Those in power would like you to believe that the banking crisis is over so that you do not alter habits or make any various options than you have actually currently made. Honestly, it has simply started and it’s becoming worse and it will get even worse. That’s what we’re going to speak about today. And I’m going to reveal you how to safeguard yourself.

CHAPTERS:

0:00 Intro

1:19 Business Crunch

4:29 The Shift is Coming

7:27 Business Financial Obligation

11:06 Small Company Credit

14:44 Indebted Customers

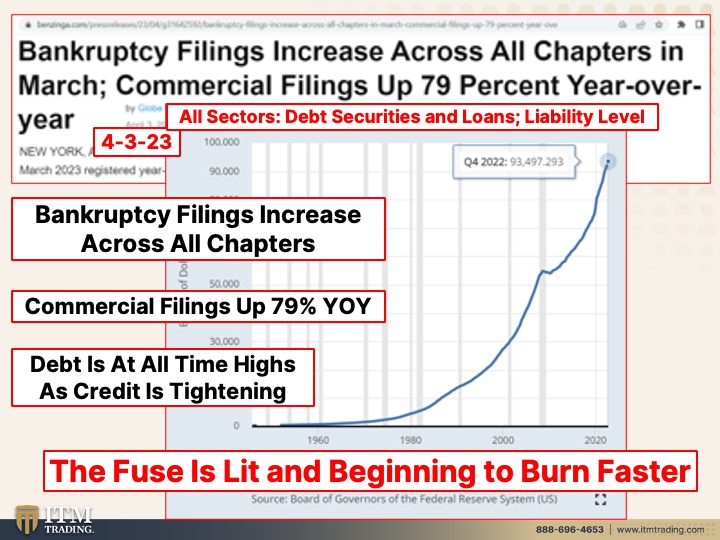

15:57 Personal Bankruptcy Filings Up

18:20 Gold Steady

RECORDS FROM VIDEO:

Those in power would like you to believe that the banking crisis is over so that you do not alter habits or make any various options than you have actually currently made. Honestly, it has actually simply started and it’s becoming worse and it will get back at worse. That’s what we’re gon na speak about today and I’m gon na reveal you how to safeguard yourself, showing up.

I’m Lynette Zang, Chief Market Expert here at ITM Trading a complete physical gold and silver dealership concentrating on customized techniques. However these techniques are based upon over 4,800 currencies that no longer exist and those repeatable patterns. So I’m seeing all of these repeatable patterns taking place. Can you see them? Trigger we speak about it a lot. So what simply occurred with SVB and Signature Bank and and Credit Suisse, etcetera. You understand those in power truly do desire you to believe, fine well those were simply one off occasions that’s not having any effect.

