Less houses are offering than typical this spring– however the ones that are altering hands are going quickly, with a little swimming pool of purchasers circling around an even smaller sized swimming pool of listings. Today’s inflation report, which reveals sluggish however constant development on alleviating rate gains, verifies it’s most likely the Fed will stop briefly on interest-rate walkings next month.

Restricted stock and raised home loan rates continue to reduce U.S. house sales as we go into the heart of spring, usually a hot homebuying season. Today’s inflation report reveals a minor downturn in rate gains, validating that home loan rates are most likely to remain about where they are for the next numerous months. That’s since the Fed’s interest-rate walkings are working as planned to reduce inflation, albeit gradually. That suggests they most likely will not trek or cut rates of interest at their next conference in June.

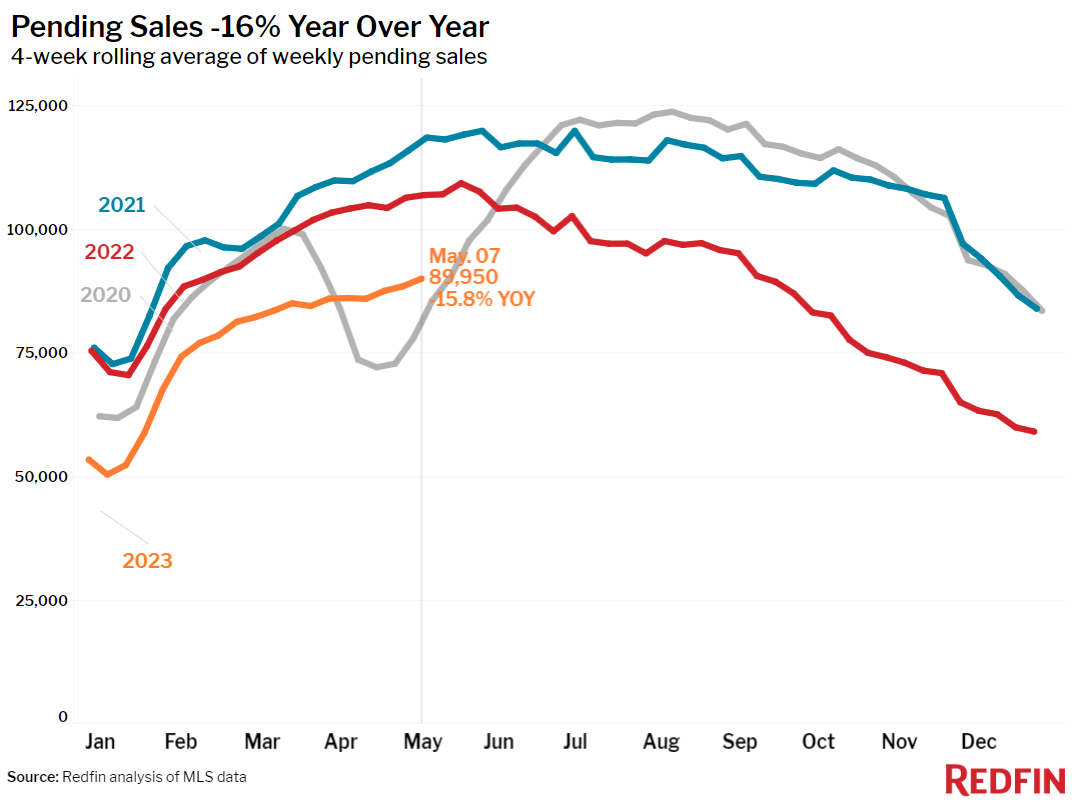

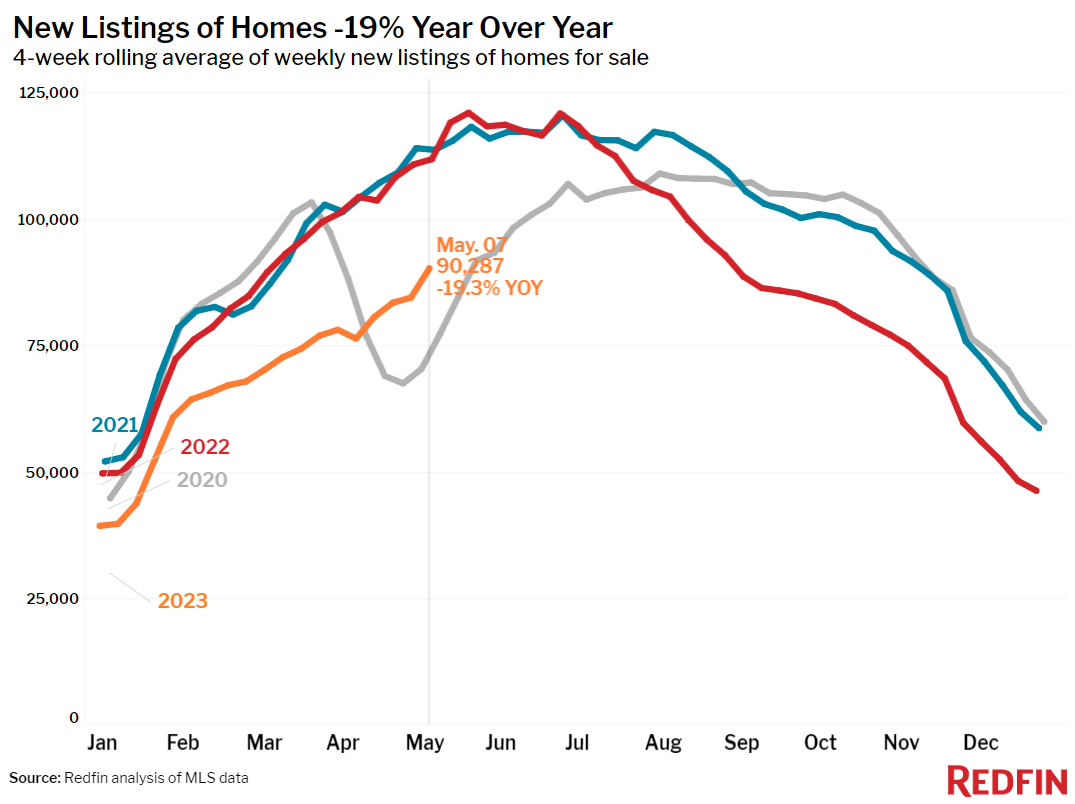

New listings of houses for sale dropped 19% year over year throughout the 4 weeks ending Might 7, adding to an unseasonal month-to-month decrease in overall stock. There were 16% less pending house sales than a year previously, showing the absence of listings and the group of prospective purchasers who have actually been evaluated by 6%- plus home loan rates and record-high month-to-month payments.

