Raghuram Rajan, Teacher of Financing at the University of Chicago and previous Guv of the Reserve Bank of India, fears that the crisis in the United States banking sector is not over. He discusses why he believes the tension in the monetary system is an unexpected effect of simple financial policy, and why a soft landing appears not likely.

In the United States, one bank after another is collapsing. After the failures of Silicon Valley Bank and Signature Bank in March, another bank, First Republic Bank, needed to be saved through an emergency situation takeover at the start of Might. PacWest is feared to be next. Even the shares of bigger banks such as United States Bancorp and Capital One are under heavy pressure.

Although things otherwise stay incredibly peaceful in the monetary markets, Raghuram Rajan sees no factor to sound the all-clear. “Regrettably, the sense is that this specific stage of the banking issues is over, however I believe the banking system still requires viewing”, states the financing teacher at the University of Chicago and previous Guv of the Reserve Bank of India.

Dr. Rajan understands what he is speaking about. In the summertime of 2005, he triggered a stir when he alerted versus excesses in the banking system in front of the put together monetary elite at the financial seminar in Jackson Hole. He was greatly slammed at that time, however today he is among the most popular financial experts of our time.

In a thorough discussion with The marketplace NZZ, which has actually been gently modified for length, he discusses why the banking crisis is most likely to continue, where the primary vulnerabilities in the monetary system are and why, in his view, they are an effect of the simple cash with which the Federal Reserve has actually consistently flooded the system in the previous years. He likewise states why the threat of a difficult landing for the economy is high.

” Eventually, we require to pay more attention to simple financial policy, producing the type of monetary vulnerabilities that result in the issues we’re seeing today”: Raghuram Rajan.

Teacher Rajan, the local banking crisis in the United States is dragging out. With First Republic Bank, another organization just recently collapsed. How do you evaluate the scenario?

As it held true with Silicon Valley Bank and Signature Bank, First Republic Bank remained in a really tight spot. This was a bank in the classification of the “strolling injured”, it was unavoidable that something would occur ultimately. Regrettably, the sense is that this specific stage of the banking issues is over, however I believe the banking system still requires viewing.

Why?

The current occasions highlighted mid-sized banks with unstable deposits and property issues. I believe the property issues have not disappeared. There are still great deals of losses to be soaked up on bank balance sheets, and the issue with unstable deposits hasn’t disappeared either. There definitely are deposits that are taking a look at greater rates of interest and requiring greater rates of interest to remain. That implies net interest margins for numerous banks are diminishing significantly. As an outcome, there will be a concern of longer-term health of the banking system, specifically relating to mid-sized banks exposed to locations like business realty.

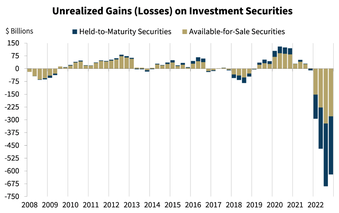

Overall latent gains (losses when unfavorable) on financial investment securities either offered for sale or held to maturity by FDIC guaranteed banks in the United States.

The wider concern is, naturally, how did we get here?

The Federal Reserve has actually put out a report, speaking about bad bank management, however likewise bad guidance. Nevertheless, what does not get any reference is the function of simple cash for over 10 years. Eventually, we require to pay more attention to the function of simple financial policy in producing the type of monetary vulnerabilities that resulted in the issues we’re seeing today. If there wasn’t a threat of systemic problems, you would not require these bank saves, you might simply let them stop working. However the truth that you do not desire them to stop working is due to the fact that you stress over a spread or contagion, which contagion originates from systemic elements like financial policy.

This previous summertime, you and 3 co-authors provided a paper at the financial seminar in Jackson Hole that alerted of prospective issues in the banking system relating to the turnaround of QE. To what level does this crisis seem like familiarity for you, specifically because you had currently mentioned dangers in Jackson Hole prior to the last monetary crisis?

It’s not a lot a remembrance, it’s more the underlying hesitation to see financial policy as a cause, and sort of blame it on whatever else. There is this belief in academic community which has actually percolated to the reserve banks that it’s possible to have a tidy separation in between financial problems, which financial policy looks after, and monetary stability problems, which guidance looks after. The thinking is that in some way you can keep them different. The issue, naturally, is that financial policy produces pressures that incentivize the economic sector to make the type of errors that result in systemic tension in the monetary system. Then, you have an issue which results in bailouts and so on.

What brings you to this thesis?

There were precursors of what we are seeing today, which recommends this is not a coincidence, however has a long genesis. For example, in September 2019 all hell broke out in monetary markets when repo rates skyrocketed. The repo crisis was a liquidity crisis, and due to the fact that rates of interest weren’t raised at that time it remained simply a liquidity crisis. The Fed can be found in and bailed out the system with liquidity, so we didn’t need to stress over solvency.

The next shock followed with the Covid crash in March 2020, where the Fed stepped in a lot more powerfully.

