Simply when I believed it was safe to state we were getting more standard spring real estate stock, we struck a snag recently, as active stock and brand-new listings decreased. Ideally, this is simply a blip, which can take place from time to time with weekly information. We had a great deal of drama over the week in between Federal Reserve conferences and banking tension, and home loan rates and purchase applications both fell.

Here’s a fast rundown of the recently:

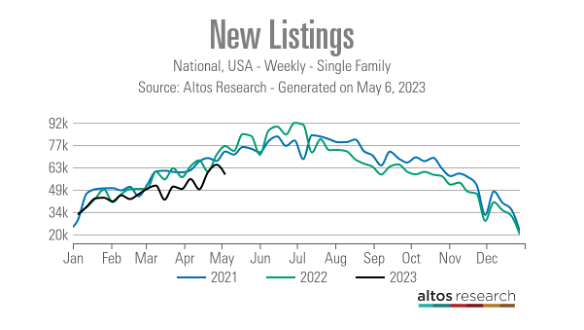

- Overall active listings fell by 2,545, and brand-new listing information likewise fell week to week, continuing the streak of the most affordable brand-new listing information ever tape-recorded in history.

- Home mortgage rates fell recently as we began the week at 6.73%, got as low as 6.43% to end the week at 6.5%.

- Purchase application information fell 2% weekly as the streak of greater rates affecting the weekly information continues.

Weekly real estate stock

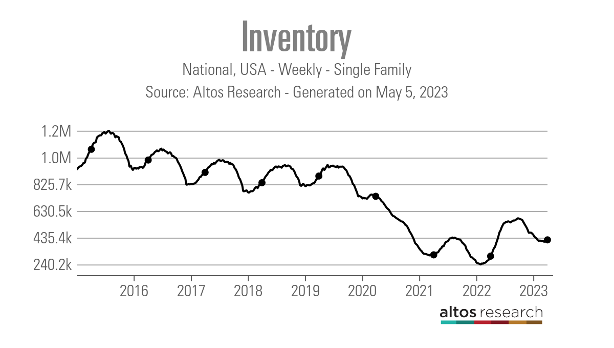

The numbers today are regrettable: stock needs to be growing like it does at this time every year. However, the weekly stock information can sometimes have huge go up or down that can differ the longer seasonal pattern so I require to see a couple of more weeks of stock decreasing prior to I make excessive out of one week.

Nevertheless, something is for sure, real estate is not going to crash due to massive panic-selling– a scare strategy of late 2021 that didn’t work then or now. New noting information was trending at lowest levels in 2021 abd 2022 and now it’s producing a brand-new all-time low pattern in 2023.

- Weekly stock modification (April 28-May 5): Stock fell from 422,270 to 419,725

- Exact same week in 2015 (April 29-May 6): Stock increased from 287,821 to 300,481

- The bottom for 2022 was 240,194

- The peak for 2023 up until now is 472,680

- For context, active listings for today in 2015 were 1,081,085

Weekly real estate stock

According to Altos Research Study, brand-new listing information decreased weekly and is still trending at lowest levels in 2023. This information line can have some wild swings up and down, however for one of the most part, we do see the standard seasonal boost in brand-new listings information. We are approximately 2 months far from the seasonal decrease in brand-new listings.

Because the 2nd half of 2022, after the huge spike in home loan rates, this information line hasn’t gotten much traction. In 2015 at this time, we saw some development year over year, however this year it’s been various.

New noting weekly information over the previous 3 years:

- 2023: 58,432

- 2022: 76,691

- 2021: 73,291

Brand-new listing information from previous years to offer you some historic viewpoint.

- 2017 99,880

- 2016 88,105

- 2015 94,101

As you can see in the chart below, brand-new listing information is extremely seasonal; we do not have much time to get some more development here.

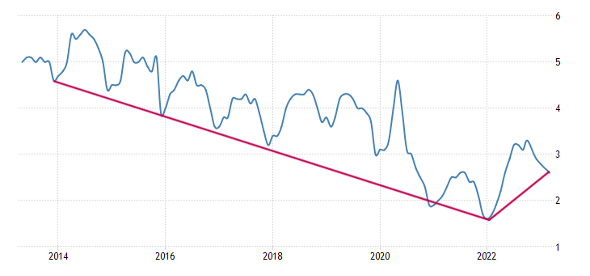

The NAR information returning years demonstrates how challenging it has actually been to return to anything regular on the active listing side because 2020. In 2007, when sales were down huge, overall active listings peaked at over 4 million We had high stock levels while the joblessness rate was still exceptional in 2007.