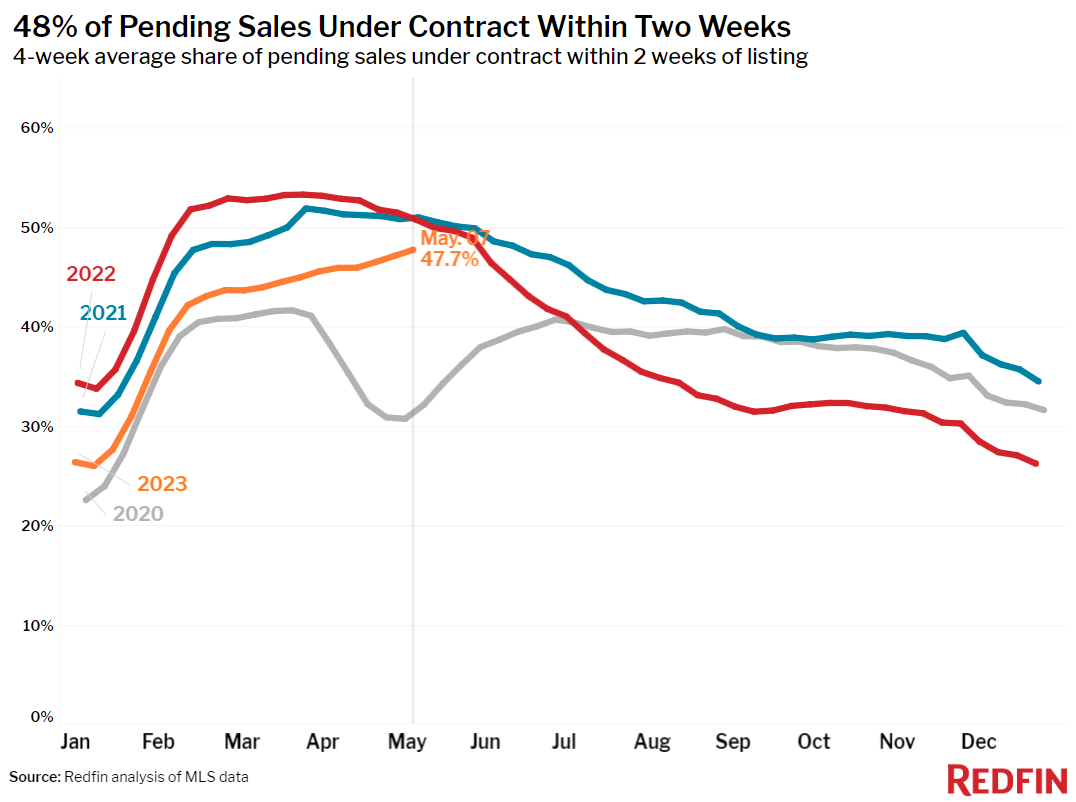

However in spite of the stock crunch, pending sales have actually increased over the recently, as they usually do this season. In addition, mortgage-purchase applications are up 5% on a seasonally changed basis. The swimming pool of purchasers is little however figured out, with almost half of the houses that do offer doing so within 2 weeks. That share has actually increased over the last month, which isn’t normal for this time of year.

” This spring’s real estate market is hot however cold, with little listings making it less active than typical however quick and competitive at the exact same time. The bright side is that purchasers are out there, searching for a seat in a video game of musical chairs. The problem exists aren’t adequate chairs,” stated Redfin Deputy Chief Economic Expert Taylor Marr “A great deal of possible house sales are secured till home loan rates boil down to a level for which present owners would want to sell their 3% rate. The issue is that’s not likely to occur anytime quickly, as although inflation is progressively boiling down from in 2015’s record-high levels, it’s still above target.”

Today’s real estate market is regional, with various parts of the nation experiencing various patterns

While a lack of listings and couple of however fast-moving sales identify the U.S. real estate market as an entire, each city location is distinct.

Austin, TX Redfin Premier representative Gabriel Recio reports that homebuying need has actually gotten this spring, however there suffice houses for sale that he’s not seeing much competitors. Pending sales and brand-new listings are each down about 9% from a year previously in Austin, smaller sized decreases than a lot of cities, and rates are down the most in the nation (-18% YoY).

” I have actually seen an increase of property buyers go into the marketplace over the last month,” Recio stated. “The restoration is partially since individuals got tired of waiting on home loan rates to come down and partially since they feel it’s a great time to get a house without much competitors. Much of today’s purchasers are individuals relocating from other states and some are financiers.”

In Jacksonville, FL, Redfin Premier representative Heather Kruayai states sellers are suppressed– therefore are a great deal of potential purchasers. “Property owners are secured by low home loan rates. They’re not offering unless they require to move for something like a brand-new task or another significant life modification,” she stated. “Houses that do go on the marketplace are offering rapidly if they’re low-cost starter houses, however middle-of-the-road and costly houses are sitting.”

Leading indications of homebuying activity:

- For the week ending May 11, the typical 30-year set home loan rate was 6.35%, down a little from 6.39% the week previously. That’s the 2nd straight week of rates inching down. The everyday average was 6.57% on Might 10.

- Mortgage-purchase applications throughout the week ending Might 5 increased 5% from a week previously, seasonally changed. Purchase applications were down 32% from a year previously.

- The seasonally changed Redfin Property buyer Need Index– a procedure of ask for house trips and other homebuying services from Redfin representatives– was up a little from a month previously throughout the week ending Might 7 and down simply 2% from a year previously, the tiniest yearly drop in a year. Need is hardly decreasing from year-ago levels since purchasers were withdrawing rapidly at this time in 2015 as home loan rates increased above 5% for the very first time considering that 2009.

- Google look for “ houses for sale” were little bit altered from a month previously throughout the week ending Might 6, and down about 15% from a year previously.

- Visiting activity since Might 6 was up 26% from the start of the year, compared to an 14% boost at the exact same time in 2015, according to house trip innovation business ShowingTime

Secret real estate market takeaways for 400+ U.S. city locations:

Unless otherwise kept in mind, the information in this report covers the four-week duration ending Might 7 Redfin’s weekly real estate market information returns through 2015.

Information based upon houses noted and/or offered throughout the duration:

For bullets that consist of metro-level breakdowns, Redfin examined the 50 most populated U.S. cities. Select cities might be left out from time to time to make sure information precision.