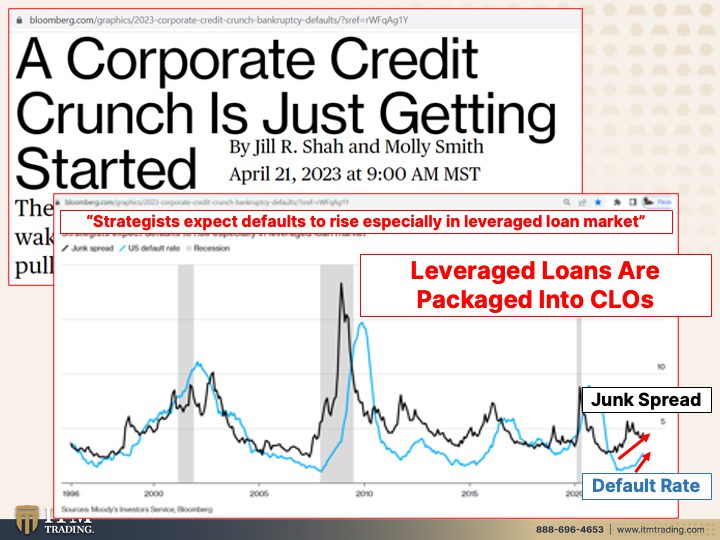

And yet what’s truly taking place is a business credit crunch is simply beginning. There are uneasy indications of business distress in the wake of the banking crisis raising the specter that a pullback in loaning will drag down the economy. Yes, due to the fact that this system is based upon never ever ending financial obligation which suggests it’s not simply that you pay that financial obligation off because when you pay financial obligation off that pulls cash out of the system. It’s the capability to roll that financial obligation over, roll that financial obligation over, roll that financial obligation over. So we got a huge issue and it’s simply the pointer of the iceberg due to the fact that it’s likewise all those derivatives based upon that. However we’ll speak about that. Spread signal greater default rate in the loan market strategists anticipate defaults to increase, specifically in the utilize loan market, right? So what’s utilize? It resembles financial obligation upon financial obligation upon financial obligation. So a corporation will have this level of credit however that level of financial obligation based upon this itty bitty bit quantity of credit, that’s what occurred with Shearson when they headed out. They were so over leveraged, however that utilize, as I have actually revealed you in previous videos, has actually just become worse and there’s simply no rejecting it. So this is the scrap spread. Now scrap is ranked listed below triple B which is the distinction in between the United States and sorry about that. That’s the distinction. The spread is the distinction in interest that they pay on poor quality corporations versus what they would pay on treasuries. Which I imply I’m reluctant to state that that’s a high quality bond, however fine. And what we’re seeing that remains in both cases, even as the scrap spread has actually boiled down, the default rate has actually increased. You are not making money for the danger that you are taking and utilize loans, as we have actually discussed often times in the past. And the bank for worldwide settlements has actually likewise talked about that there is an issue developing due to the fact that what you require to be knowledgeable about is that utilize loans are generally from lower quality corporations and after that they’re packaged up into CLOs collateralized loan commitments. And according to the bank for worldwide settlements, they have actually taken control of for the CDOs, which is collateralized debt commitment, which is what imploded in 2008. So this is the exact same thing, it’s simply that those were based upon subprime home mortgages. These are based upon subprime loans and the capability for those corporations to roll that financial obligation over, which might be a difficulty.

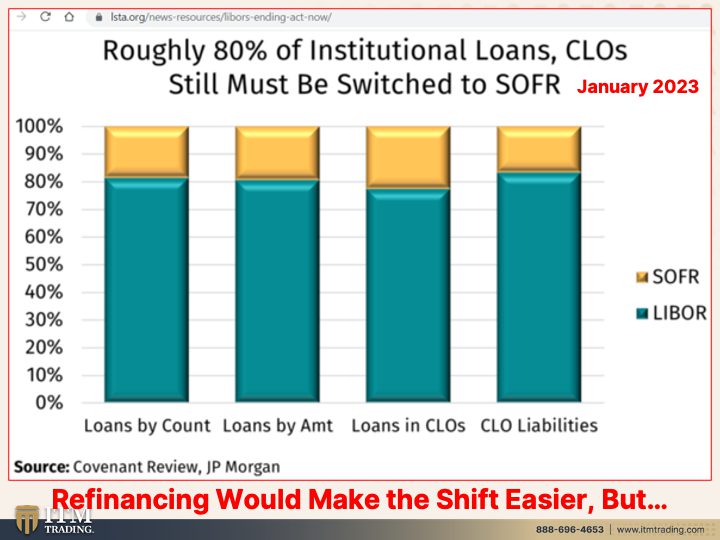

Now we have the LIBOR SOFR shift being available in and they’re stating whatever is hunky-dory and possibly it is. I imply this is a grand experience, experiment that they have never ever, ever, ever, ever done prior to. And definitely all these extremely clever men that can develop all of these monetary ingenious items can manage this. Perhaps they can, possibly they can’t. However I can see a genuine threat that’s taking place. And what you require to understand, this was since January and here we remain in April practically to May. And what you’re taking a look at is, is less than or more than 80% of the CLOs have actually transitioned into. SOFR now they put great deals of laws in location, they have actually put, they have actually put fallback language in location, they put all of these things in location to make that occur, however they have actually not had the ability to make the solutions and even with a repair be precisely like LIBOR. So my issue and what they’re attempting to do is, you understand, if you simply have like a bit and a bit and a bit and there is a modification in rate cause keep in mind these rate of interest affect the concept, right? So when rate of interest increase, the concept worth, present market price decreases and the other way around. When rate of interest fall, then the present market price of those properties increase. However the issue is, is we remain in an environment where rate of interest have actually been increasing considerably, which suggests there are a great deal of losses in the CLO playbook also. It would be a lot simpler if they might re-finance these CLOs, however once again, they’re having issues doing that due to the fact that of the credit crunch, the high rate of interest, the banking crisis. Which’s not over yet. So we have actually got a great deal of threat and possibly I’m incorrect, possibly you understand, possibly June 30th, 2023, which is when they stated the LIBOR would disappear, indicating the Bank of England and the powers that be, it’s disappearing. Perhaps it’ll be an absolutely nothing hamburger and I hope it’s an absolutely nothing hamburger however possibly it’ll be a huge crisis, I do not understand. However that’s why you hold gold due to the fact that then it does not matter. I constantly like to do what if I’m ideal and what if I’m incorrect? And if I can do something where it truly does not matter if I’m ideal or incorrect, rock-and-roll hoochie coup, that is what I will do by far each and every single time. That is a really safe location to be which’s what gold provides for you. Does not matter ideal or incorrect.

