pixelfit/E+ through Getty Images

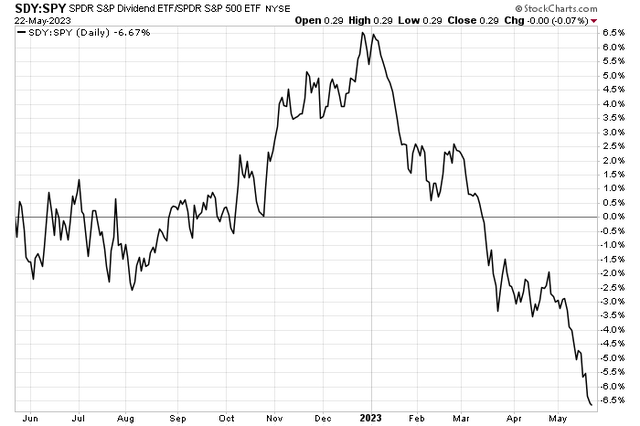

S&P 500 dividend stocks have actually cratered compared to the broad market. After peaking at the beginning of the year, the element is down about 13 portion points on SPY when evaluating the efficiency of the SPDR S&P Dividend ETF ( SDY) and the SPX. Amongst the high-yielders is Franklin Resources ( NYSE: BEN). I have a hold ranking on the business for weak property circulations (bearish) however likewise recuperating market conditions (bullish), though its chart leans unfavorable.

Dividend Stocks Decrease Vs. The S&P 500

The California-based $12.3 billion market cap Property Management and Custody Banks market business within the Financials sector trades at a low 14.8 routing 12-month GAAP price-to-earnings ratio and pays a high 4.9% dividend yield, according to The Wall Street Journal.

According to Bank of America Global Research Study, BEN is a worldwide property supervisor with over $1.3 Tn in AUM, over 10,000 workers internationally, and an existence in 6 continents. BEN supplies financial investment management services to retail, institutional, and high-net-worth customers internationally with abilities throughout all property classes consisting of equities, set earnings, multi-asset, options, and cash markets.

Previously this month, BEN provided Q1 results that had something for the bulls and bears. While income fell 7.7% year-on-year, EPS validated above Wall Street expectations due to much better net circulations throughout long-lasting property classes. Outflows summed to $3.7 billion, much better than the almost $11 billion of outflows reported in the very same quarter a year earlier. AUM ended Q1 sequentially greater at $1.42 trillion vs. $1.39 trillion in Q4. Then later on in the month, Franklin provided its April AUM upgrade, which revealed flat property development compared to the end of March.

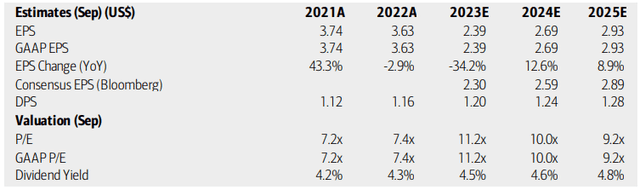

On appraisal, experts at BofA see profits falling dramatically this year prior to EPS development returns in 2024 and 2025. The Bloomberg agreement projection has to do with on par with what BofA sees. Dividends, on the other hand, are anticipated to increase at an ongoing consistent rate over the coming quarters. With low profits multiples following weak share cost efficiency over the previous 2 years, BEN seems an engaging worth case, however a soft development outlook is a headwind for the bulls.

Franklin Resources: Incomes, Evaluation, Dividend Projections

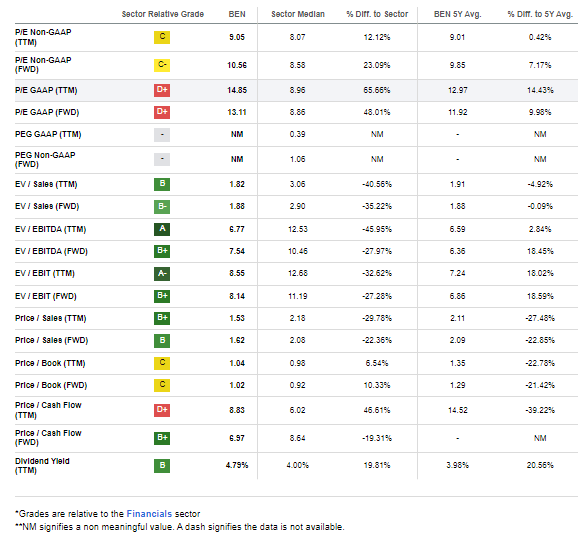

Franklin trades at 13.1 times next year’s profits, however that is 10% above its 5-year typical numerous. On a price-to-book basis, shares appear like a much better offer at simply 1.0 x compared to a long-lasting mean better to 1.3 x. If we use a P/E closer to the sector typical and $2.50 of NTM profits, then shares must remain in the mid-$ 20s, which is where it trades today. Its next profits date is slated for July 27 and the next dividend date is June 29.

BEN: Mixed Evaluation Metrics, An Above-Sector P/E

Looking For Alpha

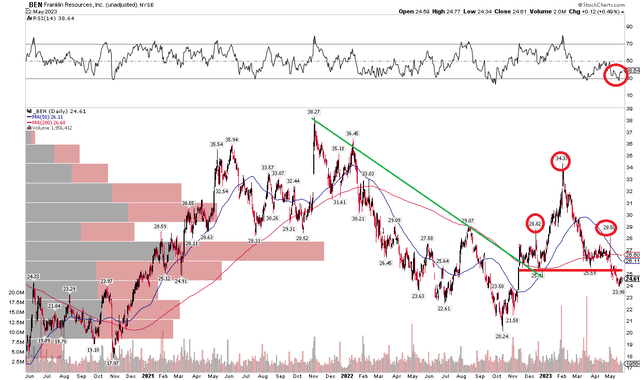

The Technical Take

I was neutral on BEN in 2015 due to the lukewarm appraisal and bad chart. Notification in the chart listed below that the share rose from the October low through an early February peak. It was a near-double, however those gains were short lived. BEN toppled amidst wider Financials sector distress over the back half of Q1. A stopped working rally to resistance previously this month leaves the chart susceptible for additional disadvantage.

I find a bearish head and shoulders pattern, with 2 shoulders near $28.50 and the head at the 52-week high north of $34. A neck line breakdown a couple of weeks ago set off the bearish pattern. What’s more, have a look at the RSI momentum reading at the top of the chart – it validates a brand-new YTD low in cost. I see assistance at the October low of around $20 – that is likewise the happy medium of where the stock sold 2020.

BEN: Bearish Head And Shoulders With RSI Verification

The Bottom Line

I restate my hold ranking on BEN. The appraisal is neutral, and the chart leans bearish. The benefit case is that property costs have actually recuperated, however the business has much to show.