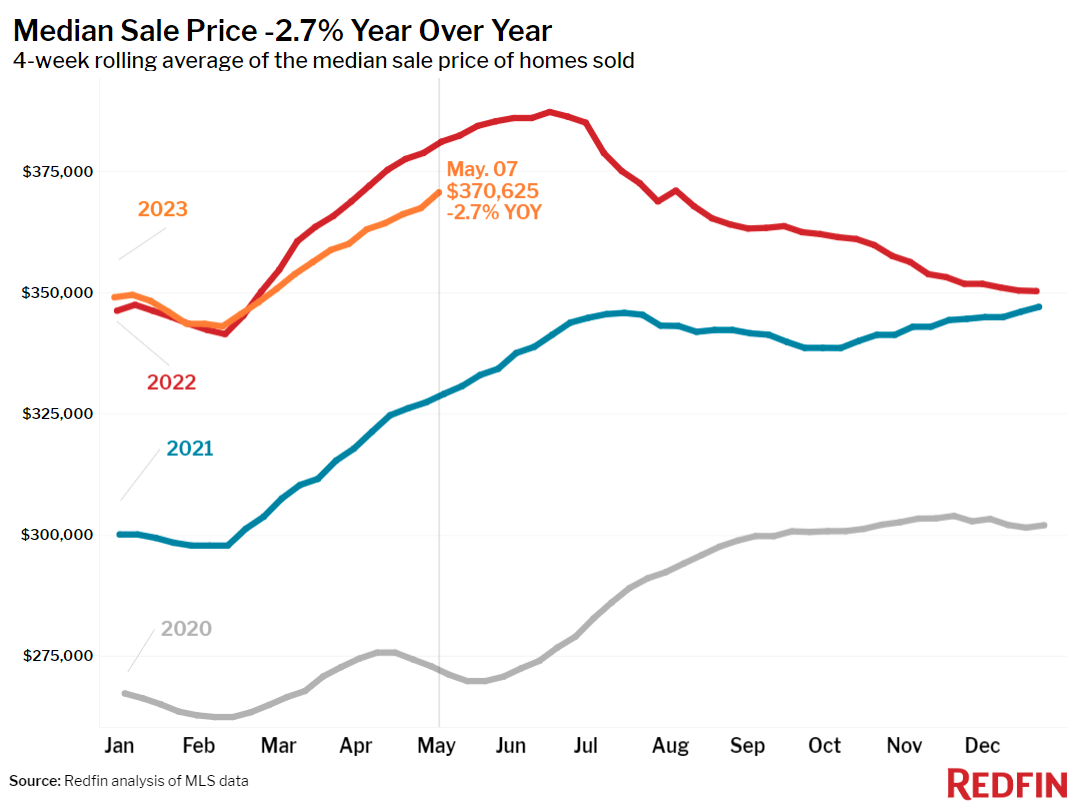

- The average house price was $370,625, down 2.7% from a year previously. That’s the 11th-straight four-week duration of decreases.

- Home-sale rates decreased in 30 cities, with the most significant drops in Austin, TX (-17.7% YoY), Oakland, CA (-15.7%), San Francisco (-11.9%), Las Vegas (-10.7%) and San Jose, CA (-9.7%). That’s the most significant drop considering that a minimum of 2015 for Austin.

- List price increased most in Fort Lauderdale, FL (10.6% YoY), Milwaukee (6.9%), Cleveland, OH (6%), Indianapolis (5.7%) and Providence, RI (5.3%).