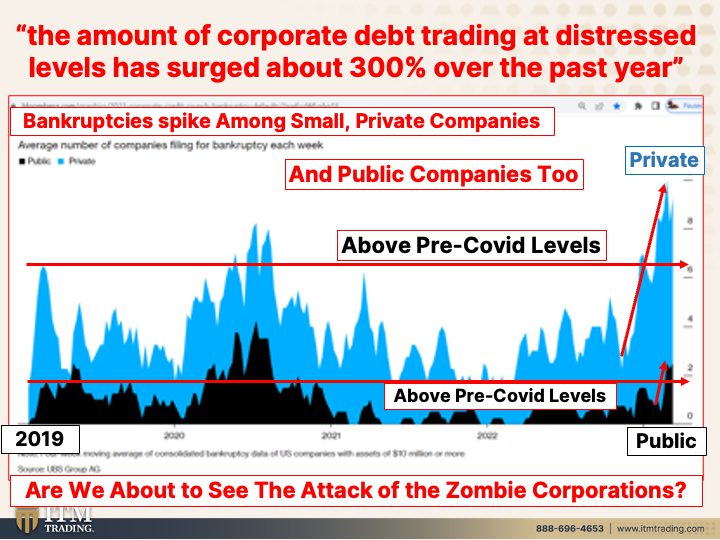

However the quantity of business financial obligation that is presently trading at distress levels has actually risen about 300% over the previous year. Whoa. The quantity of business financial obligation trading at distress levels has actually risen 300% over the previous year. Distress levels are indicating they’re having problem rolling things over, making their their payments. This is bad, entering into insolvencies which’s what this is revealing us. Insolvencies, spike amongst little personal business, the typical variety of business declaring insolvencies every week. Now, this chart begins in 2019 so you can see where it was then. And you can see in the personal business it is well above the pre COVID levels 2019. Now here we remain in 2020 as the crisis entered into play And what ‘d they do? Obviously they pumped a great deal of cash into the system so it made it cool down, fine? I imply if you distribute loans and you print great deals of cash and provide it away totally free, it can make things look fine, however does it truly fix the issue? No, it simply tides it. Which’s what they have actually been doing because 2008. So we have truly huge issues therein, however it’s likewise affecting the general public business also. And those 2 are above pre COVID levels. So what is that informing you? We got an issue Houston, we got an issue. And are we ready to see the increase of the zombie corporations? Now you may remember, trigger we have actually discussed it in the past, that zombie corporations are corporations that do not make sufficient earnings to pay all the interest on the financial obligation. Forget the concept, simply even the interest on the financial obligation. Therefore the banks desiring it to look more like this, right? Like there’s no issue or not much issue here. They would lend these corporations more cash so that they might pay the interest on the financial obligation and whatever else came due. However what that did was it provided the, provided the corporations a lot more financial obligation to handle. So are the banks whatever thought about and the credit crunch that we’re discussing here, are we ready to see the increase of the zombie corporations? Remember I did an interview, I do not understand, it was a variety of months back and and you understand, she resembled, oh yeah, we’re gon na have the zombie armageddon, which, and I stated, well yeah, due to the fact that we have actually got zombie corporations out there. So the reality that they’re represented by like people on ridiculous television programs, however honestly these zombie corporations might be an extremely well recognized name. Remember they packed that triple B, which is simply at the line of financial investment quality due to the fact that a great deal of funds can’t purchase scrap. And likewise they need to pay greater interest. Very little as you simply saw, the spreads aren’t truly that much not making money to take that danger. However I believe we have a genuine issue that will rear it’s awful head.