This shows that the mass supply development we saw from 2005-2007 was because of credit tension, not since the economy remained in an economic crisis; the U.S. didn’t enter into economic downturn till 2008. Although the labor market is presently revealing indications of getting softer, there is no job-loss economic downturn yet.

The overall NAR stock is still 980,000 As you can see in the chart below, there is a huge distinction in between the present real estate market and those trying to find a repeat of 2008.

NAR overall active listing information returning to 1982

Individuals frequently ask me why there is such a distinction in between the NAR information versus the Altos Research study stock information. This link describes the distinction and deserves a read.

While this was a frustrating week on the stock development side, I hope this is simply a one-week blip. We can see what a distinction a year makes in stock information. For instance, in 2015, from April 22-29, weekly active listings grew by 16,311. Up until now this year, after the seasonal bottom in stock took place the week of April 14, the overall development in active listings because that week has actually been just 14,257.

Generally, we would see active listings beginning to grow at the end of January. Nevertheless, that development has actually taken longer in 2023 than any other year in U.S. history therefore far the active listing development from April to Might has actually been moderate.

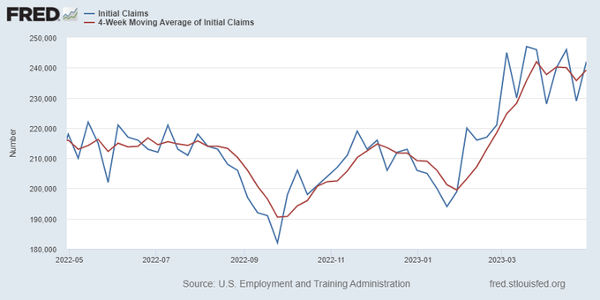

The 10-year yield and home loan rates

Recently we had numerous ground mine for the 10-year yield and home loan rates to increase or fall with the Fed conference and 4 labor market reports. Although the Fed raised the Federal funds rate, the bond market is picking up a slower labor market and home loan rates fell.

Tracking the 10-year yield and home loan rates are vital for real estate stock since when rates fall, purchaser need improves, permitting more houses to be purchased and getting a cover on stock development, which we have actually seen because 2012. The only 2 years we have actually seen the active stock grow were 2014 and 2022 when softness in need permitted stock to grow.

The huge distinction in between 2022 and 2014, as you can see in the chart below, is that the bottom in 2022 was an all-time record low; we can see year-over-year development in overall active listings. Nevertheless, the boost in stock this year from last still puts active listings near lowest levels.

NAR Overall Active Listings

We have actually seen from 2022 that the month-to-month supply of NAR information has actually grown more aesthetically in the information lines; this suggests houses are taking longer to offer than in the past. I discussed this recently and discussed it in the HousingWire Daily podcast

NAR Regular Monthly Supply Data

Home mortgage rates began recently at 6.73% and fell as the labor information and banking tension drove cash to the bond market. We quickly broke under my essential Gandalf line in the sand (in between 3.37% -3.42%) intraday, just to close right at the line and increase by the end of the week. This line has actually been really legendary.

Home mortgage rates was up to a low of 6.43% then ended the week at 6.5%. The spreads in between the 10-year yield and 30-year home loan rates have actually been dreadful for a very long time and have actually become worse throughout the banking tension. While credit is stlll streaming for traditional loans, home loan prices has actually been bad. Home mortgage rates in a routine market ought to be 5.25% today however are at 6.5%. Can you think of the real estate market at 5.25% today when we discovered stabilization with rates varying in between 5.99% -7.10% this year?

In my 2023 projection, I stated that if the economy remains company, the 10-year yield variety ought to be in between 3.21% and 4.25%, corresponding to 5.75% to 7.25% home loan rates. If the economy gets weaker and we see an obvious increase in unemployed claims, the 10-year yield needs to go as low as 2.73%, equating to 5.25% home loan rates

Naturally, the banking crisis has actually included a brand-new variable to economics this year. Nevertheless, even with that, the labor market, while getting softer, hasn’t broken yet. We have actually remained in the forecasted variety all year, even with all the drama from the banking crisis, which isn’t great news for the economy.