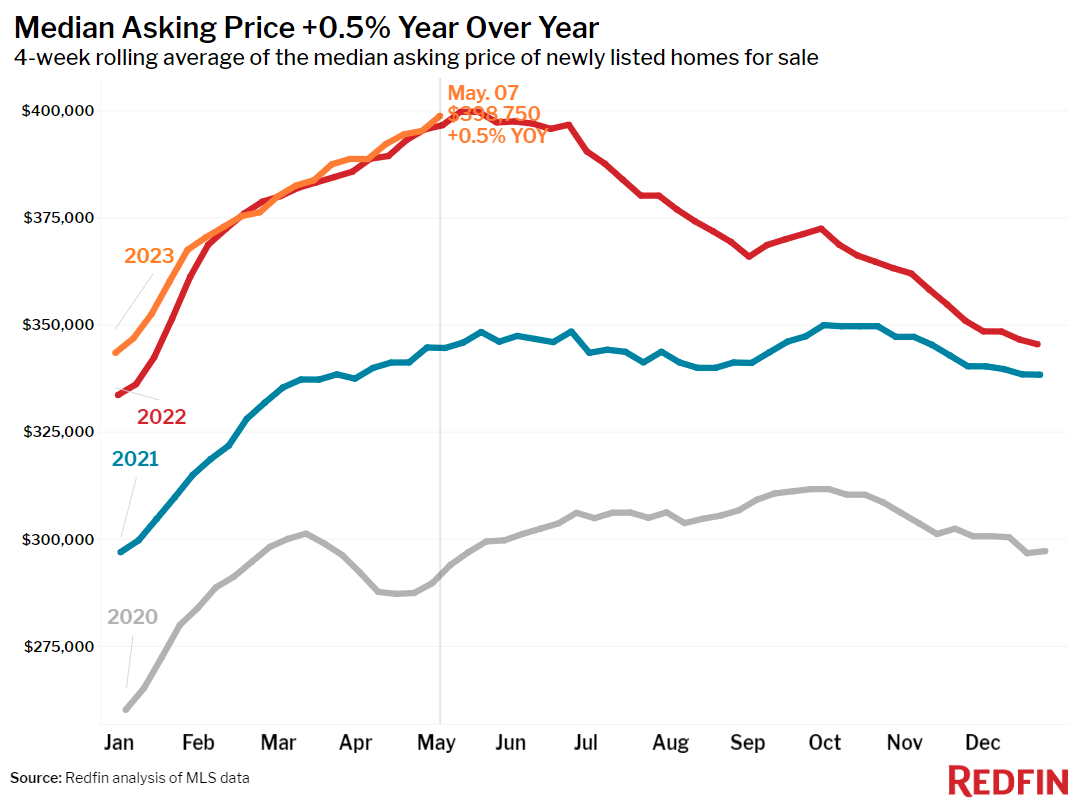

- The average asking rate of freshly noted houses was $398,750, approximately flat (+0.5%) from a year previously.

- The month-to-month home loan payment on the median-asking-price house struck a record high of $2,566 at a 6.35% home loan rate, the present weekly average. That’s up 9.7% ($ 226) from a year previously.

- Pending house sales were down 15.8% year over year.

- Pending house sales fell in all cities Redfin examined. They dropped most in Las Vegas (-38.7 YoY%), Seattle (-37.6%), Chicago (-34.4%), Oakland (-33.9%) and Sacramento, CA (-32.9%).

- New listings of houses for sale fell 19.3% year over year.

- New listings decreased in all cities Redfin examined. They dropped most in Riverside, CA (-48.7% YoY), Anaheim, CA (-48.6%), Los Angeles (-40.6%), San Diego (-39%) and Las Vegas (-38.6%).