Covid would have been a huge crisis if the Fed had not can be found in and flooded the marketplaces with liquidity. At the exact same time, the federal government needed to put in a substantial quantity of cash to companies which then repaid their banks. In truth, loan losses throughout the pandemic were minimal relative to what was expected. That made us think yet once again that we should not stress over dangers due to the fact that ultimately someone will come and bail us out. This time, the Fed is raising rates of interest at the exact same time as they’re withdrawing liquidity and it ends up being a twin issue for these local banks we’re speaking about.

Why precisely?

When the Fed takes part in quantitative easing, it does not occur in a vacuum. For instance, when the Fed purchases bonds from a pension fund, it is paying the pension fund for those bonds, and the pension fund then transfers the payments into its savings account. So basically, the Fed has actually secured bonds of the economic sector and changed them with reserves and these reserves wind up on banks’ balance sheets. Thus, QE not just increases the size of the reserve bank’s balance sheet, however likewise drives a growth in the wider banking system’s balance sheet.

What are the effects of this?

This growth in the wider banking system’s balance sheet is moneyed in a really unstable method, with uninsured need deposits. So unless the banks invest thoroughly and keep a really close watch on liquidity, they can encounter issues. It appears paradoxical: You’re flooding the marketplace with the most liquid property on earth which is reserve bank reserves, however due to the fact that business banks fund it in a specific method– by releasing need deposits, by releasing credit lines versus the reserves– they have a great deal of claims on liquidity they need to please.

That is precisely what is occurring today. With quantitative tightening up, or QT, the Fed is diminishing its balance sheet and draining pipes liquidity from the system.

When you decrease the reserves, these claims do not decrease in percentage. As a result, the system gets tighter and tighter, which produces issues. Now, that is presuming the banks invest effectively. However a few of them purchase long-lasting treasuries and comparable possessions which expose them to property side threat over and above the liability side threat they currently have. Most likely, they have actually been believing they do not need to stress because they have actually purchased long-lasting treasuries which are viewed to be quite liquid. However as we have actually seen, those treasuries can fall in worth when rates of interest increase, and after that you have a solvency issue combined with a liquidity issue.

Where do you believe we will go from here?

Depositors have actually ended up being a lot more mobile, maybe as an outcome of current occasions or maybe more typically. Reality is, they desire greater rates of interest which implies the steady, low interest deposit is no longer as simple to come by for numerous banks. To make it through, they need to pay greater rates of interest. However if you’re paying greater rates of interest, then you can’t money those long-lasting low rate of interest loans you made through the duration of simple cash. That’s due to the fact that those low rate of interest loans no longer provide you adequate profits to pay the expense of your deposits. Appropriately, the concern is that moving forward, a variety of banks will begin reporting lower and lower earnings. We need to see, however there are research studies revealing that numerous banks might begin reporting unfavorable earnings.

Simplistically, could we likewise state that the monetary system has ended up being so addicted to the liquidity offered by the Fed and other reserve banks that it is now struggling with withdrawal signs due to the fact that liquidity is being drained pipes?

That’s an excellent example: The system is addicted to simple liquidity, and if you have actually offered it with high levels of liquidity it gets utilized to the greater levels. There is sort of a hysteresis in this procedure: The more you feed it, the more it gets utilized to it, and after that withdrawing from that high level ends up being tough. Definitely, it’s extremely tough to return to the initial levels, however it’s currently tough to even bring it down rather. That’s the experience we saw in September 2019 with the repo crisis, we saw it in spades in 2020 throughout the Covid crisis, and we see some proof of that once again now.

In Europe, too, the ECB has actually flooded the system with enormous quantities of liquidity and even pressed rates of interest into unfavorable area. Will European banks quickly deal with issues comparable to those in the United States?

A minimum of up until now, it appears that the European managers have actually been paying more attention to such elements as rate of interest threat. What was explained in the Fed’s report by itself efficiency is that while they acknowledged these dangers, whenever the objective posts sort of altered: When they designed in considerable rates of interest run the risk of at a bank, the bank slammed the design and firmly insisted that it is in fact doing much better, and after that the managers didn’t always firmly insist that the bank brings the rate of interest run the risk of into line in a brief amount of time. It’s great that the Fed acknowledged that there were supervisory issues. However it’s unclear why standard banking concepts were compromised – which is something the Fed will need to consider.

Does this mean that there is less threat of a banking crisis in Europe?

It is less clear that there is an entire systemic problem. There is a concern with banks like when it comes to Credit Suisse which are still having a hard time to discover a clear service. Likewise, depositors end up being a bit more going to look for greater rates of interest. Earning money off of drowsy depositors is going to be more difficult and harder. That’s a prospective problem even for the European banks. However I do not believe the level of direct exposure on the property side, a minimum of from the outdoors, appears as significant.

What about dangers outside the banking system?