My line in the sand for the Fed pivot has actually constantly been 323,000 unemployed claims on the four-week moving average. This has actually been my huge financial information line for the cycle because I raised my 6th and last economic downturn warning on Aug. 5, 2022. While the labor market is getting less tight, it’s not broken yet.

From the Department of Labor: Preliminary claims for joblessness insurance coverage advantages increased by 13,000 in the week ended April 29, to 242,000. The four-week moving average likewise increased by 3,500 to 239,250

Purchase application information

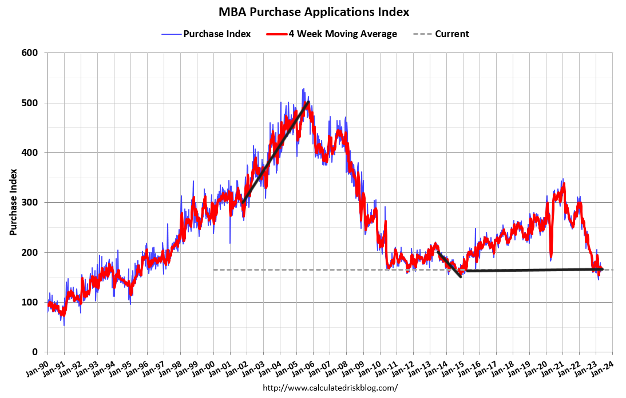

Purchase application information has actually been the primary supporting information line for the real estate because Nov. 9, 2022, with 16 favorable prints versus 7 unfavorable prints, after making some vacation changes. For 2023, we have actually had 9 favorable prints versus 7 unfavorable prints.

The MBA purchase application information line has actually been extremely rate-sensitive: when the 10-year yield and home loan rates increase, it usually produces an unfavorable weekly print, and when they both fall, we get a favorable print. This previous week we saw a 2% week-to-week decrease in the information line.

The year-over-year decrease in purchase application information was 32%; as I have actually kept in mind, we are working from the mom of the all-time most affordable bars in 2023. As we can see in the chart above, simply having 16 favorable prints because Nov. 9 has actually supported the information– it’s been tough to break lower than the levels we saw back in 1996.

The year-over-year compensations will get significantly simpler as the year advances, specifically in the 2nd half. This information line watches out 30-90 days for sales, and we are practically made with the seasonality. I constantly weigh this report from the 2nd week of January to the very first week of May. Next week for the tracker, I will report on how 2023 need looks based upon this index.

Generally, purchase application volumes constantly fall after May. Now, post-COVID-19, this index has actually had some unusual late-in-year development information. So, after May, I will resolve this concern with seasonality and whether we will see some development later on in the year, as we have actually seen in previous years.

The week ahead: It’s Inflation week!

All eyes are on the CPI report today, beginning Wednesday, and we have the PPI inflation report on Thursday. The whole market understands the heading inflation development rate peaked in 2015, so look out for the core inflation information, omitting shelter inflation. Naturally, core CPI is mostly driven by shelter inflation, and all of us understand by now that it will cool down, specifically as the year advances. Nevertheless, the Fed and the marketplaces concentrate on service inflation, omitting shelter.

I am watching on the cars and truck inflation information as that may be persistent today, keeping core inflation greater than it ought to be.

The bond market never ever purchased into the 1970s inflation facility, so the 10-year yield is better to 3% than 5%. Because the whole market is watching out on credit getting tighter, I will be enjoying the Senior Loan Officer Viewpoint Study on Bank Loaning Practices on Monday. This will offer more ideas into how quick credit is getting tighter in the U.S. economy, which is essential at this growth phase.

So, we will have some financial information to see if the 10-year yield can break lower and send out home loan rates lower also. Up until now, the Gandalf line in the sand has actually held up versus some ruthless attacks this year, however we will see if we can break under that line of 3.37% and head lower in yields. Why is that essential? Due to the fact that the 10-year yield and home loan rates have actually constantly danced together, and if the 10-year yield heads lower, home loan rates will follow it.