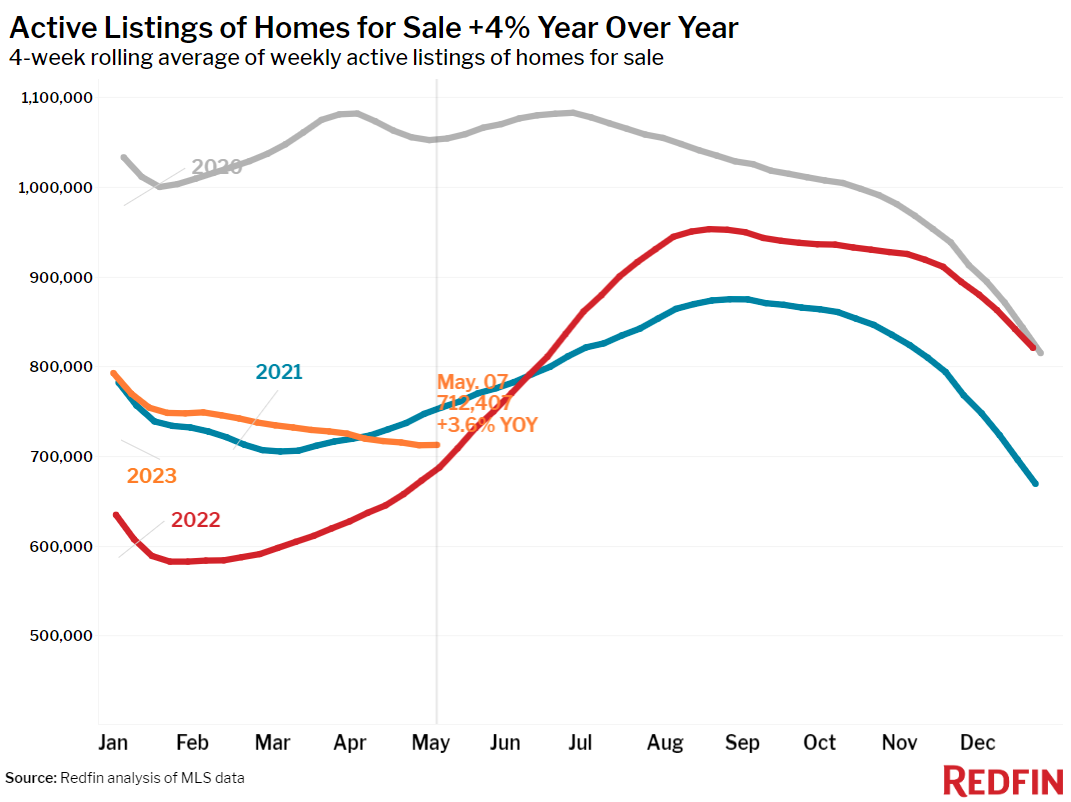

- Active listings (the variety of houses noted for sale at any point throughout the duration) were up 3.6% from a year previously, the tiniest boost considering that June. Active listings fell about 1% from a month previously; usually, they publish month-over-month boosts at this time of year.

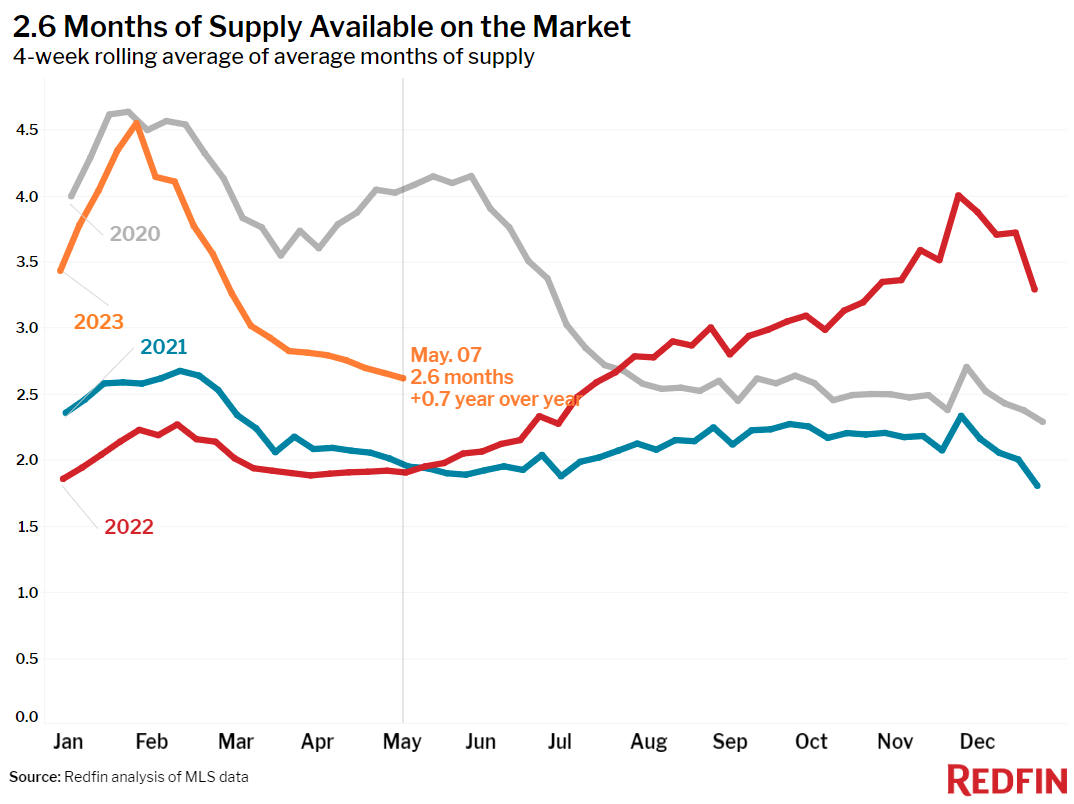

- Months of supply– a procedure of the balance in between supply and need, computed by the variety of months it would consider the present stock to cost the present sales rate– was 2.6 months, up from 1.9 months a year previously. 4 to 5 months of supply is thought about well balanced, with a lower number showing seller’s market conditions.

- 48% of houses that went under agreement had actually an accepted deal within the very first 2 weeks on the marketplace, below 51% a year previously however up from 46% a month previously. Generally, we see month-over-month decreases at this time of year.