Europe likewise had an enormous market intervention to supply simple liquidity throughout the pandemic. On both sides of the Atlantic, insolvencies sort of decreased instead of up throughout the pandemic. And, offered the size of the shock, that would recommend that there are issues accumulated in the system. Whether this is a huge issue or a procedure of modification, only time will inform. The smart business utilized the simple cash to extend maturities, raise more funding so regarding construct larger buffers. Now, they can weather an economic downturn if an economic downturn takes place or if a few of the fallout from the war in Ukraine ends up being harder.

What about the less smart business?

The genuine issue originates from the business that were currently at the margin and could not obtain that much long-lasting financial obligation. They needed to obtain shorter-term financial obligation, which financial obligation will begin developing quickly. At that point, they need to re-finance in an environment which is far less tolerant to run the risk of than throughout the pandemic. So my sense is tension will approach in the system, however it is extremely tough to see just how much and where. As we saw last fall, the UK’s experience with leveraged liability-driven financial investments was an issue few individuals were concentrated on. Likewise in the United States, I do not believe there was a great deal of concentrate on rate of interest dangers lowering these banks. So when liquidity boils down, when monetary conditions turn harder, the issues in some cases emerge in unanticipated locations. For that reason, up until we see rates of interest begin boiling down, up until we see liquidity support, we need to be on the alert for more issues.

Up until now, nevertheless, reserve banks are not signifying any impending easing of financial policy. To what level will the banking crisis in the United States impact the Fed’s efforts to bring inflation under control?

The hardest part is the last mile. We have actually currently seen a few of the simple gains: supply chain snarls are ending up being untangled and a few of the energy rates that had actually increased throughout the early stage of the war have actually boiled down. In basic, all that has actually been soaked up into the inflation numbers. In the United States, real estate needs to boil down, and it is most likely to come down later on in the year, however much of the other changes have actually happened. Inflation is now being held up by strong services inflation, which implies core inflation is supporting at a high level. Appropriately, the Fed requires to see core inflation boil down, and this is where I believe they wish to see more slack in the labor market so that a few of the forces rising salaries in the service sector will soften.

What does this mean for the future course of financial policy?

The Fed is captured in a bind. If it stops briefly, the marketplace would commemorate and the Fed would not have the ability to complete the task. At the exact same time, it can not keep treking rates and see the system break. So the genuine concern the Fed will be considering is inflation versus monetary stability. Things are beginning to slow in the United States. However last quarter, despite the fact that development slowed, the customer was still rather strong. Till the Fed gets the customer to decrease a bit, I believe they will not feel their task is done. Usually, if financial policy succeeds in lowering inflation, it takes place at the expense of maybe a higher downturn. Mind you, downturns are difficult to handle, due to the fact that as soon as a downturn begins, it has sort of a life of its own.

Nevertheless, the stock exchange are obviously wishing for a moderate decline. Equities are holding up remarkably well.

It’s intriguing, if you take a look at the information, this is a relatively narrow market rally, mostly focused around huge tech business. It’s not as if all stocks are benefitting, it’s more all this buzz about ChatGPT and generative AI is offering individuals a sense that huge tech may have a lot more firepower. It’s entities like Microsoft, Apple and even Meta that are holding up the marketplace. Because sense, I would not put excessive weight on the stock exchange rally.

So how do you evaluate the likelihood of a soft landing of the economy?

With high rates of interest it’s seldom a smooth landing. At this moment, a soft landing appears to be a really low likelihood. Here’s the paradoxical thing: as the economy shows more life it ends up being clearer the Fed needs to do more to slow it down which then produces more of a possibility that economy changes more suddenly.

A possible political face-off over the United States financial obligation ceiling includes another aspect of unpredictability. What would be the effects of a financial obligation faceoff in Washington?

The financial obligation ceiling is a concern, it might produce some chaos in treasury markets if we specify where the federal government needs to focus on expenses. I make sure the Treasury has actually been considering a fallback if Congress does not act, however they definitely do not wish to develop fallback and provide Congress an out. So up until the last day, we do not understand. I do believe it’s rather essential for the credit score of the United States that there will be not even a look of a default. I hope that Congress does discover some compromise, that reasonable individuals from both sides, Republicans and Democrats, come together to pass a costs.

The Fed is currently under heavy political pressure after the inflation ordeal. What about its trustworthiness, after it had erroneously minimized the rise in inflation as “momentary”?

This is foregone conclusion, there is constantly political pressure on the reserve bank, and on the Fed more so than on any other reserve bank. Having actually been a main lender, I understand that reserve banks do not understand whatever. They understand practically as much as clever market experts, perhaps a little bit more, however not a substantial lot more. The temporal problem is something that will weigh on them, however these have actually been uncommon scenarios with substantial unpredictabilities. Definitely, they have actually been incorrect, however I would not state that decreases individuals’s beliefs about what they put primary: keep inflation under control. And, if you take a look at market expectations on 5-Year/5-Year forward inflation, which is a procedure of their trustworthiness, the rate has actually been stuck at around 2.2% for the last 7 or 8 months, through all the ups and downs. So definitely, some individuals in the market think that the Fed will do whatever it requires to be done. The only joker in the pack now is the monetary stability problem which they likewise need to focus on.

Raghuram Rajan