And it is the last decimation of the United States small companies due to the fact that this has actually been beginning truly because 2000, truly because Wall Street and our those in charge chose that Amazon was way more vital than the mama and pop stores that were out there. So they didn’t need to earn a profit and Wall Street still rewarded them for it as they removed the little mama and pops. Well, whoever handled to endure it survived. Perhaps they survived COVID, possibly they didn’t, however whoever handled to get through that crisis, well now they’re dealing with the worst credit in a years after SVB, it wasn’t that SVB or signature, were lending to small companies due to the fact that they weren’t. However all of the banks are drawing back on their credit. So more companies had trouble getting loans last month. That’s going all the method back to 2012, which is when they were, were papering over. Oh, not another one. They do too. They have great deals of these. When they were papering over all of the issues from 2008, they did not fix any of those concerns. They simply papered them over. Those are pertaining to haunt us now I’m informing you.

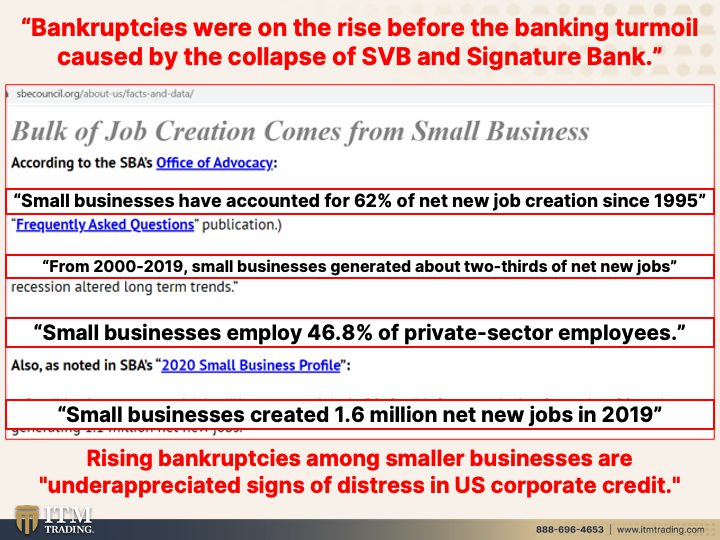

So are big corporations having that exact same issue? Well we did see that, yeah, there is certainly an uptick in insolvencies, however honestly they were on the increase prior to the banking chaos triggered by the collapse of SVB and Signature Bank. And let us not forget Credit Suisse. Here’s the issue though. The bulk of task productions in this nation originates from small companies. Small companies have actually represented 62% of net brand-new task production because 1995. From 2000 to 2019, small companies produced about 2 thirds of net brand-new tasks. So closer to 75%, no. Yeah, small companies utilize No, that has to do with right. 62% small companies. It’s been a long early morning, sorry. Small companies utilize 46.8% of economic sector staff members. So think of this, small companies produced 1.6 million net brand-new tasks in 2019. So if Fed, well Fed chair Powell has definitely specified that he desires a pullback in task production so that individuals can request for greater salaries due to the fact that after all the greater salaries is what’s triggering the inflation, not their cash printing, right? However increasing insolvencies amongst smaller sized companies are underappreciated indications of distress in United States business credit. We got an issue. Houston, what are you doing? And I do not imply Houston, the location is simply we have actually got an issue. So what are you doing to remove this affecting you?

Food, Water, Energy, Security, Barterability, Wealth Conservation, Neighborhood and Shelter, then it does not affect you a lot. Countries greatly indebted customers deal with an uncomfortable margin call. Now this remains in Canada, Canadian’s capability to adapt to greater rates might be explanatory for other nations. Definitely. Their financial obligation levels are near a record development and customer financial obligation has actually surpassed earnings. And today the Bank of England were informing us or informing individuals that reside in the UK that you understand, they simply may need to get utilized to a various standard of life due to the fact that what individuals are attempting to do is preserve their present standard of life. And what they’re doing is they’re handling financial obligation in order to do that. However eventually you either need to service that financial obligation, roll it over or pay it off or default on it. Those are your alternatives. So what we’re seeing is customers are stressed out and insolvency rates are beginning to go up to pre pandemic levels, which is worrying.

