PAVEL IARUNICHEV/iStock through Getty Images

Business cycle has 4 stages: growth, peak, contraction, and trough. Our portfolio allowance modifications depending upon what stage of business cycle we are presently experiencing. Today, our company believe we remain in the contraction stage of business cycle. We release on this subject often.

Provided this facility, the allowance in our portfolio to money and money equivalents is fairly high. Among our favored possessions to park money and make significant yield is U.S. Treasury costs.

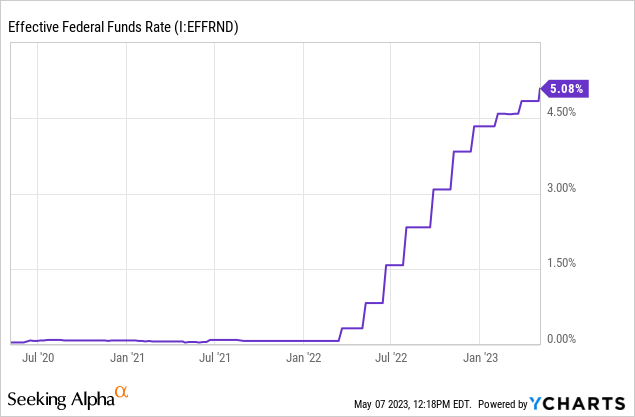

Selecting the best expense or bond, in regards to period, significantly depends upon where rate of interest are anticipated to go. If rate of interest are anticipated to decrease one might choose longer period and vice versa. The Federal Reserve has actually been strongly treking short-term rate of interest through the Federal Funds Rate over the previous 12+ months. Throughout that amount of time we leaned towards the quickest period bonds with our biggest choice on drifting rate notes which have ultra-low convexity to rates. Convexity is the procedure of how a bond’s cost modifications with modifications in rates. Basically, it is a procedure of rates of interest threat. Throughout an increasing rates of interest environment the very best carrying out bonds will have the most affordable convexity.

Today, the Fed revealed another 25 basis point raise to the Fed Funds rate. In reaction, we released a brand-new short article called That’s It, Walkings Are Done And Rates Have Peaked At 5%. In it, we anticipate that this is most likely the last rate walking of this cycle. We extremely motivate you to examine that short article to comprehend why.

So, this asks the concern. If we anticipate rates to stop briefly, do we alter our period direct exposure? The response is it depends.

The SPDR Bloomberg 3-12 Month T-Bill ETF ( NYSEARCA: BILS) is a fund that purchases a well balanced mix of Treasury costs which leads to a typical maturity of 0.42 years or about 5 months. One might handle their own portfolio of Treasury costs however the gross expenditure ratio is 0.135% which is sensible for smaller sized portfolios provided the time you can conserve not needing to setup the deals. The reliable convexity for this fund is 0% according to the fund’s site

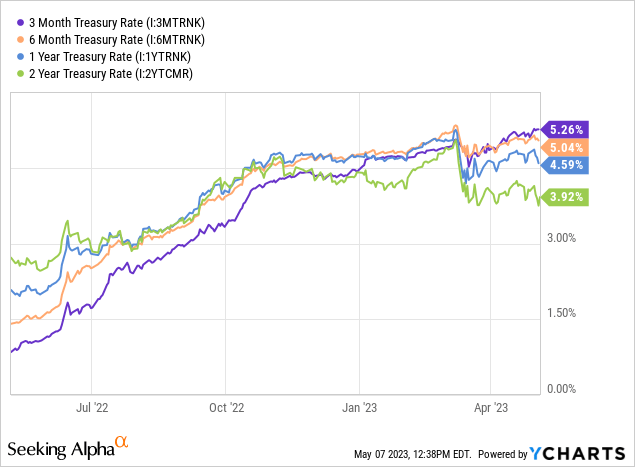

The fund uses 5% yield to maturity. This is the factor. While 5% is greater than what the 1 year and 2 year Treasuries provide, it is listed below the 3 month and 6 month Treasury. For the part of our portfolio that we wish to secure yields for 6 months, we would be much better off purchasing a 6M Treasury for 5.04% than a 5M ETF for 5%.

