chart mentions that “Charges Are Ensured. Returns Are Not.” Eventually, the monetary system wishes to keep your wealth within it and they desire overall control of it.

Lynette Zang Discussing: Retirement Plans.

Lynette invests the last couple of minutes of her five-minute Facebook discussion welcoming you to her approaching webinar. The subject is troublesome retirement strategies and how this a circumstance impacts you. She informs us there are $75.5 trillion purchased these strategies worldwide. The issues begin to develop when you take a look at the layers and layers of utilize connected with these retirement strategies. If you do not comprehend what utilize is and what monetary dangers are connected with the marketplace of this size then you actually must view her webinar. It is offered by following this link In conclusion, follow Lynette on Facebook and YouTube to discover her newest updates.

Word count: 953