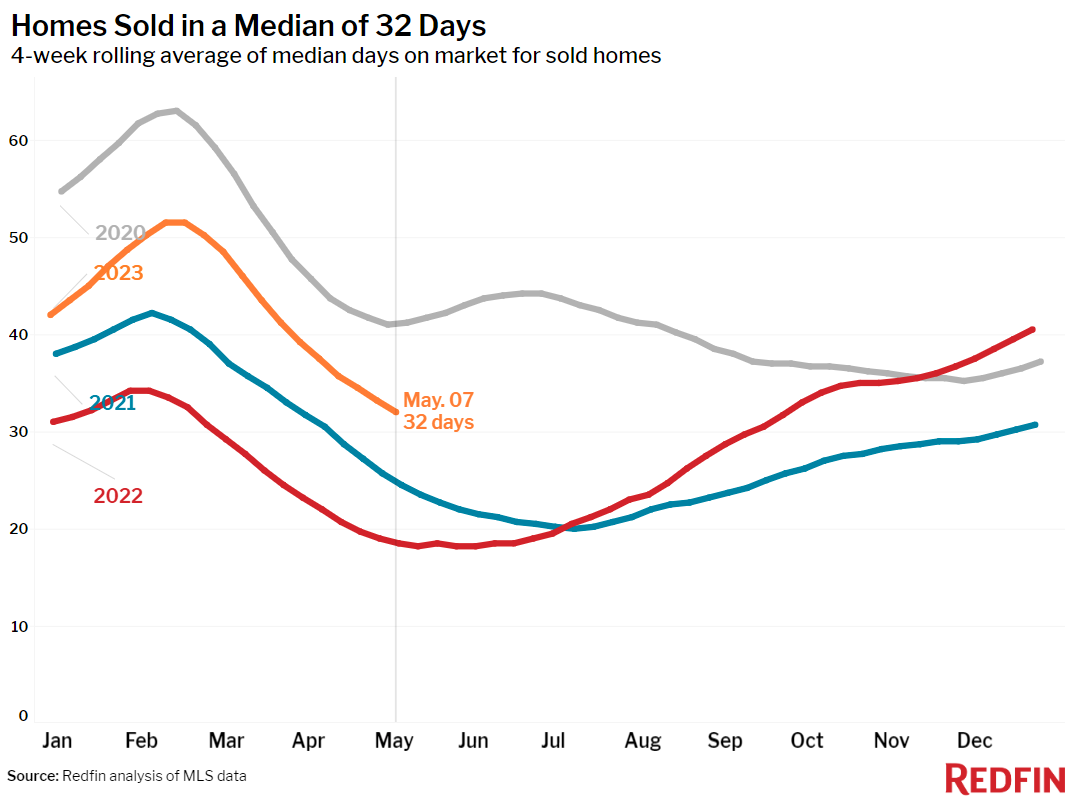

- Houses that offered were on the marketplace for a typical of 32 days, the quickest period considering that September. That’s up from 19 days a year previously, which was close to the record low.