Additionally, we continue to choose drifting rate notes for most of our money allowance. Drifting Rate Notes provided by the Treasury pay a variable rate as figured out by the most current 3 month T-bill rate plus a spread. Spreads have actually been appealing recently with 0.2% just recently provided and 0.169% provided today. We are long the iShares Treasury Drifting Rate Bond ETF ( TFLO) which purchases drifting rate notes and uses a yield to maturity of 5.35%. This fund likewise has a convexity of 0 however the reliable period is 0.01.

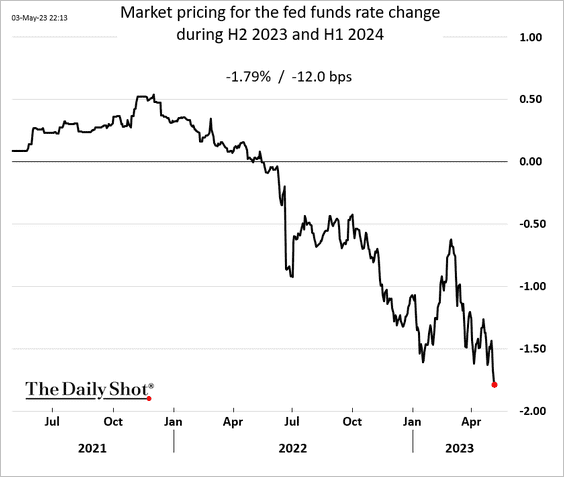

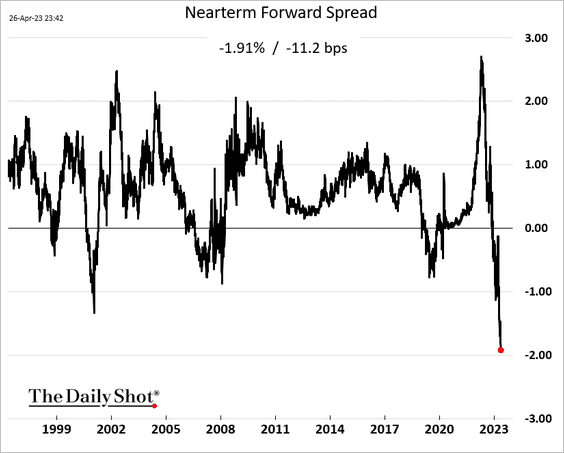

If rates were to start to fall, drifting rate notes would no longer be appealing. Till that takes place, BILS uses a good however not exceptional yield. Bond markets are pricing in high cuts to rate of interest quickly. Futures markets are pricing in a 1.79% decline in the Fed Funds rate by H1 2024. The near-term forward spread is even much deeper at -1.91%. Futures are pricing in a 76% possibility of lower rates within the next 4 months.

The Daily Shot (utilized with approval) The Daily Shot (utilized with approval)

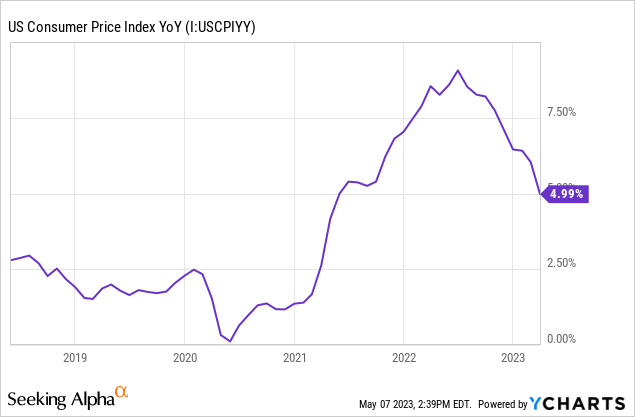

If futures markets are right, the overall return in between BILS and drifting rate notes over the next 5 months is most likely to be a tossup. BILS will not experience much capital gratitude due to the low convexity and it will need to reach the yield provided by FRNs through rate cuts. Contrary to markets, we do not anticipate rate cuts to be impending. The Fed dot plot suggests that the FOMC anticipates to hold rates above the present level through completion of the year. Our company believe them, a minimum of over the next 6 months. This is due to the fact that inflation stays sticky and Fed was captured off guard and appeared silly when they stated it was temporal. Leading signs of inflation recommend that the CPI needs to stay above 3% through completion of the year, above the Fed’s 2% target.

Even if we anticipated rate cuts to start today, the 6 month Treasury uses somewhat much better return than BILS without management costs and an additional month of period. For these factors, we do not choose BILS in our portfolio at this time. The 5% yield is great, however not rather sufficient.