In reality, insolvency filings increased throughout all chapters in March. Business filings were up 79% year over year, year over year. And these are all sectors, financial obligation levels and loans. The liability level, this was 2020. No right here. This is 2020, this is 2008. This returns to 1960. In a debt-based system, in order to grow, in order to see the GDB grow, you have actually got to grow the financial obligation. So what occurs when you can’t do that any longer? When you can’t pay it or like service it, roll it over, you’re gon na default on it, you’re gon na default on it. So you can see quickly, the response is more financial obligation, however we are at a wall. We can’t grow more financial obligation. They’re gon na attempt. However the other thing that I desire you to bear in mind, is that financial obligation can provide you the form of having wealth. Ooh, take a look at that elegant cars and truck, take a look at that elegant home, take a look at these elegant journeys, take a look at all the important things that they’re doing. However if you’re doing it all on financial obligation, your earnings much better grow faster than your financial obligation or you’re gon na have problem servicing it. So insolvency filings increase throughout all chapter business filings of 79% year-over-year. And financial obligation is at a perpetuity high as credit is tightening up. So what that’s truly informing you and revealing you is that the fuse is lit and it’s starting to burn quicker. That’s why it’s crucial for you if you have not done it currently. You require to have that technique in location and you require to be performing it while you still have the chance.

And what’s the very best method to perform it? Well, it’s truly basic for me. It’s this right out of the system. Functional genuine cash throughout the world. And what have we seen? We have actually seen gold constant around 2000 as economic downturn worries fuels safe house need. Yeah, gold. Physical in your ownership is a safe house property. The very best safe house property due to the fact that of its usage internationally and its need internationally. Physical gold and silver are likewise the most liquid properties worldwide. I get this concern all the time. Who’s gon na purchase my gold? Well, if you reflect to the anxiety, although the majority of the population remained in abject hardship, not everyone was, due to the fact that wealth never ever vanishes it simply moves place. So those up at the 1%, they have the concrete properties, they understand how to have the wealth move their method. The powers that be desire you to keep your wealth in intangibles due to the fact that then they can manage it a great deal simpler. They’re not pertaining to your home to bang on the door. The majority of people nowadays do not own much gold. And if they do own it, they own it in Individual retirement accounts that are simple to sweep and eliminate from you. And the truth is, is if you do not hold it, you do not own it. And it is unimportant what you view in a law court. So hold it and own it. It’s quite basic.

However why is it the most liquid property? I inform inform you this all the time, I most likely informed you this a lots times simply in this due to the fact that it has the broadest purchaser base. It truly is that basic. For that reason it has continuous need. And if you have not done so currently, we simply released just recently our brand-new Thrivers neighborhood. And you can discover that and download it at online at www.thriverscommunity.com. And you can likewise download “the Thrivers neighborhood” on the app shop or Google Play. And if you have not done this yet, get your technique in location, click that Calendly link listed below, established the time to speak with among our cons, our technique specialists, and get your individual technique lined out and performed. AS SOON AS POSSIBLE. We just have as long as we have and and every day that passes is one less day that you have. So get it done as rapidly as you can. And if you have not done this yet, make certain you subscribe due to the fact that we require to keep you in the loop on what’s going on. Leave us a remark, provide us a thumbs up and share, share, share. Due to the fact that lack of knowledge does not make you immune and it does not make your household immune. And they might believe you’re insane. However if you are the one on which the commitment rests, and I understand for myself that’s where it rests with me for my household, then you got ta do it. You got ta take that duty. Ensure you have your technique in location, make certain you have it performed due to the fact that honestly, monetary guards are made from physical gold and silver. Certainly not paper assures, definitely not this trash. And till next we fulfill. Please be safe out there. Bye-Bye.

SLIDES FROM VIDEO:

SOURCES:

https://www.bloomberg.com/graphics/2023-corporate-credit-crunch-bankruptcy-defaults/?sref=rWFqAg1Y

https://www.lsta.org/news-resources/libor-transition-clos-you/

https://www.lsta.org/news-resources/libors-ending-act-now/

https://www.bloomberg.com/graphics/2023-corporate-credit-crunch-bankruptcy-defaults/?sref=rWFqAg1Y

https://www.bloomberg.com/graphics/2023-corporate-credit-crunch-bankruptcy-defaults/?sref=rWFqAg1Y

https://sbecouncil.org/about-us/facts-and-data/

https://news.yahoo.com/private-bankruptcy-filings-blowing-past-201500764.html