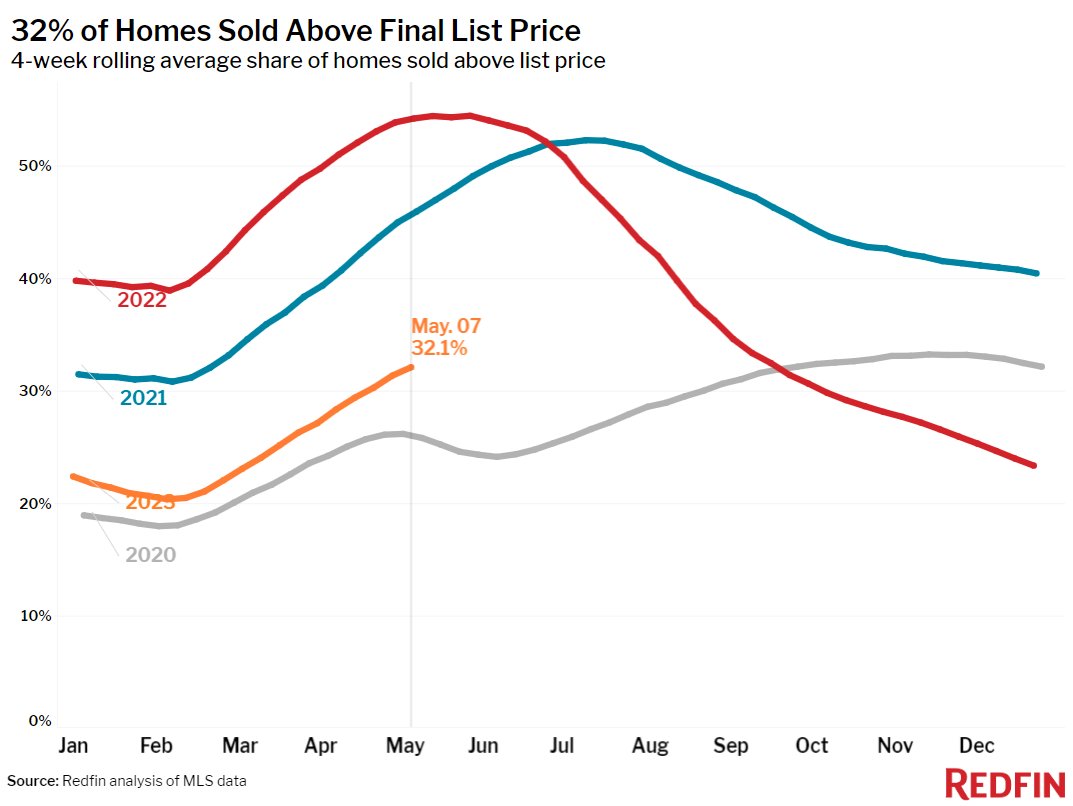

- 32% of houses offered above their last market price. That’s the greatest share considering that September however is below 54% a year previously.

- Usually, 5% of houses for sale weekly had a cost drop, up from 3.1% a year previously.

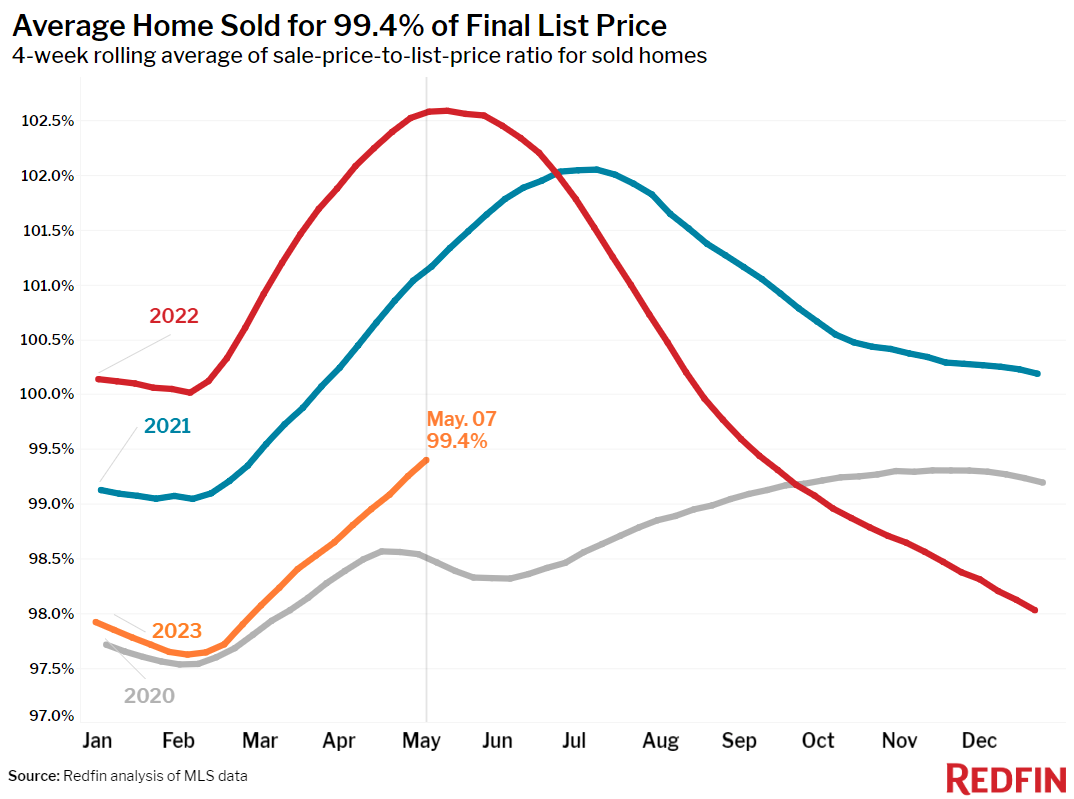

- The typical sale-to-list rate ratio, which determines how close houses are offering to their last asking rates, was 99.4%. That’s the greatest level considering that September however is below a record-high 102.6% a year previously.

Describe our metrics meaning page for descriptions of all the metrics utilized in this report.